The Effect of Financial Literacy, Risk of Use and Benefit on Interest in Transactions Using QRIS in Generation Z

DOI:

https://doi.org/10.38035/jafm.v6i1.1751Keywords:

Financial Literacy, Risk, Benefit, Interest, Generation Z, QRISAbstract

This quantitative research analyzes Financial literacy's impact, risks of use, and benefits of transaction interest using QRIS for Generation Z in Cirebon City. The object of this research is Generation Z in Cirebon, with a sample size of 402 people. Information was collected by conveying surveys through Google form; partial least squares (PLS) tools three analysis was used to examine the data. This research shows the results that financial literacy has a noteworthy and favorable impact on the interest variable in making transactions utilizing QRIS in Generation Z. The risk of use has a favorable and remarkable effect on the variable curiosity about transacting utilizing QRIS in Generation Z. The study's findings demonstrate that financial literacy has an influence quite a considerable favorable impact upon QRIS interest in Generation Z. The anticipated outcomes of this study will offer material regarding readers to increase their knowledge about the elements influencing interest in transacting utilizing QRIS in Generation Z. It can increase interest in transacting using QRIS.

References

Alma Nabila Kuntoro Putri, Amelia Setiawan, & Hamfri Djajadikerta. (2024). THE EFFECT OF PERCEIVED FINANCIAL LITERACY, USEFULNESS, CONVENIENCE, AND RISK ON GENERATION Z'S INTEREST IN USING QRIS.

Dairobi, M., & Anisah, H. U. (2025). Impact of halal destination image, value, experience, and contact on revisit intentions of Haul Sekumpul attendees. 24(1), 27. https://doi.org/10.24123/mabis.v24i2.805

Engko, C., Benony Limba, F., & Achmad, A. P. (2023). THE INFLUENCE OF KNOWLEDGE AND INTEREST IN TRANSACTIONS USING QRIS SERVICES WITH THE TECHNOLOGY ACCEPTANCE MODEL (TAM) AS A MEDIATING VARIABLE. https://doi.org/10.46306/rev.v4i1

Gede, W., Bratha, E., Program, M., Management, M., Bhayangkara, U., Raya, J., & Author, K. (2022). LITERATURE REVIEW OF MANAGEMENT INFORMATION SYSTEM COMPONENTS: SOFTWARE, DATABASE AND BRAINWARE. 3(3). https://doi.org/10.31933/jemsi.v3i3

Hayyi Farhan Taqiyuddin. (2022). Analysis of Factors Affecting the Intention to Use ShopeePay E-Wallet: A Study of Generation Z in Indonesia.

Joan Tony Sitinjak, L. (2019). GO-PAY DIGITAL PAYMENT.

Kurnia Rahman Syaifuddin, A. F., & Supriyanto. (2022). ANALYSIS OF FACTORS AFFECTING INTEREST IN USING QRIS AS A PAYMENT METHOD DURING THE PANDEMIC. 1(1), 1-21.

Listiyono, H., Nur Wahyudi, E., Agus Diartono, D., Stikubank Semarang Jl Tri Lomba Juang No, U., & Semarang, M. (2024). Dynamics of QRIS Implementation: Reviewing Opportunities and Challenges for Indonesian MSMEs. https://doi.org/10.37817/ikraith-informatika.v8i2

Musyaffi, A. M., Johari, R. J., Rosnidah, I., Sari, D. A. P., Amal, M. I., Tasyrifania, I., Pertiwia, S. A., & Sutanti, F. D. (2021). Digital Payment during Pandemic: An Extension of the Unified Model of QR Code. Academic Journal of Interdisciplinary Studies, 10(6), 213-223. https://doi.org/10.36941/ajis-2021-0166

Ningsih, H. A., Sasmita, E. M., & Sari, B. (2021). The Effect of Perceived Benefits, Perceived Ease of Use, and Perceived Risks on Decisions to Use Electronic Money (QRIS) in College Students.

Nur Yasar, I., Handayani, T., & Puspitasari, L. (2022). SYI'AR IQTISHADI Journal of Islamic Economics, Finance and Banking Perceptions of Using QRIS Electronic Money. 6(1). www.wartaekonomi.co.id,

Putri, N. I., Munawar, Z., & Komalasari, R. (2022). Interest in using QRIS as a means of payment after the pandemic.

Rizal Syahri Alfani, & Kurnia Rina Ariani. (2023). THE INFLUENCE OF PERCEIVED BENEFITS, PERCEIVED CONVENIENCE, RISK, AND TRUST ON DECISIONS TO USE ELECTRONIC MONEY (QRIS).

Safitri, J. (2024). THE EFFECT OF USING QRIS ON GENERATION Z'S FOOD CONSUMPTION BEHAVIOR: A THEORY OF PLANNED BEHAVIOR (TPB) ANALYSIS. 10(1), 2599–3348. https://doi.org/10.30739/istiqro.v10i1.2827

Salma Adilah Rahma. (2024). THE INFLUENCE OF FINANCIAL LITERACY, RISK OF USE, EASE OF USE, AND BENEFITS ON THE INTEREST IN USING DIGITAL WALLETS IN GENERATION Z INDONESIA.

Daniarti, Rahma, Karona Cahya Susena, and Lydia Gustina Putri. 2024. “Factors Affecting Consumer Interest in Using Qris as a Payment Method in Bengkulu City.” 1(2): 71-82.

Kurnia Rahman, Ahmad Fahri Syaifuddin, and Supriyanto Supriyanto. 2022. “Analysis of Factors Affecting Interest in Using Qris as a Payment Method during the Pandemic.” Indonesian Scientific Journal of Islamic Finance 1(1): 1-21. https://journal.uinsi.ac.id/index.php/INASJIF/article/view/4739.

Putri, Azzahra Firdausya Caesa. 2024. “THE INFLUENCE OF PERCEIVED BENEFITS, CONVENIENCE, RISK, SECURITY, AND WORD OF MOUTH ON INTEREST IN USING THE QUICK RESPONSE CODE INDONESIAN STANDARD (QRIS) ON SLEMAN DISTRICT UMKM ACTORS.”

Putri, Melisa Tania, Atika Jauharia Hatta, and Cahyo Indraswono. 2023. “Analysis of Perceived Usefulness, Perceived Ease of Use, Trust, Lifestyle, Financial Literacy, and Risk Toward the Use of Qris as a Digital Payment Tool for Students in Yogyakarta.” Journal of Economics and Business 17(3): 215–28. doi:10.53916/jeb.v17i3.73.

Sugiharti, Harpa, and Kholida Atiyatul Maula. 2019. "The Effect of Financial Literacy on Student Financial Management Behavior." Accounting: Journal of Accounting and Finance 4(2): 804–18. doi:10.35706/acc.v4i2.2208.

Ummah, Masfi Sya'fiatul. 2019. “No????????????????????? ?????????????????Title.” Sustainability (Switzerland) 11(1): 1-14. http://scioteca.caf.com/bitstream/handle/123456789/1091/RED2017-Eng-8ene.pdf?sequence=12&isAllowed=y%0Ahttp://dx.doi.org/10.1016/j.regsciurbeco.2008.06.005%0Ahttps://www.researchgate.net/publication/305320484_SISTEM_PEMBETUNGAN_TERPUSAT_STRATEGI_MELESTARI.

Wuryani, and Risa Nadya Septiani Eni. 2020. “THE EFFECT OF FINANCIAL LITERACY AND FINANCIAL INCLUSION ON THE PERFORMANCE OF UMKM IN SIDOARJO.” 9.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Lutvi Yanti, Alya Nuramelia, Hilda Ridayanti, Ida Rosnidah

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

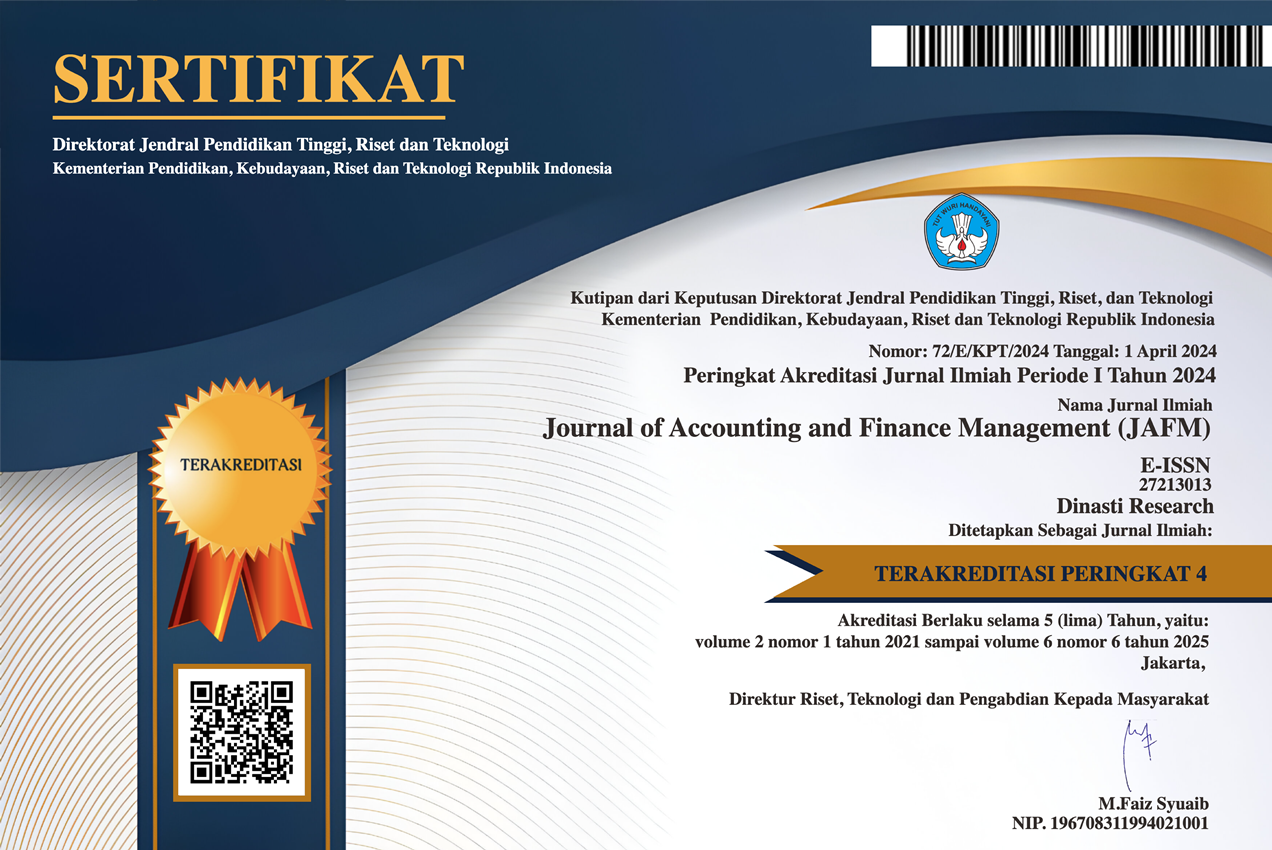

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).