The Effect of Tax Planning Aspects and Tax Awareness to the UMKM Taxpayer Compliance (Study on Sme Tax Mandatory in Karawaci Area of Tangerang City)

DOI:

https://doi.org/10.38035/jafm.v1i3.40Keywords:

Formal Aspects, Material Aspects, Tax Planning, Taxpayer Awareness, Taxpayer Compliance.Abstract

The purpose of this study is to examine how much influence the formal aspects and material aspects of tax planning, tax awareness on tax compliance. The analytical method used is quantitative and analytic statistics used, namely multiple linear regression analysis. The population of this research is the SME taxpayers in the Karawaci region of the city of Tangerang. The sampling technique used is probability sampling. The results showed that the formal aspects of tax planning and the material aspects of tax planning affect the compliance of taxpayers, while tax awareness does not affect the compliance of SME taxpayers in the Karawaci region of Tangerang.

References

Dennis-Escoffier, Shirley dan Karen A. Fortin. (2015). Taxation for Decision Makers. Mason: Thomson South Western.

Ilyas, Wirawan B. dan Ricard Burton (2010). Hukum Pajak. 5 ed. Salemba Empat, Jakarta.

Ilyas, Wirawan B. (2013). Manajemen dan Perencanaan Pajak Berbasis Resiko. Jakarta: In Media.

Inasius. (2012). Analisis Pajak Penghasilan Bagi Wajib Pajak Badan Usaha Kecil Menengah di Indonesia. Binus Bussiness Review Vol. 3 No.2 Novemer 2012

John Hutagol dan Danny Seoptriadi. (2007). Konsep dan Aplikasi Perpajakan Internasional. Jakarta: Danny Darussalam Tax Center.

Mukhlis, Simanjuntak,. (2012). Dimensi Ekonomi Perpajakan dalam Pembangunan Ekonomi. Jakarta: Penerbit Raih Asa Sukses.

Nurlis dan Widiyati. (2010). Faktor-faktor yang Memengaruhi Kemauan untuk Membayar Pajak Wajib Pajak Orang Pribadi yang Melakukan Pekerjaan Bebas Studi Kasus pada KPP Pratama Gambir Tiga. Simposium Nasional Akuntansi XIII Purwokerto.

Pancawati dan Nila Yulianawati. (2011). Faktor-Faktor Yang Mempengaruhi Kemauan Membayar Pajak.Dinamika Keuangan dan Perbankan. Vol. 3, No. 1. Hal. 126 – 142.

Permatasari, Aprilia. (2012). Pengaruh Kesadaran WP Dan Sanksi Perpajakan Pada Kepatuhan WP Dalam Membayar PBB. Bali:Universitas Udayana.

Pohan, Chairil Anwar. (2014). Manajemen Perpajakan: Strategi Perencanaan Pajak dan Bisnis (Edisi Revisi) (Indonesian Edition). Jakarta: PT Gramedia Pustaka Utama.

Ria Lusiana. (2015). Analisis Pengaruh Keadilan Perpajakan, Kesadaran Perpajakan, Pengetahuan Perpajakan Terhadap Kepatuhan Perpajakan Wajib Pajak Pemilik UMKM Terkait Penetapan Kebijakan Pajak Penghasilan Final Sesuai Peraturan Pemerintah No.46 Tahun 2013(Studi pada KPP Pratama Jakarta Tebet). Tesis S2, Universitas Mercu Buana.

Siti Kurnia Rahayu. (2017). Perpajakan Indonesia. Konsep dan Aspek Formal. Yogyakarta: Graha Ilmu.

Suandy, Erly. (2011). Perencanaan Pajak Edisi 5. Jakarta: Penerbit Salemba Empat.

Triyani. (2015). Analisa Pemahaman Aspek-aspek Perencanaan Pajak dan Pengaruhnya Terhadap Kepatuhan Wajib Pajak Badan (Studi Pada Wajib Pajak Badan di Kantor Pelayanan Pajak Madya Jakarta Pusat). Tesis S2, Universitas Mercu Buana.

Vadde & Gundarapu. (2012). Factors That Influence Rental Tax Payers Compliance With Tax System: An Emperical Study of Mekelle City, Ethiopia. Journal of Arts, Science & Commerce Vol III, Issue 4 (2) Ocotober 2012. ISSN 2231-4172.

Waluyo. (2017). Perpajakan Indonesia Edisi 12 Buku 1. Jakarta: Penerbit Salemba Empat

Waluyo. (2018). Do Efficiency of Taxes, Profability and Size of Companies affect Debt ? A Study Companies Listed in the Indonesian Stock Exchange. European Research Studies Journal, Vol. (XXI), Issue 1.

Widodo,Widi. (2010). Moralitas, Budaya dan Kepatuhan Pajak, ALFABETA

Detik. (2018). Jurus Sri Mulyani Tingkatkan Kesadaran Pajak Masyarakat. Diakses tanggal 23 November 2018 dari www.detik.com.

Kemenkeu. (2018). Pengadilan Negeri Pontianak Vonis Terpidana Pajak. Diakses tanggal 22 November 2018 dari www.pajak.go.id

Okezone. (2019). Penerimaan Pajak UMKM Belum Optimal. Diakses tanggal 26 Agustus 2019 dari www.okezone.com.

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

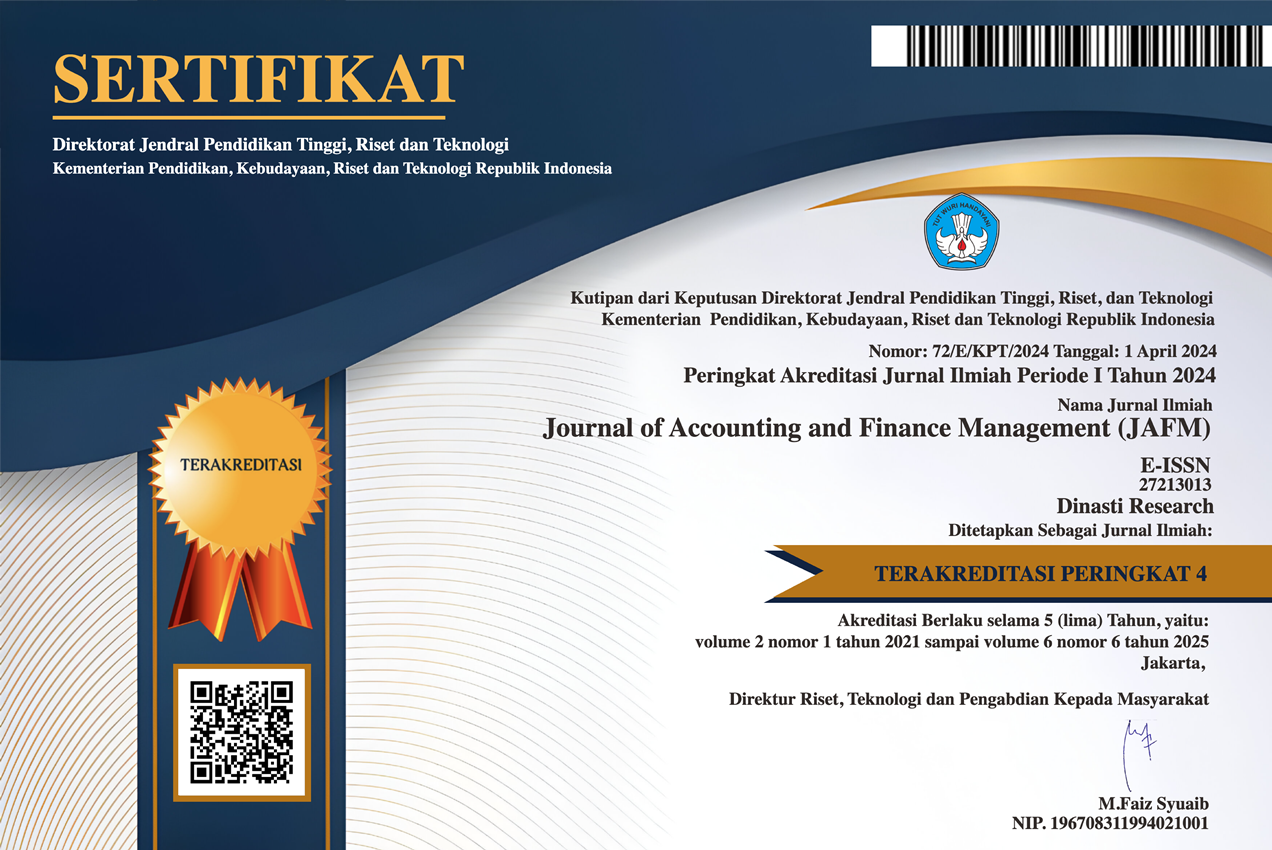

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).