The Effect of Carbon Management Accounting, Competitive Business Strategic and Carbon Emission Disclosure on Company Performance Moderated by Green Intellectual Capital

DOI:

https://doi.org/10.38035/jafm.v5i5.715Keywords:

carbon management accounting, Competitive Business Strategy, Carbon Emission Disclosure, Firm Performance, Green Intellectual CapitalAbstract

Several climate changes or extreme weather that often occur throughout the world in recent years, this directly makes society focus and increases the level of awareness of climate change that occurs. warming. Global warming is a hot issue and has become a public focus to be discussed in several world organization forums in recent decades. Global warming can be caused by the main factor, namely carbon emissions. This study aims to examine the effect of Carbon Management Accounting, Competitive Business Strategy, and Carbon Emission Disclosure on Company Performance moderated by Green Intellectual Capital. This study took the research population in energy sector companies. The type of data used in this study is secondary data in the form of company financial reports that are used as samples. The research method used in this study is a quantitative research method. The sample was selected using the purposive sampling method. For hypothesis testing, this study uses multiple linear regression analysis. Based on the results of this study, it shows that Carbon Management Accounting and Carbon Emission Disclosure have an effect on Firm Performance, but Carbon Emission Disclosure has no effect on Firm Performance. Green Intellectual Capital strengthens the influence of Carbon Management Accounting on Firm Performance and Green Intellectual Capital does not strengthen the influence of Competitive Business Strategy and Carbon Emission Disclosure Strategy on Firm Performance.

References

Ahmad, N. N. N., & Sulaiman, M. (2004). Environmental disclosures in Malaysian annual reports: A legitimacy theory perspective. International Journal of Commerce and Management, 14(1), 44 58. https://doi.org/10.1108/10569210480000173

Alamanda, Rizkita. (2014). Studi Kasus: Gerakan Samarinda Menggugat. Jurnal Hukum Lingkungan Vol. 1 Issue 2.

Al-Tuwaijri, S. A., T. E. Christensen, and K. Hughes. 2004. The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Accounting, organizations and Society 29 (5):447-471.

Anggraeni, D. Y. (2015). Carbon Emission Disclosure, Environmental Performance, and Firm Value. Jurnal Dan org/10.21002/jaki.2015.11

Ardillah, K., & Rusli, Y. M. (2022). THE EFFECT OF CORPORATE GOVERNANCE STRUCTURES, ENVIRONMENTAL PERFORMANCE, AND MEDIA COVERAGES TO CARBON EMISSIONS DISCLOSURE. Ultimaccounting Jurnal Ilmu Akuntansi, 14(2), 246-263.

Breliastiti, R. (2017). Pengaruh Motif Corporate Social Responsibility Terhadap Kualitas Lingkungan Dan Dampaknya Terhadap Kinerja Keuangan Perusahaan Pertambangan Di Indonesia. Jurnal Akuntansi Bisnis, 7(2).

Cerbioni, F., & Parbonetti, A. (2007). Exploring The Effect of Corporate Governance on Intellectual Capital Disclosure: An Analysis of European Biotechnology Companies. European Accounting Review, 16 (4): 791-826.

Chair, A. F. Analisis Pengaruh Pengadopsian IFRS, Karakteristik Perusahaan, dan Kepemilikan Blockholder Terhadap Manajemen Laba.

Chaniago, R. G., & Trisnawati, R. (2021, October). Analisis Pengaruh Profitabilitas Growth Leverage Dan Komite Audit Terhadap Manajemen Laba Perusahaan Sektor Perbankan Yang Terdaftar Di BEI. In Prosiding Seminar Nasional Kewirausahaan (Vol. 2, No. 1, pp. 127-141).

Cornelia, E., & Adi, S. W. (2022). Pengaruh Profitabilitas, Leverage, Free Cash Flow dan Asimetri Informasi Terhadap Manajemen Laba Pada Perusahaan Manufaktur Sektor Industri Barang Konsumsi Yang Terdaftar di Bursa Efek Indonesia Pada Tahun 2016-2019. JEpa, 7(1), 177-186.

Dewi, E. P., & Nurhayati, I. (2022). Pengaruh Leverage dan Profitabilitas Terhadap Manajemen Laba Dengan Kepemilikan Manajerial Sebagai Variabel Moderasi. Jurnal GeoEkonomi, 13(1), 40-54.

Effendi, E., Masnur, M., & Rahmadanti, R. (2021). The Effect of Disclosure of Other Comprehensive Income, Profitability, Leverage, and Company Size on Earnings Management (Study on Financing Institutions SubSector Service Companies Listed on the Indonesia Stock Exchange for the 2018-2019 Period).

Fenster, M. (2015), “Transparency in search of a theory”, European Journal of Social Theory, Vol.18 No.2, pp. 150-167.

Ghozali, I (2013). Aplikasi Analisis Multivariete dengan Program IBM SPSS 23. Edisi Kedelapan: Penerbit Universitas Diponegoro.

Ghozali, I. (2016). Aplikasi Analisis Multivariate dengan Program IBM SPSS19, Badan Penerbit Universitas Diponegoro, Semarang.

Ghomi, Z.B. and Leung, P. (2013), “An empirical analysis of the determinants of greenhouse gas voluntary disclosure in Australia”, Accounting and Finance Research, Vol.2 (1), pp. 110 127.

Giacomo, N.D., Githrie, J. and Farneti, F. (2017), “Environmental management control system for carbon emission”, PSU Research Review, Volume 1 (1), pp. 39-50. Rusli, Yohanes Mardinata. 2016. “Pengaruh Kualitas Audit Dalam Hubungan Antara Tax Planning Dengan Nilai Perusahaan.” Prosiding Seminar Nasional INDOCOMPAC, 395 406.

Rusli, Y. M., Nainggolan, P., & Pangestu, J. C. (2020). Pengaruh Independent Board of Commissioners, Institutional Ownership, and Audit Committee terhadap Firm Value. Journal of Business & Applied Management, 13(1), 049-066

Rusli, Yohanes Mardinata, Yvonne Augustine, Etty Murwaningsari, and Ririn Breliastiti. 2019. “The Moderating Effect of Competitive Business Strategy on Corporate Environmental Performance and Corporate Carbon Emission Disclosure towards Corporate Financial Performance.” Journal of Economics and Sustainable Development 10(6): 117–26.

Setiawan, T. (2017). PENGUNGKAPAN AKTIVITAS GREEN SUPPLY CHAIN MANAGEMENT PADA PERUSAHAAN KATEGORI EMAS PROPER 2013–2014. Jurnal Akuntansi Bisnis, 9(2).

Setiawan, T., Adriana, F., & Sihombing, P. R. (2021). Karakteristik Perusahaan, Profitabilitas dan Corporate Social Responsibility Disclosure (CSRD). Journal of Business & Applied Management, 14(1), 017-026.

Surjadi, M., Hakki, T. W., Rusli, Y. M., & Supiadi, S. (2023). KEPEDULIAN MANAGEMEN DENGAN LINGKUNGAN HIJAU SEBAGAI PEMODERASI ANTARA INOVASI HIJAU TERHADAP KINERJA PERUSAHAAN YANG BERKELANJUTAN. Accounting Cycle Journal, 4(2), 34-44

S. Hermuningsih, "Pengaruh Profitabilitas, Growth Opportunity, Sruktur Modal Terhadap Nilai Perusahaan Pada Perusahaan Publik di Indonesia," Buletin Ekonomi Moneter dan Perbankan, pp. 127–148, 2013.

Septian Dwi Santoso, & Pipit Rosita Andarsari. (2022). Pengaruh Kepemilikan Manajerial, Ukuran Perusahaan dan Kualitas Audit Terhadap Integritas Laporan Keuangan. Owner : Riset Dan Jurnal Akuntansi, 6(1), 690-700. https://doi.org/10.33395/owner.v6i1.585

Taufiq, E., & Pratiwi, S. (2022). Pengaruh Carbon Management Accounting dan Pengungkapan Lingkungan pada Perusahaan Pertambangan yang Terdaftar di Bursa Efek Indonesia. EKOMBIS REVIEW: Jurnal Ilmiah Ekonomi Dan Bisnis, 10(1), 506–517.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Tandry Whittleliang Hakki, Karvicha Akwila, Priccilya Jurjanta

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

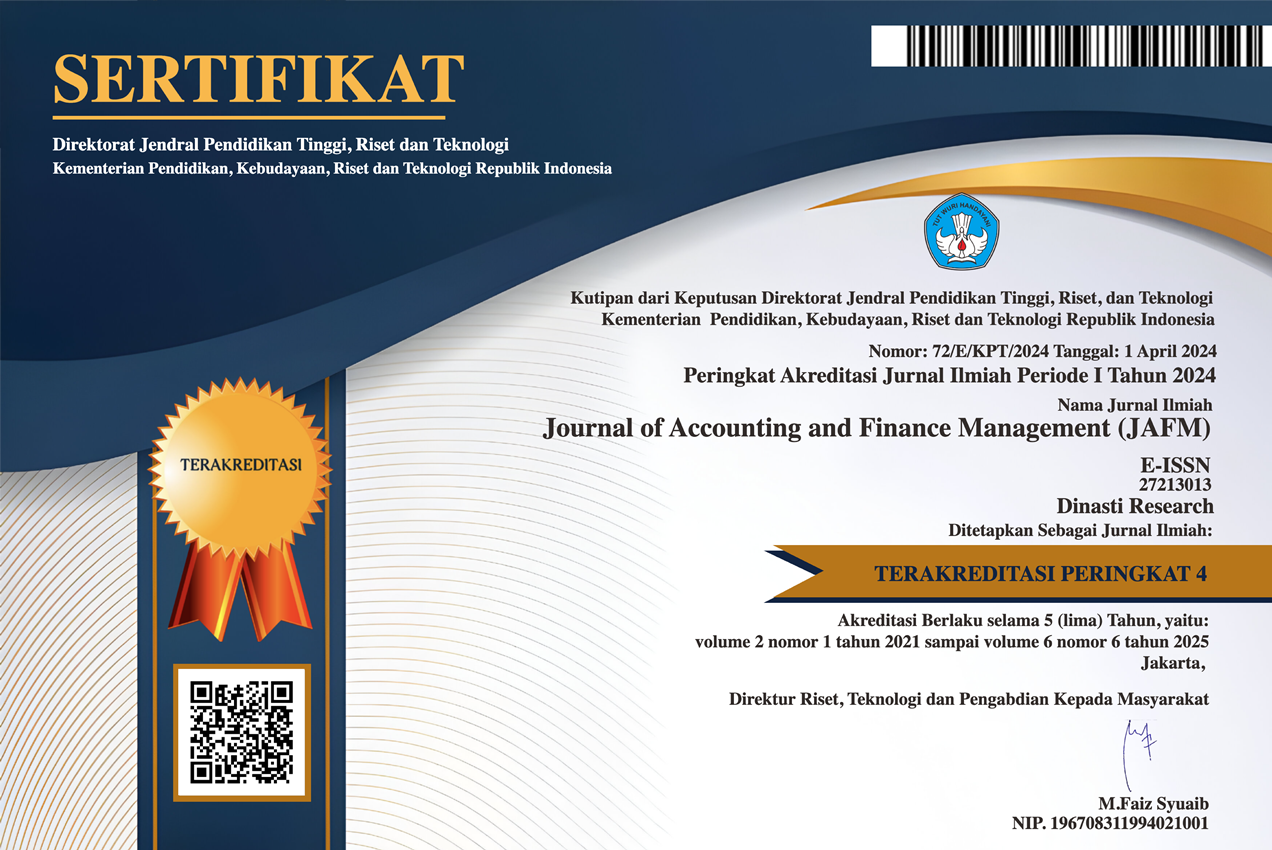

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).