The Influence of Intellectual Capital, Good Corporate Governance, Funding Decisions and Investment Decisions on Firm Value Mediated by Profitability as an Intervening Variable in LQ45 Companies for the 2020–2024 Period

DOI:

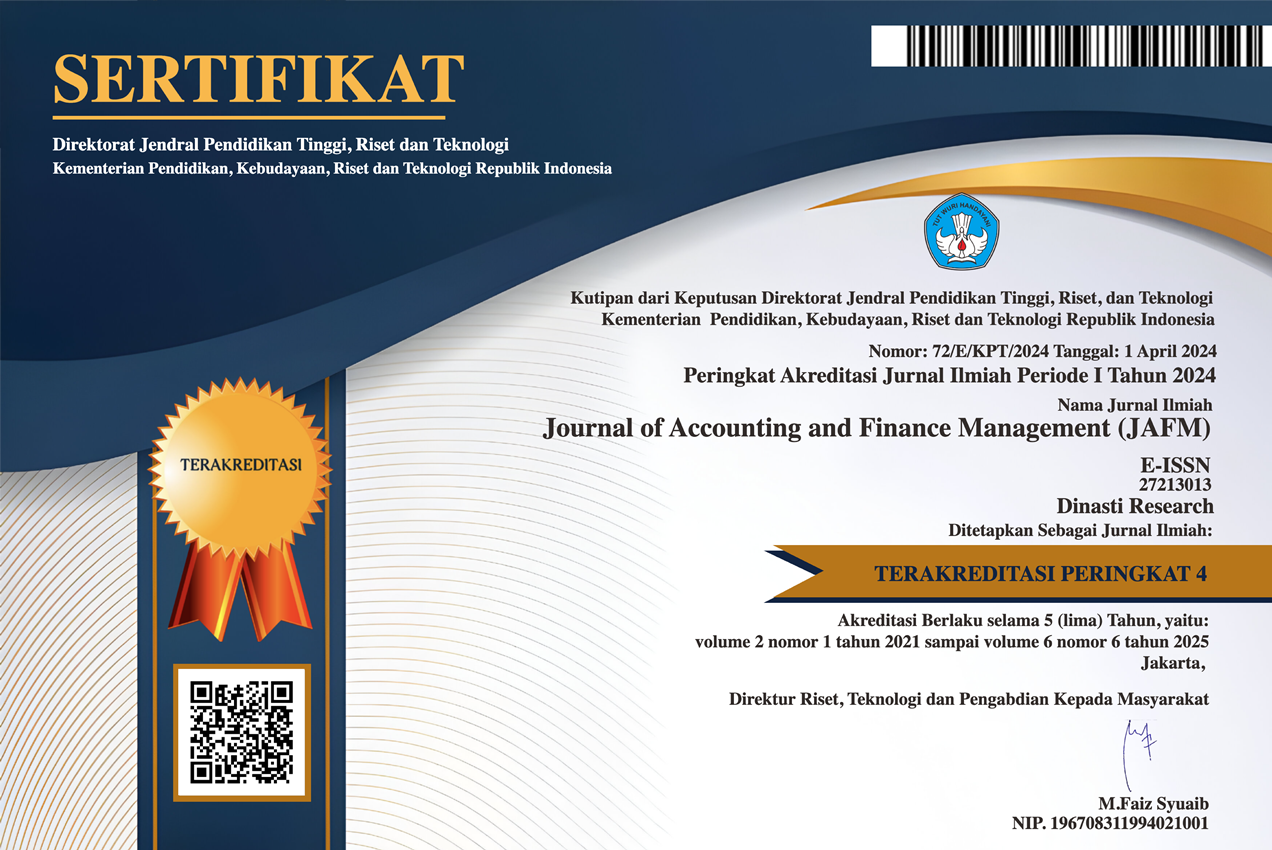

https://doi.org/10.38035/jafm.v6i4.2396Keywords:

Intellectual Capital, Good Corporate Governance, Financing Decisions, Investment Decisions, Firm Value, ProfitabilityAbstract

This study aims to analyze the influence of intellectual capital, good corporate governance, funding decisions, and investment decisions on firm value, with profitability as an intervening variable, in LQ45 companies during the 2020–2024 period. The sampling method used in this research is purposive sampling, in which 26 companies listed in the LQ45 index were selected as the research sample. The secondary data were obtained from annual financial reports. The results of this study indicate that intellectual capital has a significant effect on profitability; good corporate governance has a significant effect on profitability; funding decisions have a significant effect on profitability; investment decisions have a significant effect on profitability; intellectual capital has a significant effect on firm value; good corporate governance has a significant effect on firm value; funding decisions have a significant effect on firm value; investment decisions have a significant effect on firm value; profitability does not have a significant effect on firm value; intellectual capital through profitability does not have a significant effect on firm value; good corporate governance through profitability does not have a significant effect on firm value; funding decisions through profitability have a significant effect on firm value; and investment decisions through profitability have a significant effect on firm value.

References

Abdillah, A. (2014). Analisis Pengaruh Kebijakan Dividen, Kebijakan Hutang, Profitabilitas dan Keputusan Investasi Terhadap Nilai Perusahaan Manufaktur. Jurnal Ekonomi dan Bisnis 1(2): 1-16.

Brigham, E. F., & Houston, J. F. (2006). Fundamentals of Financial Management (10th ed.). Mason: Thomson South-Western.

Brigham, E. F., & Houston, J. F. (2019). Dasar-Dasar Manajemen Keuangan (Edisi 14). Jakarta: Salemba Empat.

Fadhila & Akhmad. (2020) Pengaruh Profitabilitas, Solvabilitas Dan Likuiditas Terhadap Nilai Perusahaan. Jurnal Ilmu dan Riset Akuntansi. (STIESIA) Surabaya.

Fauziah, N., & Asandimitra, N. (2018). Keputusan Investasi dan Pengaruhnya terhadap Nilai Perusahaan. Jurnal Ilmu Manajemen, 6(4), 541–550.

Ghozali, I. (2014). Structural Equation Modeling: Metode Alternatif dengan Partial Least Square (PLS). Semarang: Badan Penerbit Universitas Diponegoro.

Ghozali, I., & Latan, H. (2015). Partial Least Squares: Konsep, Teknik dan Aplikasi menggunakan Program SmartPLS 3.0 (2nd ed.). Semarang: Badan Penerbit Universitas Diponegoro.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM) (2nd ed.). Thousand Oaks, CA: SAGE Publications.

Handarini, D. (2018). Pengaruh Keputusan Pendanaan terhadap Profitabilitas dan Nilai Perusahaan. Jurnal Manajemen Keuangan, 6(2), 101–110.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305–360.

Kasmir. (2018). Analisis Laporan Keuangan (Edisi 2). Jakarta: RajaGrafindo Persada.

Muhajirin, M., & Panorama, F. (2018). Metodologi Penelitian Kuantitatif. Jakarta: Bumi Aksara.

Nuridah, S., Merliyana, M., Sagitarius, E., & Surachman, S. N. (2023). Pengaruh Good Corporate Governance Terhadap Nilai Perusahaan. Jurnal Ekonomi, Bisnis Dan Manajemen, 2(2), 01-10.

Purnama, H., & UPY, F. B. (2018). Pengaruh struktur modal, kebijakan deviden, dan keputusan investasi terhadap Nilai Perusahaan (Studi Kasus Perusahaan Manufaktur yang Go Publik di Bursa Efek Indonesia) Periode 2012-2016. Jurnal Akmenika Vol 15 No. 2, Oktober 2018.

Purwanto, A. (2020). Manajemen Strategis untuk Keunggulan Bersaing. Jakarta: Salemba Empat.

Safitri, Norma dan Aniek Wahyuati, (2015) Pengaruh Struktur Modal dan Keputusan Investasi Terhadap Profitabilitas dan Nilai Perusahaan. Jurnal Ilmu dan Riset Manajemen, Vol. 4, No. 2.

Solla, L. (2010). Good Corporate Governance dan Kinerja Perusahaan. Jurnal Keuangan dan Perbankan, 14(3), 409–419.

Sugiyono. (2014). Metode Penelitian Kuantitatif, Kualitatif, dan R&D. Bandung: Alfabeta.

Susila, M. P., & Prena, G. das. (2019). Pengaruh Keputusan Pendanaan, Kebijakan Deviden, Profitabilitas Dan Corporate Social Responsibility Terhadap Nilai Perusahaan. Jurnal Akuntansi : Kajian Ilmiah Akuntansi (JAK), 6(1), 80.

Ulum, I. (2018). Intellectual Capital: Konsep dan Kajian Empiris. Yogyakarta: Graha Ilmu.

Utami, E. S., & Wulandari, I. (2021). Pengaruh Penerapan Good Corporate Governance Terhadap Nilai Perusahaan. Jurnal Riset Akuntansi Mercu Buana, 7(2).

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Ahmad Adhan, Arna Suryani, Ali Akbar

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).