Analysis of Financial Performance and Company Value of Conventional Banks and Islamic Banks

DOI:

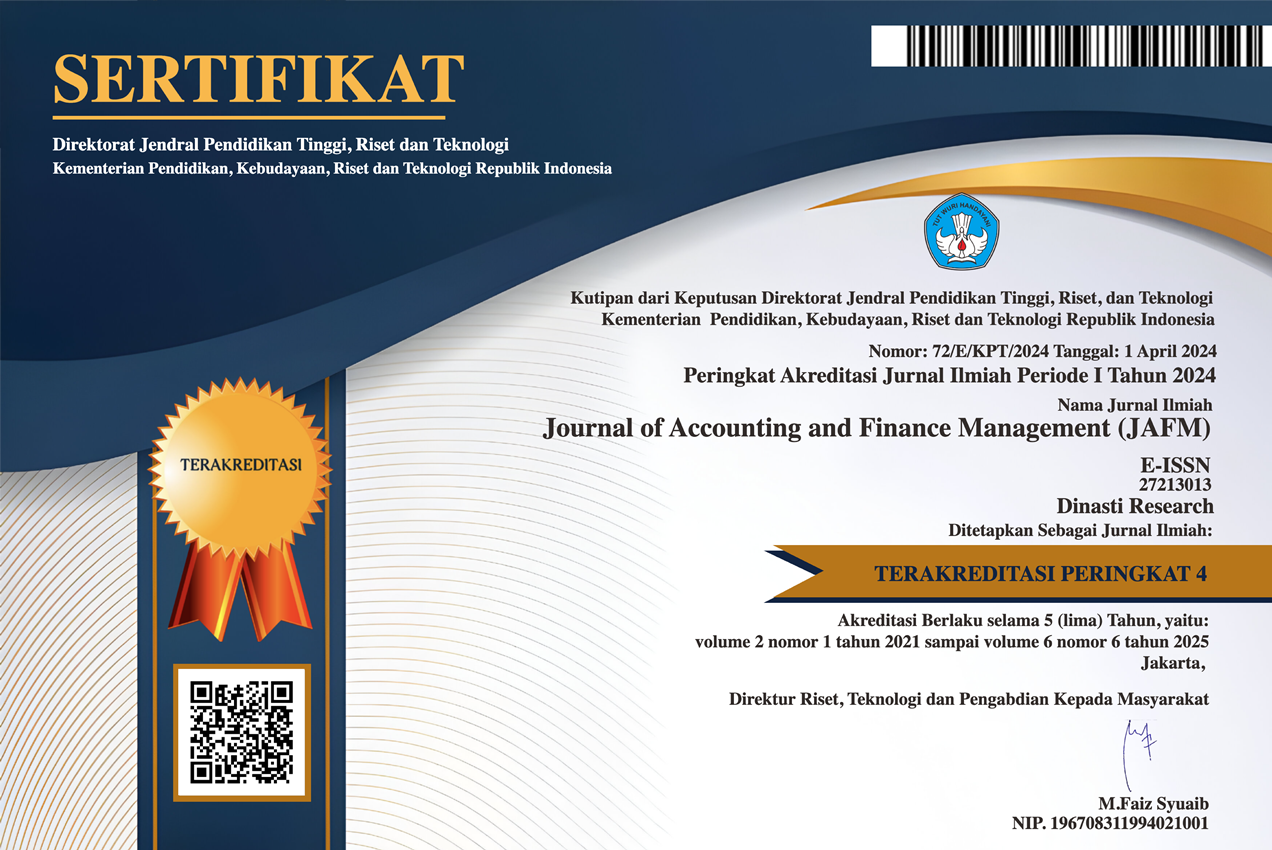

https://doi.org/10.38035/jafm.v6i3.2147Keywords:

Financial Performance, Firm Value, Conventional Banks, Islamic BanksAbstract

The purpose of this research is to study the difference in financial performance and its impact on firm value between conventional and Islamic banks in Indonesia from 2019 to 2023. With a quantitative approach and descriptive-comparative method, this study investigates various financial performance variables, including capital adequacy ratio (CAR), non-performing debt ratio (NPL), debt-to-deposit ratio (LDR), return on assets (ROA), NIM ratio, and good corporate governance (GCG), and their relationship with firm value, as measured by book price to value (PBV). This data was collected from official publications of the Financial Services Authority (OJK), the Indonesia Stock Exchange (IDX), and bank annual reports.The results showed that in conventional banks, LDR and GCG variables have a significant influence on PBV, while other variables do not have a significant influence. In Islamic banks, on the contrary, ROA and LDR are proven to have a significant influence on PBV, while CAR, NPL, NIM, and GCG have no significant influence. The results suggest that different banking systems have different value determinant structures. Conventional banks focus more on liquidity and governance, while Islamic banks focus more on profitability and efficiency of funds distribution. These results suggest that investors consider various elements in assessing a bank's prospects and valuation, depending on its operational system.

References

Anggelia B. Nursalim, Paulina V. Rate, & Dedy N. Baramuli. (2021). Pengaruh Inflasi, Profitabilitas, Solvabilitas Dan Ratio Aktivitas Terhadap Nilai Perusahaan Sektor Manufaktur Periode 2015-2018. Jurnal EMBA, 9(4), 559–571.

Anggreini, G. M., & Kartika Oktaviana, U. (2022). FAKTOR-FAKTOR PENENTU NILAI PERUSAHAAN PADA BANK UMUM SYARIAH DI INDONESIA PERIODE 2016-2020.

Asraf, A., Yurasti, Y., & Suwarni, S. (2020). Analisis Perbandingan Kinerja Keuangan Bank Syariah Mandiri Dengan Bank Mandiri Konvensional. Mbia, 18(3), 121–136. https://doi.org/10.33557/mbia.v18i3.751

Azwari, P. C., Dewi, P. R., & Zuhro, F. (2022). Analisis Perbandingan Kinerja Keuangan Pada Bank Umum Syariah Dan Bank Umum Konvensional Di Indonesia. J-MIND (Jurnal Manajemen Indonesia), 7(1), 70. https://doi.org/10.29103/j-mind.v7i1.7093

Handayani, N., Asyikin, J., Ernawati, S., & Boedi, S. (2023). Analisis pengaruh kinerja keuangan terhadap nilai perusahaan perbankan indonesia. In Online) KINERJA: Jurnal Ekonomi dan Manajemen (Vol. 20, Issue 2).

Hery. (2017). Kajian Riset Akuntansi?: mengulas berbagai hasil penelitian terkini dalam bidang akuntansi dan keuangan. PT Grasindo.

Intan Trisela Pramudita, & Ulfi Pristiana. (2020). ANALISIS PERBANDINGAN KINERJA KEUANGAN BANK SYARIAH DENGAN BANK KONVENSIONAL YANG TERDAFTAR DI BURSA EFEK INDONESIA PERIODE 2014 - 2018. JURNAL EKONOMI MANAJEMEN (JEM17), 5(2), 1–23.

Khasanah, U., & Suwarti, T. (2022). Analisis Pengaruh Der, Roa, Ldr Dan Tato Terhadap Harga Saham Pada Perusahaan Perbankan. Jurnal Ilmiah Akuntansi Dan Keuangan, 4(6), 2.

Komalasari, I., & Wirman, W. (2021). Analisis Perbandingan Kinerja Keuangan Bank Konvensional Dengan Bank Syariah Periode 2015-2019. Jurnal Akuntansi Bisnis, 14(2), 114–125. https://doi.org/10.30813/jab.v14i2.2511

Maryadi, A. R., & Susilowati, P. I. M. (2020). Pengaruh Return on Equity (Roe), Loan To Deposit Ratio (Ldr), Non Performing Loan (Npl) Dan Biaya Operasional Terhadap Pendapatan Operasional (Bopo) Terhadap Nilai Perusahaan Pada Subsektor Perbankan Yang Terdaftar Di Bei Pada Tahun 2015-2017. Jurnal Sains Manajemen Dan Kewirausahaan, 4(1), 69–80.

Roza, V. Z., & Aresteria, M. (2024). PERAN KINERJA KEUANGAN DALAM MENENTUKAN NILAI PERUSAHAAN PERBANKAN KONVENSIONAL. Media Akuntansi Dan Perpajakan Indonesia, 6(1), 97.

Syifa Utami Putri, & Eka Purnama Sari. (2023). Analisis Perbandingan Kinerja Keuangan Bank Syariah Dengan Bank Konvensional yang Terdaftar Di Bursa Efek Indonesia Periode 2016-2020. Digital Bisnis: Jurnal Publikasi Ilmu Manajemen Dan E-Commerce, 2(1), 130–143. https://doi.org/10.30640/digital.v2i1.646

Tampubolon Grandvia, B. H. (2020). PENGARUH KINERJA KEUANGAN TERHADAP NILAI PERUSAHAAN PADA BANK GO PUBLIK YANG TERDAFTAR DI BURSA EFEK INDONESIA. Jurnal AKRAB JUARA, 5(3), 84–100.

Wahyuna, S., & Zulhamdi, Z. (2022). Perbedaan Perbankan Syariah dengan Konvensional. Al-Hiwalah?: Journal Syariah Economic Law, 1(2), 183–196. https://doi.org/10.47766/alhiwalah.v1i2.879

Yana Setiana. (2018). PENGARUH KINERJA KEUANGAN TERHADAP NILAI PERUSAHAAN STUDY KASUS PADA PERBANKAN SYARIAH. UIN RADEN FATEH PALEMBANG.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Muchamad Andi Niryanto, Rizky Ramadhan, Acep Komara

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).