Central Banks and Profitability: A Systematic Literature Review

DOI:

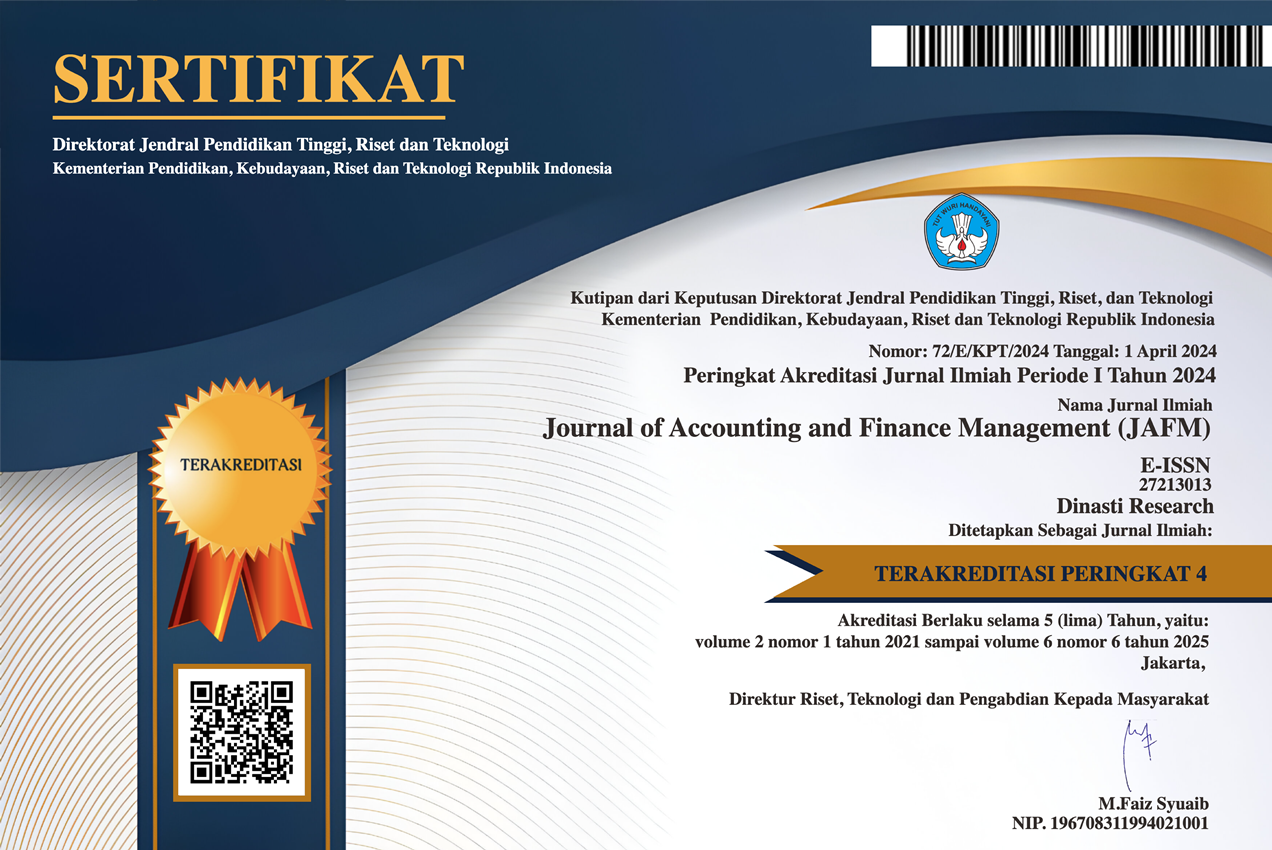

https://doi.org/10.38035/jafm.v4i5.271Keywords:

Keywords: central bank, profitability, credibility, capital structureAbstract

Abstract: Although the topic of central bank has been studied mainly in relation to the role of monetary authority and financial system regulator, the topic of central bank profit has not yet received much attention because it is difficult to observe central bank profitability due to their nature as public institutions. The review provides evidence from 22 documents, which are then classified into five central bank profitability themes: independence, monetary policy effectiveness, competition, operations and risk, and public finance. We conclude that central bank profitability can be a research agenda as profitability can be perceived as central banks’ financial strength to conduct their responsibility and to maintain their credibility.

References

Adler, G., Castro, P. & Tovar, C.E. (2016) Does central bank capital matter for monetary policy?. Open Economic Review, 27, 183–205. https://doi.org/10.1007/s11079-015-9360-1.

Alvarez-Parra, F., Arreaza, A. & Zambrano, E. (2018) Should a central bank transfer its profits to the Treasury? Economia, 18(2), 87-119. http://dx.doi.org/10.1111/jofi.13257

Aria, M. & Cuccurullo, C. (2017) bibliometrix: An R-tool for comprehensive science mapping analysis, Journal of Informetrics, 11, 959–975. https://doi.org/10.1016/j.joi.2017.08.007

Baltensperger, E, & Jordan, T.J. (1998) Seigniorage and the transfer of Central Bank profits to the government. Kyklos, 51(1), 73-88. http://dx.doi.org/10.1111/1467-6435.00038

Bassetto, M, & Messer, T. (2013) Fiscal consequences of paying interest on reserves. Fiscal Studies, 34(4), 413-436.

Bell, S., Chui, M., Gomes, T., Moser-Boehm, P. & Tejada, A. P. (2023) Why are central banks reporting losses? Does it matter?. BIS Buletin No. 68. Bank for International Settlements.

Boycko, M., Shleifer, A. & Vishny, R.W. (1996) A theory of privatisation. The Economic Journal, 106(435), 309–319. https://doi.org/10.2307/2235248

Cole, N.D. (2023) Endogenous constraints on full productive capacity in a free-market economy. Evolutionary and Institutional Economics Review, 20(1), 111-121. http://dx.doi.org/10.1515/ev-2022-0006

de Mendonça, H.F. & Tiberto, B. P. (2017) Effect of credibility and exchange rate pass-through on inflation: An assessment for developing countries. International Review of Economics & Finance, 50, 196-244. https://doi.org/10.1016/j.iref.2017.03.027.

Fischer, A.M. (2003) Measurement error and the profitability of interventions: a closer look at SNB transactions data. Economics Letters, 81(1), 137-142. http://dx.doi.org/10.1016/j.jbankfin.2013.04.026

Fishe, R.P.H., Robe, M.A. & Smith, A.D. (2016) Foreign central bank activities in US futures markets. Journal of Futures Markets, 36(1), 3-29. http://dx.doi.org/10.15057/22025

Gaganis, C. & Pasiouras, F. (2013) Financial supervision regimes and bank efficiency: International evidence . Journal Of Banking & Finance, 37(12), 5463-5475. http://dx.doi.org/10.1016/S0378-4266(97)00033-2

Goncharov, I., Ioannidou, V. & Schmalz, M.C. (2023) (Why) do central banks care about their profits?. Journal of Finance, 78, 2991-3045. https://doi.org/10.1111/jofi.13257

Hoffmann, A, & Loeffler, A. (2017) Surplus liquidity, central bank losses and the use of reserve requirements in emerging markets. Review of International Economics, 25(5), 990-998. http://dx.doi.org/10.2753/EEE0012-8775510402

Kim, I. & Kim, I. (2011) A macro-economic consequence of the central bank's reserve fund: a political-economic perspective. Hitotsubashi Journal of Economics, 52(2), 143-163. http://dx.doi.org/10.2753/REE1540-496X490307

Kim, I. & Kim, I. (2013) Central bank's retained profits and discount windows: a bureaucratic organization's discretion-seeking hypothesis. Emerging Markets Finance and Trade, 49(3), 84-102. http://dx.doi.org/10.1007/s00191-021-00759-y

Mandel, M. & Tomsík, V. (2013) Causes and consequences of emerging market central banks' long-term foreign exchange exposure. Eastern European Economics, 51(4), 26-49. http://dx.doi.org/10.1111/j.1475-5890.2013.12014.x

Pinter, J. (2018) Does central bank financial strength really matter for inflation? The key role of the fiscal support. Open Economic Review, 29, 911–952. https://doi.org/10.1007/s11079-018-9496-x.

Polanski, Z. & Szadkowski, M. (2023) Monetary policy normalization and central bank profits: a break-even point perspective. Economists Voice, 19(2), 139-164. http://dx.doi.org/10.1016/S0165-1765(03)00162-9

Prieto, P.P. (2022) The institutional evolution of central banks. Journal Of Evolutionary Economics, 32(3), 1049-1070. http://dx.doi.org/10.1016/S0261-5606(02)00009-8

Saacke, P. (2002) Technical analysis and the effectiveness of central bank intervention. Journal of International Money and Finance, 21(4), 459-479. http://dx.doi.org/10.1002/fut.21705

Schwarz, C., Karakitsos, P., Merriman, N., & Studener, W. (2015) Why accounting matters: A central bank perspective. Accounting Economics and Law-A Convivium, 5(1), 1-42. http://dx.doi.org/10.1007/s40844-023-00254-y

Sjöö, B. & Sweeney, R.J. (2001) The foreign-exchange costs of central bank intervention: evidence from Sweden. Journal of International Money and Finance, 20(2), 219-247. http://dx.doi.org/10.1515/ael-2014-0023

Stella, P. (2008) Central bank financial strength, policy constraints and inflation. IMF Working Papers 2008/049, International Monetary Fund. http://www.imf.org/external/pubs/cat/longres.aspx?sk=21718.

Sweeney, R.J. (1997) Do central banks lose on foreign-exchange intervention? A review article. Journal of Banking & Finance, 21(11-12), 1667-1684. http://dx.doi.org/10.1111/roie.12292

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).