Event Study of IPO in Indonesia: Pump-and-Dump & Flipping Strategy Analysis

DOI:

https://doi.org/10.38035/jafm.v1i1.14Keywords:

IPO, pump-and-dump, Characteristics, Macroeconomic, abnormal returnsAbstract

There were three important IPO anomalies: the positive average initial return (improperly called short-term 'underpricing'), the long-term underperformance, and hot/cold IPO. The EVENT STUDY model explained the 'underpricing' based on the assumption that the underwriter sets the initial price equal to the market-perceived true value and investors were rational. IPO prices are affected by demand and supply. The idea of the model was to explore pump-and-dump and flipping patterns exhibited upon IPO anomalies event in Indonesia. Pump-and-dump is the strategy to manipulate stock prices, while flipping was stocks bought at the IPO and sold at early days ta listing date. This strategy oftentimes exhibits anomalous behavior. Some implications of this model for the IPO market were positive 1st-day initial return (IR) and a negative relation cumulative average abnormal 5-days abnormal return (CAAR-5days) for flipping strategy. The other was a relationship between underperformance cumulative average 30-days abnormal returns (CAAR-30days) and cumulative average 5-days (CAAR-5days) abnormal returns in terms of pump-and-dump strategy. Using the relation between the Characteristics (Size of issue, Board and Floating rate) and Macroeconomics Condition (Central Bank Rate, Inflation rate, USD/IDR exchange, and GDP growth), and the IR, a CAAR-5days and a CAAR-30days, this EVENT STUDY explained the existence of the pump-and-dump and flipping pattern in the Indonesian stock exchanges. The Authors implemented a multivariate analysis of variance (MANOVA) to test hypotheses regarding the effect of a three-variables dependent (the initial return, a 5-days abnormal return, and a 30-days abnormal return) into several dependent variables. Using the IPO data taken from 2015-2019, the paper found that this EVENT STUDY explained the existence of pump-and-dump and flipping patterns at the early trading of IPO stocks in the Indonesia Exchange Market.

References

Aggarwal, R., Prabhala, N. R., & Puri, M. (2002). Institutional Allocation in Initial Public Offerings?: Empirical Evidence. The Journal of Finance, LVII(3), 1421–1442.

Bairagi, R. K., & Dimovski, W. (2011). The underpricing of US REIT IPOs?: 1996-2010. Journal of Property Research, 28(3), 233–248.

Bansal, R., & Khanna, D. A. (2012). “Pricing Mechanism and Explaining Underpricing of IPOs”: Evidence From Bombay Stock Exchange , India. International Journal of Research in Finance & Marketing, 2(2), 205–216.

Bayley, L., Lee, P. J., & Walter, T. S. (2006). IPO Flipping in Australia: Cross-Sectional Explanations. Pacific-Basin Finance Journal, 14, 327–348.

Chang, E., Chen, C., Chi, J., & Young, M. (2008). IPO Underpricing in China: New Evidence From The Primary And Secondary Markets. Emerging Markets Review, 9, 1–16.

Chen, A., & Kao, L. (2006). The Benefit of Excluding Institutional Investors from Fixed-Price IPOs?: Evidence from Taiwan. Emerging Markets Finance and Trade, 42(5–24).

Chen, H., & Lu, C. (2006). How Much Do REITs Pay for Their IPOs?? Journal of Real Estate Finance Economic, 33, 105–125.

Deb, S. G., & Mishra, B. (2009). Long-Term Risk-Adjusted Performance of Indian IPOs.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the Estimators for Autoregressive Time Series With a Unit Root. Journal of the American Statistical Association, 74(366), 427.

Dimovski, W. (2010). The Underpricing of A-REIT IPOs in Australia During 2002 to 2008. Pacific Rim Property Research Journal, 16(1), 39–51. https://doi.org/10.1080/14445921.2010.11104294

Ibbotson, R. G., & Ritter, J. R. (1995). Initial Public Offerings (Vol. 9). Elsevier Science B.V.

Ibbotson, R. G., & Sindelar, J. I. (1988). OFFERINGS. Journal of Applied Corporate Finance, 1(2), 37–46.

Indriani, S., & Marlia, S. (2013). The Evidence of IPO Underpricing in Indonesia 2009 - 2013. Review of Integrative Business & Economics Research, 4(1), 299–316.

Islam, M. A., Ali, R., & Ahmad, Z. (2010). Underpricing of IPOs?: The Case of Bangladesh. Global Economy and Finance Journal, 3(1), 44–61.

Johansen, S. (1988). Statistical Analysis of Cointegration Vectors. Journal of Economic Dynamics and Control, 12, 231–254.

Ljungqvist, A. (2007). Ipo Underpricing *. In B. E. Eckbo (Ed.), Handbook of Corporate Finance (pp. 376–422). Elsevier B.V.

A. H. Manurung & J. C. Manurung (2019). Underpricing:Macroeconomic Variables. International Journal of Civil Engineering and Technology (IJCIET), Vol 10, Issue 03, 1739-1745.

A. H. Manurung., E. Juwono & I. Siswanti (2019). Behavior of Initial Return in Indonesia Market. Journal of Applied Finance & Banking, vol. 9, no. 4, 2019, 37-45 ISSN: 1792-6580 (print version), 1792-6599 (online), Scienpress Ltd, 2019.

Mok, H. M. K., & Hui, Y. V. (1998). Underpricing and Aftermarket Performance of IPOs in Shanghai, China. Pacific Basin Finance Journal, 6, 453–474.

Ritter, J. A. Y. R. (1991). The Long-Run Performance of Initial Public Offerings. The Journal of Finance, XLVI(1), 1–27.

Ritter, J. A. Y. R., & Welch, I. V. O. (2002). A Review of IPO Activity, Pricing, and Allocations. The Journal of Finance, LVII(4), 1795–1828.

Tian, L. (2011). Regulatory Underpricing?: Determinants of Chinese Extreme IPO Returns ?. Journal of Empirical Finance, 18(1), 78–90. Retrieved from http://dx.doi.org/10.1016/j.jempfin.2010.10.004

Vos, E. A., & Cheung, J. (2018). New Zealand IPO Underpricing: The Reputation Factor. Small Enterprise Research, 03(23).

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

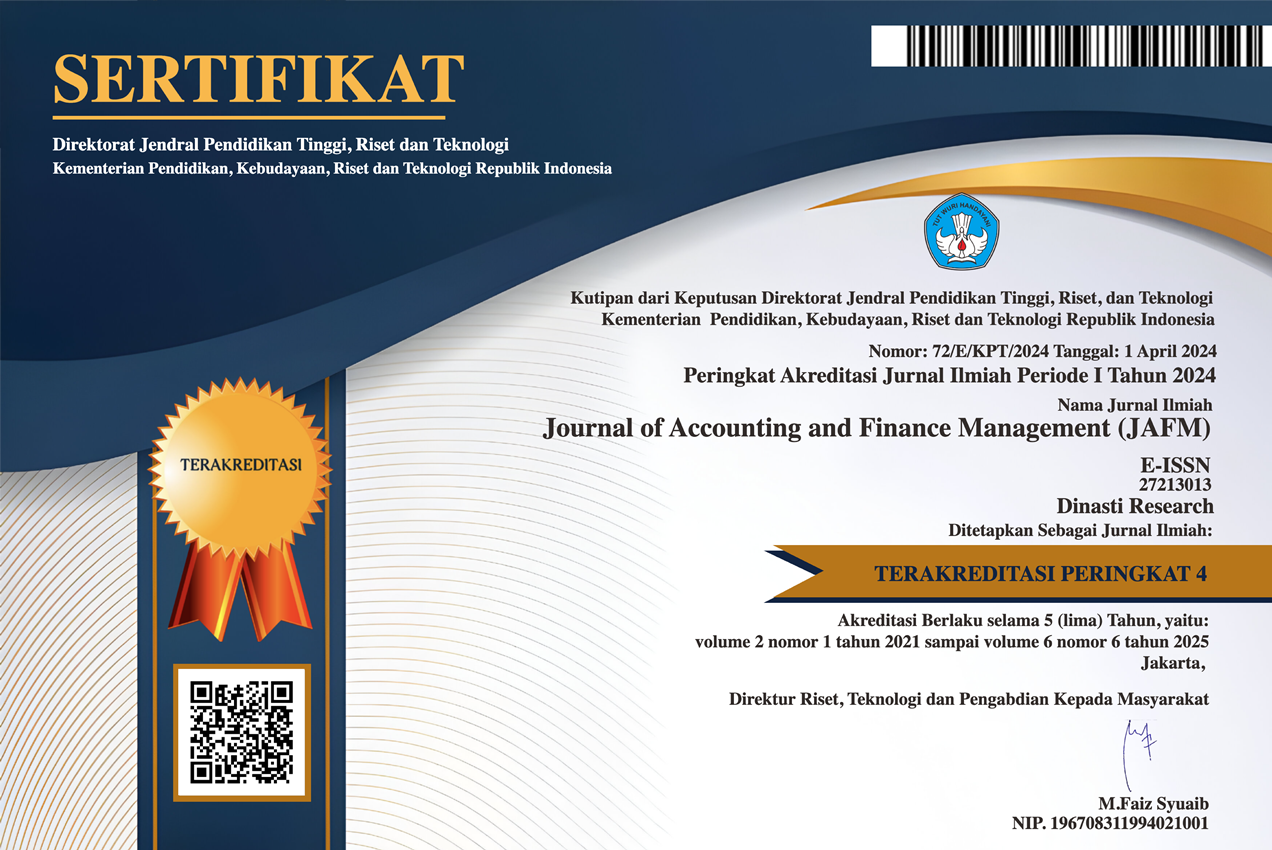

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).