The Effect of Awareness, Income, and Service Quality on Taxpayer Compliance in Paying Land and Building Tax in Kuningan District

DOI:

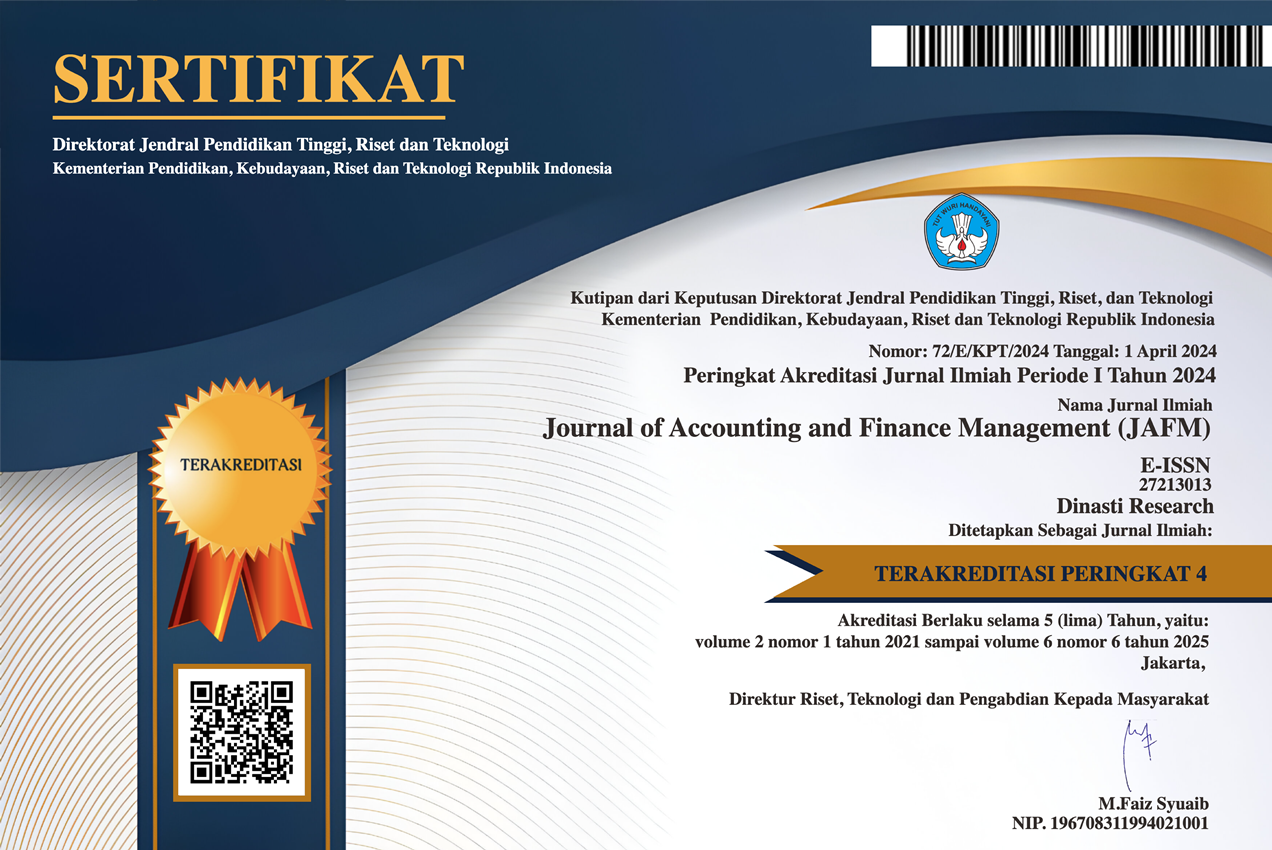

https://doi.org/10.38035/jafm.v6i3.2140Keywords:

Awareness, Income, Service Quality, Taxpayer Compliance, Land and Building TaxAbstract

This study looked at how taxpayer compliance with paying Land and Building Tax (PBB) in Kuningan District was impacted by awareness, income level, and service quality. This study employed a quantitative approach using SPSS software version 26 to handle data from multiple linear regression analysis. One hundred randomly chosen respondents (random sampling) from among taxpayers registered with the Kuningan Regency Regional Revenue Agency were given questionnaires in order to collect data. The findings of analysis show that the level of awareness and quality of service contribute significantly to taxpayer compliance in PBB payments. On the other hand, there is no discernible impact of the income variable on the degree of compliance. The government can take these results into account when developing strategies to increase taxpayer compliance, such as by enhancing the standards of public services related to taxes and providing continuous tax education.

References

Alfian, N., & Rohmaniyah. (2021). Effect of Income and Taxpayer Awareness on Compliance in Paying Land and Building Tax (PBB). Advance?: Jurnal Accounting, 8(2), 31–46. http://e-journal.stie-aub.ac.id

Almaas, R. (2024, January 30). Musabah PBB-P2 Dialihkan jadi Pajak Daerah. https://pajak.go.id/id/artikel/musabab-pbb-p2-dialihkan-jadi-pajak-daerah?utm_source=chatgpt.com

Anugrah, M. S. S., & Fitriandi, P. (2022). Analisis Kepatuhan Pajak Berdasarkan Theory Of Planned Behavior. Jurnal Info Artha, 6, 1–12.

Badar, G., & Kantohe, M. (2022). Pengaruh Kesadaran Wajib Pajak, Pengetahuan Wajib Pajak Dan Tingkat Penghasilan Terhadap Kepatuhan Dalam Membayar Pajak Bumi Dan Bangunan (PBB) Di Kecamatan Tompaso. JAIM: Jurnal Akuntansi Manado, 3, 334–343.

Cynthia, P. N., & Djauhari, S. (2020). Pengaruh Pendapatan Wajib Pajak, Sosialisasi, Kualitas Pelayanan Dan Sanksi Pajak Terhadap Kepatuhan Dalam Membayar Pajak Bumi Dan Bangunan. Jurnal Penelitian Dan Kajian Ilmiah, 18.

Izmi, D. A., & Purnamasari, N. (2024). The Influence Of Taxpayer Awareness And Tax Sanctions On PBB-P2 Taxpayer Compliance In Bandung City In 2024. Journal of Social and Economics Research, 6(1). https://idm.or.id/JSER/index.

Janiman, & Firasati, A. (2023). Pengaruh Kesadaran Wajib Pajak, Kualitas Pelayanan Fiskus Dan Sanksi Pajak Terhadap Kepatuhan Wajib Pajak Orang Pribadi Di Kpp Pratama Cirebon Satu. Journal of Economics and Business UBS.

Mumu, A., Sondakh, J., & Suwetja, I. (2020). Pengaruh Pengetahuan Perpajakan, Sanksi Pajak, Dan Kesadaran Wajib Pajak Terhadap Kepatuhan Membayar Pajak Bumi Dan Bangunan Di Kecamatan Sonder Kabupaten Minahasa. Jurnal Riset Akuntansi, 15, 175–184.

Oktaviano, B., Wulandari, D. S., & Fauziyyah, S. (2023). Taxpayer Compliance in Paying Rural and Urban Land and Building Tax (PBB-P2) in the Perspective of the Theory of Planned Behavior. East Asian Journal of Multidisciplinary Research, 2(7), 3131–3150. https://doi.org/10.55927/eajmr.v2i7.4982

Patriandari, & Amalia, H. (2022). Pengaruh Pengetahuan Perpajakan, Kesadaran Wajib Pajak Dan Sanksi Perpajakan Terhadap Kepatuhan Wajib Pbb-P2 Pada Bapenda Jakarta Timur Tahun 2020. AKRUAL?: Jurnal Akuntansi Dan Keuangan, 4(1), 48–56. https://doi.org/10.34005/akrual.v4i1.2025

Poeh, M. (2022). Pengaruh Pendapatan Wajib Pajak, Sanksi Perpajakan, dan Pengetahuan Perpajakan Terhadap Kepatuhan Wajib Pajak dalam membayar Pajak Bumi dan Bangunan (PBB) pada Kecamatan Alak Kota Kupang. Jurnal Pendidikan Ilmu Pengetahuan Sosial (JPIPS), 14, 281–291.

Purnamasari, D., Sari, D., & Mulyati, Y. (2024). Pengaruh Kualitas Pelayanan Pajak dan Kesadaran Wajib Pajak Terhadap Kepatuhan Wajib Pajak Bumi dan Bangunan. Owner Riset & Jurnal Akuntansi, 8(1), 934–943. https://doi.org/10.33395/owner.v8i1.1876

Ratulia, A., & Halimatusyadiah. (2024). Pengaruh Kualitas Pelayanan Pajak, Pengetahuan Dan Kesadaranwajib Pajak Terhadap Kepatuhan Wajib Pajak Bumi Dan Bangunan (PBB) Di Kota Bengkulu. Jurnal Ilmiah MEA (Manajemen, Ekonomi, Dan Akuntansi), 8, 892–906.

Sandra, A., & Angelika, W. (2022). Analisis Pengaruh Kesadaran Wajib Pajak, Penghasilan, Kualitas Pelayanan Dan Sosialisasi Terhadap Kepatuhan Membayar PBB-P2. Akmen, 19, 266–282.

Wardani, S., Kurniawan, R., & Haryono. (2024). Teori Atribusi: Memahami Hubungan Kualitas Layanan, Pemahaman Perpajakan, Implementasi Sanksi dan Kepatuhan Pajak. JRAP (Jurnal Riset Akuntansi Dan Perpajakan), 11, 183–197. https://doi.org/10.35838/jrap.2024.01

Wildan, M. (2025). DJP: Rasio Kepatuhan Wajib Pajak di 2024 Sebesar 85,75 Persen. DDTC News . https://news.ddtc.co.id/berita/nasional/1808066/djp-rasio-kepatuhan-wajib-pajak-di-2024-sebesar-8575-persen

Wulandari, R. (2023). Pengaruh Kesadaran Wajib Pajak, Kualitas Pelayanan. Pengetahuan Perpajakan dan Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak PBB-P2 di Kabupaten Rembang. JSMA (Jurnal Sains Manajemen & Akuntansi), 15.

Yashilva, W. (2024, September 12). 82,4% Sumber Pendapatan Negara Berasal dari Pajak. https://data.goodstats.id/statistic/824-sumber-pendapatan-negara-berasal-dari-pajak-HQvsd

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Dede Santi Halimatusadiyah, Melha Melha, Aoliyah Firasati

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).