CEO Power dan Komparabilitas Laporan Keuangan

DOI:

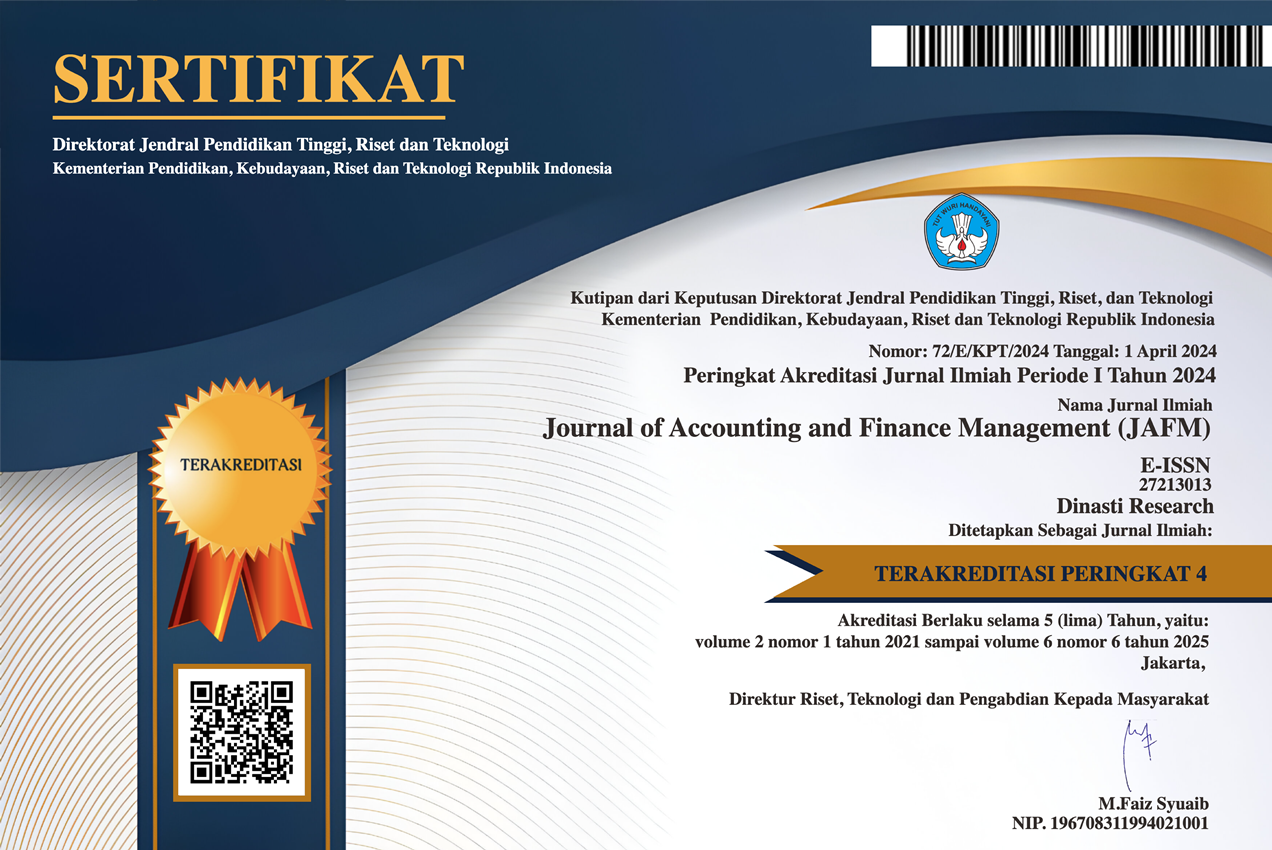

https://doi.org/10.38035/jafm.v6i3.2283Keywords:

CEO Power, Financial Statement ComparabilityAbstract

Penelitian ini bertujuan untuk menguji perngaruh CEO Power terhadap Komparabilitas Laporan Keuangan sebagai karakteristik kualitatif pelaporan keuangan. Populasi dalam penelitian ini adalah Perusahaan manufaktur yang terdaftar di Bursa Efek Indonesia periode 2018-2023. Jumlah sampel dalam penelitian ini yaitu 175 perusahaan dengan 880 observasi. Penelitian ini menggunakan regresi data panel, dimana hasil penelitian menunjukkan pengaruh negatif yang signifikan terhadap kepemilikan kas perusahaan. Sehingga semakin tinggi CEO Power dalam sebuah Perusahaan, maka semakin rendah tingkat komparabilitas laporan keuangan.

References

Alamsyah, I. F., Esra, R., Awalia, S., & Nohe, D. A. (2022). Analisis regresi data panel untuk mengetahui faktor yang memengaruhi jumlah penduduk miskin di Kalimantan Timur. Prosiding Seminar Nasional Matematika dan Statistika,

Alzoubi, E. S. S. (2018). Audit quality, debt financing, and earnings management: Evidence from Jordan. Journal of International Accounting, Auditing and Taxation, 30, 69–84.

Baker, T. A., Lopez, T. J., Reitenga, A. L., & Ruch, G. W. (2019). The influence of CEO and CFO power on accruals and real earnings management. Review of Quantitative Finance and Accounting, 52(1), 325–345.

Barth, M. E., Landsman, W. R., Lang, M., & Williams, C. (2012). Are IFRS-based and US GAAP-based accounting amounts comparable? Journal of accounting and economics, 54(1), 68–93.

Bouaziz, D., Salhi, B., & Jarboui, A. (2020). CEO characteristics and earnings management: empirical evidence from France. Journal of Financial Reporting and Accounting, 18(1), 77–110.

Butar, S. B. (2017). Implikasi gaya audit terhadap komparabilitas laporan keuangan. Jurnal Dinamika Akuntansi dan Bisnis Vol, 4(2), 189–210.

Cheng, L. T., Chan, R. Y., & Leung, T. Y. (2010). Management demography and corporate performance: Evidence from China. International Business Review, 19(3), 261–275.

Davila, A., & Foster, G. (2005). Management accounting systems adoption decisions: Evidence and performance implications from early?stage/startup companies. The Accounting Review, 80(4), 1039–1068.

De Franco, G., Kothari, S. P., & Verdi, R. S. (2011). The benefits of financial statement comparability. Journal of Accounting research, 49(4), 895–931.

DeFond, M., Hu, X., Hung, M., & Li, S. (2011). The impact of mandatory IFRS adoption on foreign mutual fund ownership: The role of comparability. Journal of accounting and economics, 51(3), 240–258.

FASB, F. A. S. B. (1980). Statement of financial accounting concepts No. 2. summary of principal conclusions a hierarchy of accounting qualities (2)”.

FASB, F. A. S. B. (2010). Conceptual framework for financial reporting, chapter 3: qualitative characteristics of useful. Statement of Financial Accounting Concepts, No. 8.

Finkelstein, S. (1992). Power in top management teams: Dimensions, measurement, and validation. Academy of Management journal, 35(3), 505–538.

Francis, J. R., & Gunn, J. L. (2015). Industry accounting complexity and earnings properties: Does auditor industry expertise matter. Available on line at https://www. uts. edu. au/sites/default/.../AccDG_Francis% 20Gunn__WP, 20(2), 015.

Ghozali. (2018). Aplikasi Analisis Multivariate Dengan Program IBM SPSS 25. Badan Penerbit Universitas Diponegoro.

Hambrick, D. C. (2007). Upper echelons theory: An update. In (Vol. 32, pp. 334–343): Academy of Management Briarcliff Manor, NY 10510.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of management review, 9(2), 193–206.

Huang, P., & Zhang, Y. (2012). Does enhanced disclosure really reduce agency costs? Evidence from the diversion of corporate resources. The Accounting Review, 87(1), 199–229.

IFRS, C. (2018). IFRS Framework: Conceptual Framework for Financial Reporting¸ IFRSFoundation. In: London.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. In Corporate governance (pp. 77–132). Gower.

Jiang, W., Lee, P., & Anandarajan, A. (2008). The association between corporate governance and earnings quality: Further evidence using the GOV-Score. Advances in Accounting, 24(2), 191–201.

Li, S., Ho Park, S., & Shuji Bao, R. (2014). How much can we trust the financial report? Earnings management in emerging economies. International Journal of Emerging Markets, 9(1), 33–53.

Luong, H., Gunasekarage, A., & Biswas, P. K. (2025). CEO power and financial statement comparability. International journal of managerial finance, 21(3), 693–731.

Malmendier, U., & Tate, G. (2005). Does overconfidence affect corporate investment? CEO overconfidence measures revisited. European financial management, 11(5), 649–659.

Rashid, M. M. (2020). Presence of professional accountant in the top management team and financial reporting quality: Evidence from Bangladesh. Journal of Accounting & Organizational Change, 16(2), 237–257.

Setianto, A., & Juliarto, A. (2014). Penerapan IFRS dan hubungannya dengan komparabilitas pengungkapan aset tetap pada laporan keuangan perusahaan Fakultas Ekonomika dan Bisnis].

Sitorus, N. J., & Ardiati, A. Y. (2017). Pengaruh Standar Akuntansi Keuangan Indonesia Baru, Ukuran Kantor Akuntan Publik, Ukuran Perusahaan dan Umur Perusahaan Terhadap Audit Report Lag. Modus, 29(2), 139–156.

Westbrook, A. D. (2020). We ('re) Working on Corporate Governance: Stakeholder Vulnerability in Unicorn Companies. U. Pa. J. Bus. L., 23, 505.

Zouari, Z., Lakhal, F., & Nekhili, M. (2012). Do CEO’s characteristics affect earnings management? Evidence from France. Evidence from France (June 11, 2012).

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Sofi Hanani, Zahroh Naimah

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).