The Effect of Company Performance, Company Complexity, Company Size on the Board of Commissioners Structure Moderated by Managerial Ownership

DOI:

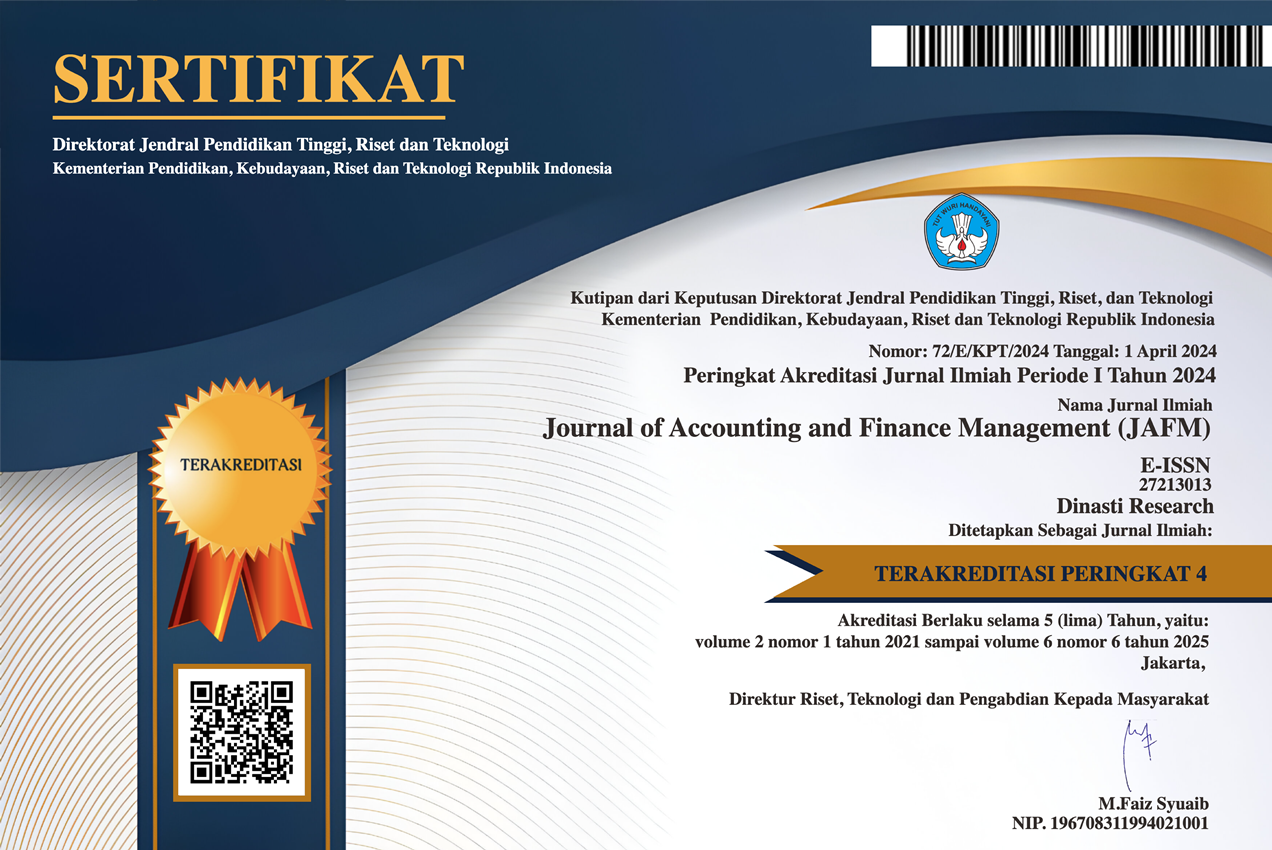

https://doi.org/10.38035/jafm.v5i4.702Keywords:

Company Performance, Company Complexity, Company Size, Board of Commisioner, Managerial OwnershipAbstract

The role of the Board of Commissioners is very important to minimize agency problems so that shareholder wealth maximization can be achieved. Under one board, a number of studies have investigated the effect of the effectiveness of the Board of Directors on their company's performance. In Indonesia, existing research related to the effectiveness of the Board of Commissioners investigates the effectiveness of the Board of Commissioners as one of the determining factors for the possibility of financial distress and investigates effectiveness. This study aims to examine the effect of Company Performance, Company Complexity, Company Size on the Structure of the Board of Commissioners and examine whether there is a role of Managerial Ownership as a moderation in the influence of Company Performance, Company Complexity, Company Size on the Structure of the Board of Commissioners carried out by the company. This study took the research population from financial sector companies listed on the Indonesia Stock Exchange for the period 2019-2022. The type of data used in this study is secondary data in the form of company financial reports that are used as samples. The research method used in this study is a quantitative research method. The sample was selected using the purposive sampling method. For hypothesis testing, this study uses multiple linear regression analysis. Based on the results of the study, it shows that company performance has a significant effect on the Board of Commissioners Structure, then Company Complexity and Company Size do not have a significant effect on the Board of Commissioners structure. Managerial Ownership strengthens the influence of Company Performance on the Board of Commissioners Structure. Managerial Ownership does not strengthen the influence of Company Complexity and Company Size on the Board of Commissioners Structure.

References

Agoes, S. (2012), Auditing: Petunjuk Praktis Pemeriksaan Akuntan oleh Akuntan Publik, Salemba Empat, Jakarta.

Andrian, J., & Setiawan, T. (2022). Pengaruh Diversitas Dewan Direksi dan Profitabilitas terhadap Nilai Perusahaan LQ45. Media Ilmiah Akuntansi, 10(2), 99-108.

Anuar, E., Aziz, R. A., Mohamad, M., & Hashim, R. (2020). Does Board Gender Diversity Affects Dividend Payout? Evidence from a review of literature. Journal of ASIAN Behavioural Studies, 5(16), 19-34. https://doi.org/10.21834/jabs.v5i16.350

Aslam, A. P. (2021). Do Diversities on Board Affect to Dividend Payout Ratio in Indonesia?. https://doi.org/10.4108/eai.14-10-2020.2304265

Arens, A.A., Elder, R.J., dan Beasley, M.S., (2008), Auditing dan Jasa Assurance Pendekatan Terintegrasi, Edisi 12, Jilid I, Erlangga, Jakarta.

Chandra, M.O., (2015), “Pengaruh Good Corporate Governance, Karakteristik Perusahaan, dan Ukuran KAP terhadap Fee Audit Eksternal.”, Jurnal akuntansi Bisnis Vol. XIII.

Elder, R.J., Beasley, M.S., Arens, A.A., dan Jusuf, A.A., (2013), Jasa Audit dan Assurance: Pendekatan Terpadu (Adaptasi Indonesia), Salemba Empat, Jakarta.

Gammal, W.E., (2012), “Determinants of Audit Fees: Evidence From Lebanon”, Canadian Center of Science and Education

Hakki, T. W., Lesmana, M., & Selviany, S. (2023). Pengaruh Tax Management Dan Intellectual Capital Terhadap Firm Performance Yang Dimoderasi Oleh Kepemilikan Manajerial Di Era Pandemik Covid-19. Accounting Cycle Journal, 4(2), 45-56.

Jensen, M. C., Meckling, W. (1976). Theory of the Firm: Managerial behavior, agency cost, and ownership structure. Journal of Financial Economics 305-360.

Jensen, M.C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance 48, 831-880 Johnson, S., Boone, P., Breach, A., Friedman, E. (2000). Corporate governance in the Asian financial crisis. Journal of Financial Economics 58, 141–186.

Kieso, D.E., Weygandt, J.J., Warfield, T.D. (2008). Intermediate Accounting, John Wiley and Sons Inc.

Klein, A. (1998). Firm performance and board committee structure. Journal of Law & Economics, 41, 275– 303.

Lehmann, E.,Weigand, J. (2000). Does the governed corporation perform better? Governance structures and corporate performance in Germany, European Finance Review 4(2), 157-195.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance 54(2), 471-517.

Leng, A.C.A. (2004). The impact of corporate governance practices on firms’ financial performance: Evidence from Malaysian companies, ASEAN Economic Bulletin Vol. 21, No. 3, pp. 308-318.

Linck, J., Netter, J., Yang, T. (2008). The determinants of board structure. Journal of Financial Economics 87(2), 308-328. Lipton, M., Lorch, J. W. (1992). A modest proposal for improved corporate governance. The Business Lawyer 48, 59-77

Lowenstein, L. (1991). Why managers should (and should not) have respect for their shareholders. Journal of Corporation Law 17, 1-27. Mak, Y.T., Li, Y. (2001). Determinants of corporate ownership and board structure: Evidence from Singapore, Journal of Corporate Finance 7(3), 235-256

Putri, A.C. and Viverita, V. (2019), “Risk preference of founder and descendant of Indonesian family firms”, Polish Journal of Management Studies, Vol. 20 No. 2, pp. 414-426, doi: 10.17512/pjms.2019.20.2.35

Rusli, Y. M., Nainggolan, P., & Pangestu, J. C. (2020). Pengaruh independent board of commissioners, institutional ownership, and audit committee terhadap firm value. Journal of Business & Applied Management, 13(1), 049-066.

Rusli, Y. M., & Nainggolan, P. (2021). Peran Financial Performance Sebagai Pemediasi Untuk Pengaruh Antara Independent Commissioners Dan Managerial Ownership Terhadap Corporate Value Pada Banking Corporate Yang Go Public. Jurnal Penelitian Akuntansi (JPA), 2(2), 148-169.

Rusli, Y. M., & Felix, F. (2022). Anti Corruption Disclosure dan Good Corporate Governance Era New Normal di Asia Tenggara. Jurnal Administrasi Kantor, 10, 61-78.

Surjadi, M. (2021). Pengaruh Ukuran Dewan Direksi, Umur Perusahaan, dan Kepemilikan Saham Publik terhadap Corporate Social Responsibility Disclosure. Jurnal Akuntansi dan Perpajakan Jayakarta, 3(1), 1-29.

Setiawan, T., & Venona, V. (2023). Pengaruh Kinerja Keuangan Dan Kepemilikan Terhadap Nilai Perusahaan Untuk Saham Terindeks LQ 45. Owner: Riset dan Jurnal Akuntansi, 7(2), 1137-1148.

Soni,Wibowo. 2016. Pengaruh Kepemilikan Manajerial, Kepemilikan Institusional, Kebijakan Deviden dan Kebijakan Hutang terhadap Nilai Perusahaan. Tesis, Universitas Airlangga, Surabaya

Sugiyono. 2005. Metode Penelitian Administrasi. Alfabeta, Bandung.

Utama, C. A., & Utama, S. (2019). Board of commissioners in corporate governance, firm performance, and ownership structure. International Research Journal of Business Studies, 12(2), 111-136

Utama, C. A. (2012). Company disclosure in Indonesia: Corporate governance practice, ownership structure, and total assets

Wardhani, R. (2006). Mekanisme corporate governance dalam perusahaan yang mengalami permasalahan keuangan (financially distressed firms). Simposium Nasional Akuntansi 9. Padang.

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40, 185 – 211. Zefanya. (2008). Analisis pengaruh ukuran dewan, komisaris independen, dan kepemilikan manajerial terhadap NPM, ROA dan ROE sebagai kinerja keuangan perusahaan, Thesis, Fakultas Ekonomi, Universitas Indonesia

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Juan Carlos Pangestu, Tandry Whittleliang Hakki, Marta Naftalia Elisa

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).