Determinats of Profitability and Implications on Corporate Value

DOI:

https://doi.org/10.38035/jafm.v2i1.45Keywords:

Institutional Share Ownership, Managerial Share Ownership, Audit Committee Effectiveness, Corporate Social Responsibility, Company Size, Debt To Equity Ratio, Profitability, and Company Value / Tobins Q.Abstract

This study aims to prove empirically the determinants of profitability and their implications for firm value in manufacturing companies listed on the Indonesia Stock Exchange during the 2015-2019 period by using a panel data regression model with 25 manufacturing companies as the research sample. Based on the empirical results, the influencing variables positive and significant impact on profitability is Managerial Share Ownership, Audit Committee Effectiveness, Corporate Social Responsibility, company size. and variables that do not have a significant effect are institutional stock ownership and the Debt To Equity Ratio. positively and significantly. Individual companies are affected by profitability; The biggest positive influence is the company Japfa Comfeed Indonesia Tbk, the smallest positive is the Lion Metal Work Tbk company, and the biggest negative influence is the Bata Shoe Company Tbk, the smallest negative is the company Holcim Indonesia Tbk. The results of this study have implications for firm value (Tobins Q); The variables that show a positive and significant influence are the variable of Audit Committee Effectiveness, Corporate Social Responsibility, Company Size, and Debt To Equity Ratio, Return on Asset variables that have no effect are Institutional Share Ownership, Managerial Share Ownership. the biggest positive influence on changes (Tobins Q) of the company Japfa Comfeed Indonesia Tbk. the smallest positive is the company Semen Batu Raja Tbk, the biggest negative influence is the Company Tempo Scan Pacific Tbk; The smallest negative influence is the company Holcim Indonesia Tbk.

References

Bebchuk, Lucian Arye, and Jesse M. Fried. 2012. "Executive Compensation as an Agency Problem." In The Economic Nature of the Firm: A Reader, Third Edition. https://doi.org/10.1017/CBO9780511817410.026.

Brigham, Eugene F, and Houston. 2011. “Fundamentals of Translation Financial Management. Issue 10. " Jakarta: Selemba Four.

Connelly, Brian L., S. Trevis Certo, R. Duane Ireland, and Christopher R. Reutzel. 2011. "Signaling Theory: A Review and Assessment." Journal of Management. https://doi.org/10.1177/0149206310388419.

Damayanti, Ni Putu Wida Putri ;, and I Wayan Suartana. 2014. "The Effect of Managerial Ownership and Institutional Ownership on Company Value." E-Journal of Accounting.

Dewi Teresia, Estiani Sinta, and Hermi Hermi. 2016. "THE INFLUENCE OF OWNERSHIP STRUCTURE, COMPANY SIZE AND FINANCIAL DECISIONS ON COMPANY VALUE WITH COMPANY GROWTH AS MODERATING VARIABLES." Journal of Master of Accountancy Trisakti. https://doi.org/10.25105/jmat.v3i1.4969.

Eeckhoudt, Louis, Christian Gollier, and Harris Schlesinger. 2019. "Asset Pricing." In Economic and Financial Decisions under Risk. https://doi.org/10.2307/j.ctvcm4j15.14.

Fauziah, Isna. 2016. "THE EFFECT OF CORPORATE GOVERNANCE MECHANISM ON THE COMPLIANCE LEVEL OF POST-CONVERGENT IFRS MANDATORY DISCLOSURE." ESSENCE. https://doi.org/10.15408/ess.v5i2.2349.

Lukviarman, Niki. 2004. "Business Ethics Do Not Work In Indonesia: What's In Corporate Governance?" Business Strategy Journal. https://doi.org/10.20885/jsb.vol2.iss9.art2.

Melé, Domènec. 2009. "Corporate Social Responsibility Theories." In The Oxford Handbook of Corporate Social Responsibility. https://doi.org/10.1093/oxfordhb/9780199211593.003.0003.

Murwaningsari, Etty. 2012. "EFFECT OF OWNERSHIP STRUCTURE ON SHARE RETURN." Media Research Accounting, Auditing and Information. https://doi.org/10.25105/mraai.v12i1.586.

Pertiwi, Santi Trisno, and Suwardi Bambang Hermanto. 2017. "The Influence of Company Size, Debt Policy and Profitability on Firm Value." Journal of Accounting Science and Research.

Sari, Ni Made Vironika, and I GAN Budiasih. 2014. "The Effect of Debt To Equity Ratio, Firm Size, Inventory Turnover and Assets Turnover on Profitability." Udayana University Accounting E-Journal 6.2.

Sukamulja, Sukmawati. 2004. "Good Corporate Governance in the Financial Sector: The Impact of GCG on Company Performance (Case in the Jakarta Stock Exchange)." BENEFIT Journal of Management and Business.

Suryana, Febby Nuraudita, and Sri Rahayu. 2018. "The Influence of Leverage, Profitability, and Company Size on Firm Value (Empirical Study of the Pharmaceutical Sub Sector Consumer Goods Industry Companies Listed on the Indonesia Stock Exchange 2012-2016)." E-Proceeding of Management.

Vivi Adeyani, Tandean. 2016. "Good Corporate Governance." Accounting and Business Scientific Journal.

Zakiyah, Tuti. 2017. "Analysis of Agency Theory Conflict and Its Effect on Dividend Policy in Companies Joined in LQ 45 (Case Study 2011-2015)." Scientific Journal of Accounting and Finance. https://doi.org/10.32639/jiak.v6i1.124.

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

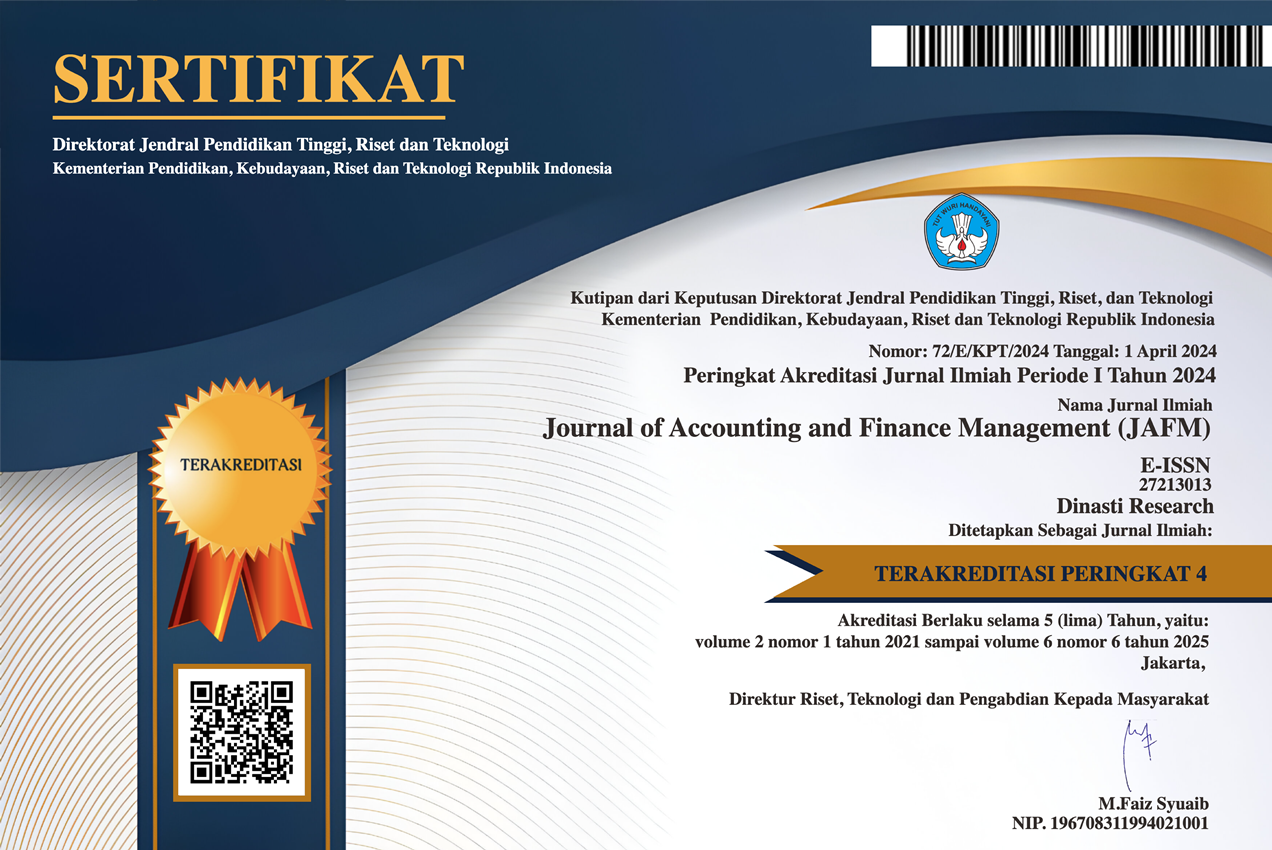

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).