The Role of Corporate Governance in Constraining Earning Management

DOI:

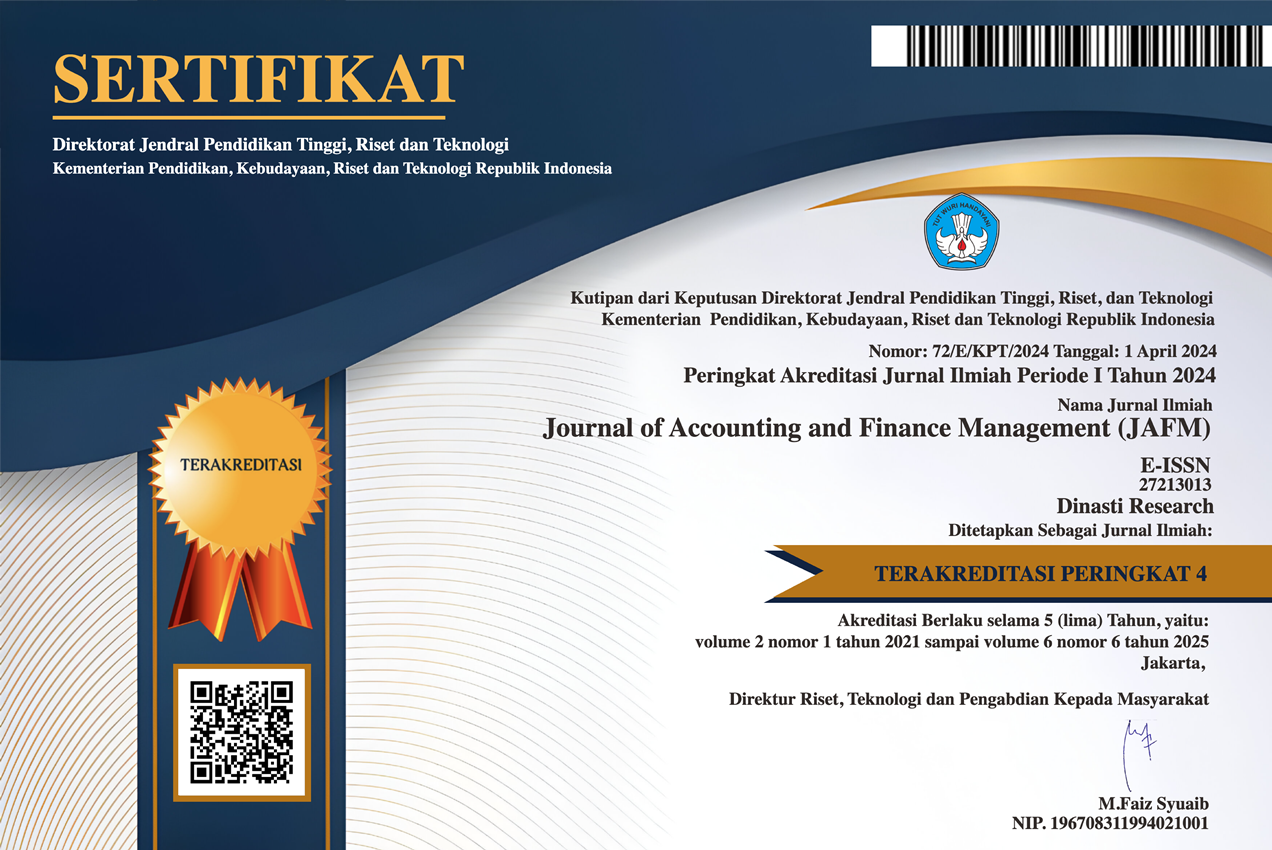

https://doi.org/10.38035/jafm.v1i3.21Keywords:

Earning Management, Ownership Structure, Board of Directors Quality, Audit Quality, Corporate GovernanceAbstract

This study examines whether corporate governance measured by audit quality, ownership structure, and board of commissioners quality has an effective role in constraining earnings management in Indonesia. The sample of this research is 163 companies in non-financial sectors listed on the Indonesia Stock Exchange in the period 2014-2018. Regression analysis is used to test the research hypothesis. Discretional accruals were used to measure earning management. The results show that the audit firm’s reputation as a proxy of audit quality has a negative significant influence (at the 5% level) on earning management practices. Contrary to the hypothesis, we found that the size of the board of commissioners has a positive significant influence (at the 5% level) on earnings management. These findings provide practical advice for the government and shareholders in providing effective corporate governance mechanisms in constraining earnings management.

References

Almazan, A., Hartzell, J. C., & Starks, L. T. (2005). Active institutional shareholders and costs of monitoring: Evidence from executive compensation. Financial management, 34(4), 5-34.

Alves, S. (2012). Ownership structure and earnings management: Evidence from Portugal. Australasian Accounting, Business and Finance Journal, 6(1), 57-74.

Arens, A. A., Elder, R. J., & Mark, B. (2012). Auditing and assurance services: an integrated approach. Boston: Prentice-Hall.

Bange, M. M., & De Bondt, W. F. (1998). R&D budgets and corporate earnings targets. Journal of Corporate Finance, 4(2), 153-184.

Becker, C. L., DeFond, M. L., Jiambalvo, J., & Subramanyam, K. R. (1998). The effect of audit quality on earnings management. Contemporary accounting research, 15(1), 1-24.

Bos, A. D., & Donker, H. (2004). Monitoring accounting changes: empirical evidence from the Netherlands. Corporate Governance: An International Review, 12(1), 60-73.

Brick, I. E., Palmon, O., & Wald, J. K. (2006). CEO compensation, director compensation, and firm performance: Evidence of cronyism?. Journal of Corporate Finance, 12(3), 403-423.

Caneghem, V.T. (2004). The impact of audit quality on earnings rounding-up behavior: some UK evidence. European Accounting Review, 13(4), 771-786.

Chadegani, A. (2011). Review of studies on audit quality. Available at SSRN 2227359.

Chi, W., Lisic, L. L., & Pevzner, M. (2011). Is enhanced audit quality associated with greater real earnings management?. Accounting Horizons, 25(2), 315-335.

Chung, R., Firth, M., & Kim, J. B. (2002). Institutional monitoring and opportunistic earnings management. Journal of corporate finance, 8(1), 29-48.

Cornett, M. M., McNutt, J. J., & Tehranian, H. (2009). Corporate governance and earnings management at large US bank holding companies. Journal of Corporate finance, 15(4), 412-430.

Davidson, R., Goodwin‐Stewart, J., & Kent, P. (2005). Internal governance structures and earnings management. Accounting & Finance, 45(2), 241-267.

DeAngelo, Linda Elizabeth. 1981. Auditor Size and Audit Quality. Journal of Accounting and Economics 3 183-199.

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. Accounting review, 193-225.

Dechow, P., Sloan, R., Sweeney, A., 1996. Causes and consequences of earnings management: An analysis of firms subject to enforcement actions by the SEC. Contemporary Accounting Research 13 (2), 1-36.

Donnelly, R., & Lynch, C. (2002). The ownership structure of UK firms and the informativeness of accounting earnings. Accounting and Business Research, 32(4), 245-257.

Fama, E. F. (1980). Agency problems and the theory of the firm. Journal of political economy, 88(2), 288-307.

Fan, J. P., & Wong, T. J. (2002). Corporate ownership structure and the informativeness of accounting earnings in East Asia. Journal of accounting and economics, 33(3), 401-425.

Firth, M., Fung, P. M., & Rui, O. M. (2007). How ownership and corporate governance influence chief executive pay in China's listed firms. Journal of Business Research, 60(7), 776-785.

González, J. S., & García-Meca, E. (2013). Does corporate governance influence earnings management in Latin American markets?. Journal of Business Ethics, 121(3), 419-440.

Gulzar, M. A. (2011). Corporate governance characteristics and earnings management: Empirical evidence from Chinese listed firms. International Journal of Accounting and Financial Reporting, 1(1), 133.

Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

Iturriaga, F. J. L., & Hoffmann, P. S. (2005). Earnings management and internal mechanisms of corporate governance: Empirical evidence from Chilean firms. Corporate Ownership & Control, 3(1), 17-29.

Jaggi, B., Leung, S., & Gul, F. (2009). Family control, board independence, and earnings management: Evidence-based on Hong Kong firms. Journal of Accounting and Public Policy, 28(4), 281-300.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305-360.

Kanagaretnam, K., Lim, C. Y., & Lobo, G. J. (2010). Auditor reputation and earnings management: International evidence from the banking industry. Journal of Banking & Finance, 34(10), 2318-2327.

Kirana, D. J. (2019). Peranan Corporate Governance Dalam Meningkatkan Kinerja Perusahaan Family Ownership Di Indonesia. Management & Accounting Expose, 1(2).

Krishnan, G. V. (2003). Does Big 6 auditor industry expertise constrain earnings management?. Accounting Horizons, 17, 1-16.

Lafond, R., & Roychowdhury, S. (2008). Managerial ownership and accounting conservatism. Journal of accounting research, 46(1), 101-135.

Lin, J. W., & Hwang, M. I. (2010). Audit quality, corporate governance, and earnings management: A meta‐analysis. International Journal of Auditing, 14(1), 57-77.

Lorca, C., Sánchez-Ballesta, J. P., & García-Meca, E. (2011). Board effectiveness and cost of debt. Journal of business ethics, 100(4), 613-631.

Lys, T., & Watts, R. L. (1994). Lawsuits against auditors. Journal of accounting research, 32, 65-93.

Memis, M. U., & Cetenak, E. H. (2012). Earnings management, audit quality, and legal environment: An international comparison. International Journal of Economics and Financial Issues, 2(4), 460-469.

Monks, R. A. G., & Minow, N. (1995). Corporate governance on equity ownership and corporate value. Journal of Financial Economics, 20, 293-315.

Santiago, M., & Brown, C. J. (2009). An empirical analysis of Latin American board of directors and minority shareholders' rights. In Forum Empresarial (Vol. 14, No. 2, pp. 1-18). Centro de Investigaciones Comerciales e Iniciativas Académicas.

Schipper, M. (1989). Beyond the boundaries: African literature and literary theory. Allison & Busby

Soliman, M. M., & Ragab, A. A. (2014). Audit committee effectiveness, audit quality, and earnings management: an empirical study of the listed companies in Egypt. Research Journal of Finance and Accounting, 5(2), 155-166.

Watts, R. L., & Zimmerman, J. L. (1986). Positive accounting theory.

Williamson, O. E. (1988). Corporate finance and corporate governance. The journal of finance, 43(3), 567-591.

Xie, B., Davidson III, W. N., & DaDalt, P. J. (2003). Earnings management and corporate governance: the role of the board and the audit committee. Journal of corporate finance, 9(3), 295-316

Yang, C. Y., Tan, B. L., & Ding, X. (2012). Corporate governance and income smoothing in China. Journal of Financial Reporting and Accounting.

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of financial economics, 40(2), 185-211.

Yu, F. (2006). Corporate governance and earnings management. Carlson School of Management, University of Minnesota, Minneapolis.

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).