Green Accounting, Environmental Performance: Mediating Role of Corporate Governance

DOI:

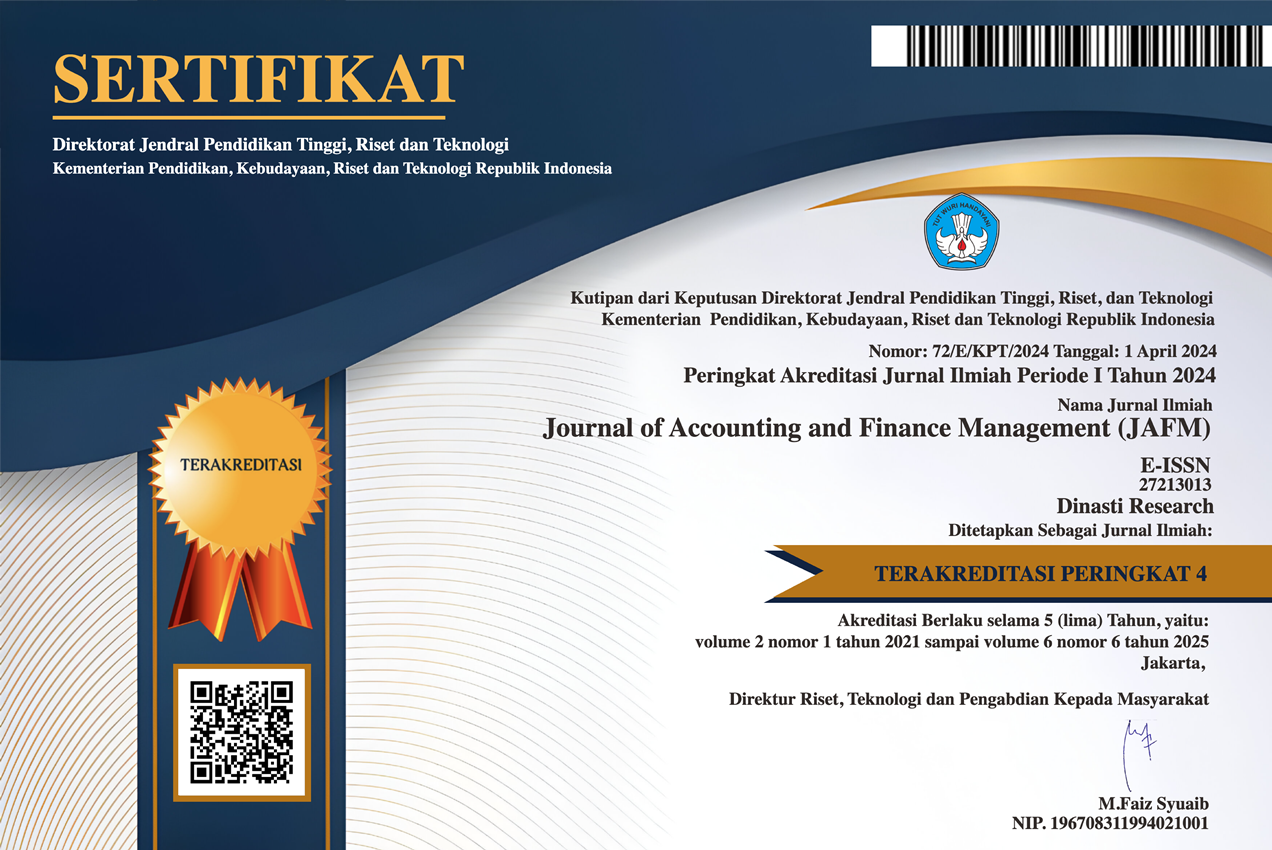

https://doi.org/10.38035/jafm.v6i6.2947Keywords:

Green Accounting, Environmental Performance, Good Corporate Governance, Financial PerformanceAbstract

The focus of this research is to investigate the mediating role GCG in the relationship between green accounting, environmental performance, and financial performance of chemical companies listed IDX period 2019 – 2023 with a sample of 10 companies, where green accounting and environmental performance variables become independent variables with corporate governance as an intervening variable and financial performance as independent variables. The analysis used in this study is panel data regression to test the hypothesis and mediation test through the Sobel test with the help of EViews software. The results of the study are: green accounting and environmental performance partially affect corporate governance, green accounting, environmental performance and corporate governance have a positive effect on financial performance. The implications of this study show that the company's attention to environmental aspects through green accounting practices and environmental performance improvement, supported by good corporate governance, is able to encourage improved financial performance.

References

Abedin, S. H., Subha, S., Anwar, M., Kabir, M. N., Tahat, Y. A., & Hossain, M. (2023). Environmental performance and corporate governance: Evidence from Japan. Sustainability, 15(4), 3273. https://doi.org/10.3390/su15043273

Altania, S., & Tanno, A. (2023). The effect of managerial ownership and institutional ownership on company financial performance. Jurnal Ilmiah Manajemen, Ekonomi, & Akuntansi (MEA), 7(1), 322–335. https://doi.org/10.31955/mea.v7i1.2924

Angelina, M., & Nursasi, E. (2021). Pengaruh penerapan green accounting dan kinerja lingkungan terhadap kinerja keuangan perusahaan. Jurnal Manajemen Dirgantara, 14(2), 211–224. https://doi.org/10.56521/manajemen-dirgantara.v14i2.286

Anggraeni, R. N., Mande, H., Suryanto, N. R., & Raheni, C. (2024). The Effect of Green Accounting on Company Performance with Good Coorporate Governance as a Moderating Variable. Reslaj: Religion Education Social Laa Roiba Journal, 6(3), 2134–2141. https://doi.org/10.47467/reslaj.v6i3.5993

Ardiana, M., Agustina, R., & Pertiwi, D. A. (2023). The Increasing Business Eco-Efficiency and Competitive Advantage through the Application of Green Accounting. Buletin Penelitian Sosial Ekonomi Pertanian Fakultas Pertanian Universitas Haluoleo, 25(1), 1–8. https://doi.org/10.37149/bpsosek.v25i1.363

Aulia, A., Siahaan, M., & Siregar, J. K. (2025). Green Accounting and Environmental Performance on Financial Performance: Strategic Insights from the Mining Industry in Indonesia. Asian Journal of Environmental Research, 2(1), 16–28. https://doi.org/10.69930/ajer.v2i1.272

Baiti, M. N., & Hersugondo, H. (2023). Peran Kinerja Keuangan Sebagai Mediasi pada Pengaruh Tata Kelola Perusahaan Terhadap Nilai Perusahaan Berbasis Lingkungan. AFRE (Accounting and Financial Review), 6(2), 148–157. https://doi.org/10.47476/reslaj.v6i3.599

Difla, D., Sulhendri, S., Sabaruddin, S., & Asmanah, S. (2023). Pengaruh Green Accounting dan Good Corporate Governance Terhadap Kinerja keuangan: Studi Empiris Perusahaan Pertambangan di Bursa Efek Indonesia Tahun 2019-2021:. UTILITY: Jurnal Ilmiah Pendidikan Dan Ekonomi, 7(02), 96–106. https://doi.org/10.30599/utility.v7i02.2130

Dura, J., & Suharsono, R. (2022). Application green accounting to sustainable development improve financial performance study in green industry. Jurnal Akuntansi, 26(2), 192–212. https://doi.org/10.24912/ja.v26i2.893

Efunniyi, C. P., Abhulimen, A. O., Obiki-Osafiele, A. N., Osundare, O. S., Agu, E. E., & Adeniran, I. A. (2024). Strengthening corporate governance and financial compliance: Enhancing accountability and transparency. Finance & Accounting Research Journal, 6(8), 1597–1616. https://doi.org/10.51594/farj.v6i8.1509

ENDIANA, I. D. M., DICRIYANI, N. L. G. M., ADIYADNYA, M. S. P., & PUTRA, I. P. M. J. S. (2020). The effect of green accounting on corporate sustainability and financial performance. The Journal of Asian Finance, Economics and Business, 7(12), 731–738. doi:10.13106/jafeb.2020.vol7.no12.731

Fasua, H. K., & Osifo, O. I. U. (2020). Environmental accounting and corporate performance. International Journal of Academic Research in Business and Social Sciences, 10(9), 142–154. http://dx.doi.org/10.6007/IJARBSS/v10-i9/7711

Francis Hutabarat, M. B. A. (2021). Analisis kinerja keuangan perusahaan. Desanta Publisher. https://books.google.com/books?hl=en&lr=&id=Vz0fEAAAQBAJ&oi=fnd&pg=PA1&dq=hutabarat&ots=QqX25xNwb_&sig=lWb_EiRN9PzNG47X7ZqndfZyXC8

Freeman, R. E. (2023). The Politics of Stakeholder Theory: Some Future Directions. In S. D. Dmytriyev & R. E. Freeman (Eds.), R. Edward Freeman’s Selected Works on Stakeholder Theory and Business Ethics (Vol. 53, pp. 119–132). Springer International Publishing. https://doi.org/10.1007/978-3-031-04564-6_5

Hamzah, M. I. (2025). Green Accounting Intervens Corporate Governance and Environmental Performance On Financial Performance. International Journal of Educational Administration, Management, and Leadership, 1–16. https://doi.org/10.51629/ijeamal.v6i1.209

Hasidi, M. H., Baheri, J., & Hajar, K. I. (2024). Financial performance evaluation using profitability and liquidity ratio analysis.https://doi.org/10.37641/jimkes.v12i4.2742

IFADA, L. M., INDRIASTUTI, M., IBRANI, E. Y., & SETIAWANTA, Y. (2021). Environmental performance and environmental disclosure: The role of financial performance. The Journal of Asian Finance, Economics and Business, 8(4), 349–362. https://doi.org/10.13106/jafeb.2021.vol8.no4.0349

Indy, L. A., Uzliawati, L., & Mulyasari, W. (2022). The effect of managerial ownership and institutional ownership on sustainability reporting and their impact on earning management. Journal of Applied Business, Taxation and Economics Research, 1(3), 243–256. https://doi.org/10.54408/jabter.v1i3.48

Jeong, Y.-C., & Kim, T.-Y. (2019). Between Legitimacy and Efficiency: An Institutional Theory of Corporate Giving. Academy of Management Journal, 62(5), 1583–1608. https://doi.org/10.5465/amj.2016.0575

Khairunisa, S., & Pohan, H. T. (2022). Pengaruh pengungkapan emisi karbon, kinerja lingkungan dan biaya lingkungan terhadap kinerja keuangan perusahaan. Jurnal Ekonomi Trisakti, 2(2), 283–292. http://dx.doi.org/10.25105/jet.v2i2.14144

Kharouf, H., Lund, D. J., Krallman, A., & Pullig, C. (2020). A signaling theory approach to relationship recovery. European Journal of Marketing, 54(9), 2139–2170. https://doi.org/10.1108/EJM-10-2019-0751

Laili, C. N., Djazuli, A., & Indrawati, N. K. (2019). The influence of corporate governance, corporate social responsibility, firm size on firm value: Financial performance as mediation variable. Jurnal Aplikasi Manajemen, 17(1), 179-â. https://doi.org/10.21776/ub.jam.2019.017.01.20

Liu, Q., Yang, X., Shen, Z., & Štreimikienė, D. (2024). Digital economy and substantial green innovation: Empirical evidence from Chinese listed companies. Technology Analysis & Strategic Management, 36(10), 2609–2623. https://doi.org/10.1080/09537325.2022.2156336

Maama, H., & Appiah, K. O. (2019). Green accounting practices: Lesson from an emerging economy. Qualitative Research in Financial Markets, 11(4), 456–478. https://doi.org/10.1108/QRFM-02-2017-0013

Marota, R. (2024). Uncovering the Potential of Sustainability: Opportunities and Challenges in Applying Green Accounting for Natural Environmental Sustainability in Companies. Journal of Sustainability Science and Management, 19(8), 89–102. http://doi.org/10.46754/jssm.2024.08.007

Moridu, I. (2023). The Role Corporate Governance in Managing Financial Risk: A Qualitative Study on Listed Companies. The ES Accounting And Finance, 1(03), 176–183. https://doi.org/10.58812/esaf.v1i03.110

Nguyen, M.,Nguyen,K.,Le,H.,Le,V., & (2023). Corporate social responsibility, board of directors’ affect financial performance:Evidence in Vietnam. International Journal of, Querydate: 2025-04-04 17:03:36. https://doi.org/10.26668/businessreview/2023.v8i8.2388

Qian, W., & Xing, K. (2018). Linking Environmental and Financial Performance for Privately Owned Firms: Some Evidence from Australia: JOURNAL OF SMALL BUSINESS MANAGEMENT. Journal of Small Business Management, 56(2), 330–347. https://doi.org/10.1111/jsbm.12261

Rahman, Md. M., & Islam, M. E. (2023). The impact of green accounting on environmental performance: Mediating effects of energy efficiency. Environmental Science and Pollution Research, 30(26), 69431–69452. https://doi.org/10.1007/s11356-023-27356-9

Riyadh, H. A., Al-Shmam, M. A., Huang, H. H., Gunawan, B., & Alfaiza, S. A. (2020). The analysis of green accounting cost impact on corporations financial performance. International Journal of Energy Economics and Policy, 10(6), 421–426. https://doi.org/10.32479/ijeep.9238

Riyadh, H., Shmam, M. A., & ... (2022). Corporate social responsibility and GCG disclosure on firm value with profitability. International Journal of …, Query date: 2025-04-04 17:03:36. https://doi.org/10.26668/businessreview/2022.v7i3.e655

Salehi, M., Ammar Ajel, R., & Zimon, G. (2023). The relationship between corporate governance and financial reporting transparency. Journal of Financial Reporting and Accounting, 21(5), 1049–1072. https://doi.org/10.1108/JFRA-04-2021-0102

Salisa, M. R., Mardiati, E., & Rahman, A. F. (2024). The Influence of Green Accounting, Corporate Social Responsibility, and Profitability on Company Value Moderated by Good Corporate Governance. The International Journal of Accounting and Business Society, 32(2), 198–213. https://doi.org/10.21776/ijabs.2024.32.2.752

Shad, M. K., Lai, F.-W., Shamim, A., & McShane, M. (2020). The efficacy of sustainability reporting towards cost of debt and equity reduction. Environmental Science and Pollution Research, 27(18), 22511–22522. https://doi.org/10.1007/s11356-020-08398-9

Shahid, Z. A., Tariq, M. I., Paul, J., Naqvi, S. A. N., & Hallo, L. (2024). Signaling theory and its relevance in international marketing: A systematic review and future research agenda. International Marketing Review, 41(2), 514–561. https://doi.org/10.1108/IMR-04-2022-0092

Solomon, J. (2020). Corporate governance and accountability. John Wiley & Sons. https://books.google.com/books?hl=en&lr=&id=JAX9DwAAQBAJ&oi=fnd&pg=PR1&dq=The+implementation+of+effective+governance+can+create+added+value+for+all+stakeholders,+because+governance+ensures+that+the+company+is+managed+with+transparency,+accountability,+and+compliance+with+the+law+to+protect+the+interests+of+shareholders+and+other+stakeholders&ots=ny4_Xw9WW6&sig=LjcWYeSBgvbJupqzEs69l_QSTw8

Zik-Rullahi, A. A., & Jide, I. (2023). Green accounting: A fundamental pillar of corporate sustainability reporting. Journal of Accounting and Financial Management, 9(8), 59–72. https://doi.org/10.56201/ijssmr.v8.no1.2022.pg32.40

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2026 Eni Suharti, Dhea Zatira, Sulhendri Sulhendri, Munzir Munzir, Sustari Alamsyah

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).