Model Penerimaan QRIS: Studi Pada Mahasiswa di Purwokerto

DOI:

https://doi.org/10.38035/jafm.v5i6.1298Keywords:

QRIS, Intention to use, StudentsAbstract

This research aims to analyze the factors that influence the intention to use QRIS. QRIS is type of digital payment that is currently popular in Indonesia. The success of using QRIS is determined by the user’s willingness to use this technology. The population of this study were students in Purwokerto who used QRIS. The samples used was 257. The data collection technique uses accidental sampling. The analysis technique uses the SEM-PLS method. The results of this research indicate that perceived transaction convenience has a positive effect on mobile usefulness. perceived transaction speed has a positive effect on mobile ease of use. Perceptions of mobile ease of use, optimisme and personal innovativeness have a positive effect on behavioral intention. And the perception of mobile usefulness has no influence on behavioral intention. The implication of this research is to analyze students’s intentions towards using QRIS and show how QRIS can increase payment efficiency.

References

Abadzhmarinova, R. S. (2014). Exploring the effect of speed of purchase on consumers intention to adopt NFC mobile payments Program?: MSc in Service Management. Copenhagen Business School, 825.

Afandi, A., Rukmana, L., & R, W. W. (2022). Efektivitas dan Efisiensi Sistem Pembayaran Non Tunai Quick Response Indonesian Standard (QRIS) dalam Mempengaruhi Inklusi Keuangan Mahasiswa. Jurnal Perbankan dan Keuangan, 3(2), 73–83. https://doi.org/10.37058/banku.v3i2.5823

Aisyah, M., & Eszi, I. M. (2020). Determinants of intention to use e-wallet using TRAM model. Jurnal Akuntansi & Auditing Indonesia, 24(2), 167–178. https://doi.org/10.20885/jaai.vol24.iss2.art10

Al-Qudah, A. A., Al-Okaily, M., Alqudah, G., & Ghazlat, A. (2024). Mobile payment adoption in the time of the COVID-19 pandemic. Electronic Commerce Research, 24(1), 427–451. https://doi.org/10.1007/s10660-022-09577-1

Ar Rasyid, R., Sunarya, E., & M Ramdan, A. (2020). Analisis Minat Menggunakan Mobile Payment Dengan Pendekatan Technology Accpetance Model Pada Pengguna Link Aja Sukabumi. HIRARKI?: Jurnal Ilmiah Manajemen Dan Bisnis, 2(2), 116–125. https://doi.org/10.30606/hirarki.v2i2.387

Arianita, A., Alfansi, I., & Anggarawati, S. (2023). Analysis Factor Affecting The Use Of Digital Payment With The Extended Utaut Model. The Manager Review, 5(1), 91–108. https://doi.org/10.33369/tmr.v5i1.29733

Aseng, A. C. (2020). Factors Influencing Generation Z Intention in Using FinTech Digital Payment Services. CogITo Smart Journal, 6(2), 155–166. https://doi.org/10.31154/cogito.v6i2.260.155-166

Azizah, S. N., Endratno, H., & Harjono, H. (2022). Analysis of Digital Legal Acceptance based on the Technology Acceptance Model 3 (TAM3). Kosmik Hukum, 22(3), 212. https://doi.org/10.30595/kosmikhukum.v22i3.15647

Azzahroo, R. A., & Estiningrum, S. D. (2021). Preferensi Mahasiswa dalam Menggunakan Quick Response Code Indonesia Standard (QRIS) sebagai Teknologi Pembayaran. Jurnal Manajemen Motivasi, 17(1), 10. https://doi.org/10.29406/jmm.v17i1.2800

Bangsa, J. R. and L. L., & Khumaeroh. (2023). Pengaruh Persepsi Manfaat dan Kemudahan Penggunaan Terhadap Keputusan Penggunaan QRIS Shopeepay pada Mahasiswa S1 Bisnis Digital Universitas Ngudi Waluyo. Jurnal Ilmiah Bisnis, Manajemen dan Akuntansi Vol 3 (No 1) 2023 Januri. https://jurnal.unw.ac.id/index.php/jibaku/article/view/2149

Boden, J., Maier, E., & Wilken, R. (2020). The effect of credit card versus mobile payment on convenience and consumers’ willingness to pay. Journal of Retailing and Consumer Services, 52. https://doi.org/https://doi.org/10.1016/j.jretconser.2019.101910

Chen, L. (2008). A model of consumer acceptance of mobile payment. International Journal of Mobile Communications, 6(1), 32–52.

Daragmeh, A., Lentner, C., & Sági, J. (2021). FinTech payments in the era of COVID-19: Factors influencing behavioral intentions of “Generation X” in Hungary to use mobile payment. Journal of Behavioral and Experimental Finance, 32, 100574. https://doi.org/10.1016/j.jbef.2021.100574

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13, 319–340.

De Kerviler, G., Demoulin, N. T. M., & Zidda, P. (2016). Adoption of in-store mobile payment: Are perceived risk and convenience the only drivers? Journal of Retailing and Consumer Services, 31, 334–344.

Eren, B. A. (2024). QR code m-payment from a customer experience perspective. Journal of Financial Services Marketing, 29(1), 106–121. https://doi.org/10.1057/s41264-022-00186-5

Faizani, S. N., & Indriyanti, A. D. (2021). Analisis Pengaruh Technology Readiness terhadap Perceived Usefulness dan Perceived Ease of Use terhadap Behavioral Intention dari Quick Response Indonesian Standard (QRIS) untuk Pembayaran Digital (Studi Kasus: Pengguna Aplikasi e-Wallet Go-Pay, DANA, OVO. Journal of Emerging Information Systems and Business Intelligence, 02(02), 85–93.

Fathi, K. A., & Wandebori, H. (2024). Investigation of Behavioral Intention To Use Digital Payment System in Indonesia From Merchant and Consumer Perspective (Case Study: Qris). Jurnal Apresiasi Ekonomi, 12(2), 309–325.

Fitriati, A., Tubastuvi, N., & Anggoro, S. (2020). The Role of AIS Success on Accounting Information Quality. The International Journal of Management and Technology, 4(2), 43–51.

Gustantio, E. R., Setiawan, A., & Djajadikerta, H. (2024). Pengaruh Gaya Hidup Konsumtif, Financial Literacy, dan Persepsi Kemudahan Bertransaksi Terhadap Penggunaan E-Wallet Pada Generasi Z. Innovative: Journal Of Social Science Research, 4(3), 11261–11273. https://doi.org/10.31004/innovative.v4i3.11417

Hair, J. F., Hult, T. M., Ringle, C. M., & Sarstedt, M. (2014). Partial Least Squares Structural Equation Modeling. In Handbook of Market Research. https://doi.org/10.1007/978-3-319-57413-4_15

Hajazi, M. U. A., Chan, S. S., Ya’kob, S. A., Siali, F., & Latip, H. A. (2021). Usage Intention of Qr Mobile Payment System Among Millennials in Malaysia. International Journal of Academic Research in Business and Social Sciences, 11(1), 645–661. https://doi.org/10.6007/ijarbss/v11-i1/8494

Harahap, R. S. P., Afandi, A., Lubis, M., & Indriani, L. (2023). Determinan Preferensi Mahasiswa Dalam Menggunakan Quick Response Code Indonesian Standard (Qris) Sebagai Alat Transaksi Pembayaran. Innovative: Journal Of Social Science Research, 3(1), 312–319. https://j-innovative.org/index.php/Innovative%0ADeterminan

Haryati, D. (2021). Fenomena Cashless Society pada Generasi Milenial dalam Menghadapi Covid-19. Business Innovation & Entrepreneurship Jounal, 3(1), 33–39. https://nextren.grid.id

Humbani, M., & Wiese, M. (2018). A cashless society for all: Determining consumers’ readiness to adopt mobile payment services. Journal of African Business, 19(3), 409–429.

Jannah, M., Hasyim, F., & Sari, L. E. P. (2023). Analisis Faktor Yang Mempengaruhi Keputusan Penggunaan Qris Pada Generasi Milenial Kabupaten Sukoharjo. Quranomic: Jurnal Ekonomi dan Bisnis Islam, 2(2), 125–141. https://doi.org/10.37252/jebi.v2i2.374

Janneth, Z., & Sari, D. (2022). Pengaruh Trust, Perceived Risk, Perceived Usefulness dan Perceived Ease of Use Terhadap Intention to Use pada Layanan Gopay di Kota Bandung. YUME?: Journal of Management, 5(2), 274. https://doi.org/10.2568/yum.v5i2.1627

Jonathan, R., & Soelasih, Y. (2022). Pembentuk Intention To Use Dompet Digital Melalui Consumer Attitude. Jurnal Manajemen, 19(1), 39–52. https://doi.org/10.25170/jm.v19i1.2300

Khadka, R., & Kohsuwan, P. (2018). Understanding Consumers’ Mobile Banking Adoption in Germany: An Integrated Technology Readiness and Acceptance Model (TRAM) Perspective. Catalyst, 18(1), 56–67.

Khoiroh, L. H., & Pangestuty, F. W. (2022). Penerapan Mobile Technology Acceptance Model (Mtam) dalam Menggunakan Qris Sebagai Sistem. Contemporary Studies in Economic, Finance and Banking, 1(2), 270–282. http://dx.doi.org/10.21776/csefb.2022.01.2.08.

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26(3), 310–322. https://doi.org/10.1016/j.chb.2009.10.013

Lau, S., & Pradana, M. N. R. (2021). Pengaruh keamanan, kecepatan transaksi dan kenyamanan terhadap penggunaan mobile payment. KINERJA: Jurnal Ekonomi dan Manajemen, 18(2), 288–295. http://journal.feb.unmul.ac.id/index.php/KINERJA/article/view/7938

Lew, S., Tan, G. W. ., Loh, X. ., Hew, J. ., & Ooi, K. . (2020). The disruptive mobile wallet in the hospitality industry: An extended mobile technology acceptance model. Technology in Society, 63. https://doi.org/10.1016/j.techsoc.2020.101430

Lu, Y., Cao, Y., Wang, B., & Yang, S. (2011). A study on factors that affect users’ behavioral intention to transfer usage from the offline to the online channel. Computers in Human Behavior, 27(1), 355–364. https://doi.org/https://doi.org/10.1016/j.chb.2010.08.013

Mareta, Y., & Meiryani. (2023). Determinants of Interest Using Qris As a Payment Technology for e-Wallet by Z Generation in Indonesia. Jurnal ilmiah indonesia, 8(2), 801–809.

Mentari, A. D. (2018). Pengaruh Kesadaran, Kecepatan Transaksi, Keamanan, Manfaat yang Dirasakan dengan Mediasi Persepsi Kemudahan Penggunaan terhadap Adopsi m-banking BRI Makassar Raya. Journal of Business and Banking, 8(1), 157–175.

Monica, F., & Japarianto, E. (2022). Analisa Pengaruh Perceived Ease of Use Dan Melalui Perceived Enjoyment Terhadap Behavior Intention Pada Digital Payment. Jurnal Manajemen Pemasaran, 16(1), 9–15. https://doi.org/10.9744/pemasaran.16.1.9-15

Muhyiddin, H., & Fauziah, A. (2022). Pengaruh Convenience to the Customer dan Customer Perceived Value and Benefit Terhadap Impulse Buying. Jurnal Ilmu Sosial dan Ilmu Politik, 19(1), 2022.

Mustofa, R. H., & Maula, P. I. (2023). Factors Influencing the Adoption of QRIS Use Faktor yang Berpengaruh pada Adopsi Penggunaan QRIS. Management Studies and Entrepreneurship Journal, 4(5), 6714–6726. http://journal.yrpipku.com/index.php/msej

Musyaffi, A. M., Sari, D. A. P., & Respati, D. K. (2021). Understanding of Digital Payment Usage During COVID-19 Pandemic: A Study of UTAUT Extension Model in Indonesia. Journal of Asian Finance, 8(6), 475–0482. https://doi.org/10.13106/jafeb.2021.vol8.no6.0475

Nahzdifah, E. D., Adnan, F., & Dharmawan, D. T. (2022). Analisis Pengaruh Kesiapan Pengguna Terhadap Penerimaan SIPENPIN Menggunakan Technology Readiness Acceptance Model. Jurnal Teknologi Informasi dan Multimedia, 4(3), 168–185. https://doi.org/10.35746/jtim.v4i3.254

Nawawi, H. H. (2020). Penggunaan E-wallet di Kalangan Mahasiswa. Emik, 3(2), 189–205. https://doi.org/10.46918/emik.v3i2.697

Nazmi, N., Azizah, S. N., Santoso, S. B., & Amir. (2024). Model Utaut Pada Perilaku Penggunaan Aplikasi Praktik Akuntansi. Jurnal Akademi Akuntansi, 7(1), 20–36. https://doi.org/10.22219/jaa.v7i1.30730

Nurhapsari, R., & Sholihah, E. (2022). Analysis of the factors of intention to use QRIS for MSMEs in Semarang City’s traditional market. Jurnal Ekonomi Modernisasi, 18(2), 199–211. https://doi.org/10.21067/jem.v18i2.7291

Nurikmah, T., Mudjiyanti, R., Santoso, S. B., & Amir. (2023). The Influence of Perceived Ease, Perceived Risk, System Security, and Service Quality on Trust in Transactions Using Shopee E-commerce. Innovation Business Management and Accounting Journal, 2(4), 264–274. https://doi.org/10.56070/ibmaj.v2i4.70

Ooi, K. ., & Tan, G. W. . (2016). Mobile technology acceptance model: An investigation using mobile users to explore smartphone credite card. Expert Systems with Applications, 59, 33–34. https://doi.org/https://doi.org/10.1016/j.eswa.2016.04.015

Parasuraman, A., & Colby, C. L. (2015). An updated and streamlined technology readiness index: TRI 2.0. Journal of service research, 18(1), 59–74.

Pasya, M. B., Nurdin, E., Yusuf, S., & Purnaman, S. M. N. (2023). The Influence of Perceived Benefits and Ease of Use Quick Response Indonesian Standard (QRIS): TAM Theory Approach. Indonesian Annual Conference Series, 2, 251–260. https://ojs.literacyinstitute.org/index.php/iacseries/article/view/1089

Phan, K., & Daim, T. (2011). Exploring technology acceptance for mobile services. Journal of Industrial Engineering and Management, 4(2), 339–360. https://doi.org/10.3926/jiem.2011.v4n2.p339-360

Puspita, Y. C. (2019). Analisis Kesesuaian Teknologi Penggunaan Digital Payment pada Aplikasi OVO. Jurnal Manajemen Informatika, 9(2), 121–128.

Rahayu, S., & Priyanto, P. R. (2023). Penggunaan Mobile Payment Pada Mahasiswa Telkom University. Kompak?:Jurnal Ilmiah Komputerisasi Akuntansi, 16(2), 249–259. https://doi.org/10.51903/kompak.v16i2.1261

Rizkiyah, K., Nurmayanti, L., Macdhy, R. D. N., & Yusuf, A. (2021). Pengaruh Digital Payment Terhadap Perilaku Konsumen Pengguna Platform Digital Payment OVO. Jurnal Ilmiah Manajemen, 16(1), 107–126.

Saputra, Y. F. E., & Bahari, A. (2024). Analisis Determinan Dan Anteseden Penggunaan Quick Response Indonesian Standard (QRIS) Pada Pembayaran Digital. Management Studies and Entrepreneurship Journal (MSEJ), 5(1), 3026–3037.

Sari, M. A., Aminah, I., & Redyanita, H. (2020). Preferensi Generasi Millenial Dalam Memilih Pembayaran Digital (Studi Kasus Pada Mahasiswa Politeknik Negeri Jakarta Depok). Jurnal Ekonomi & Bisnis, 19(2), 97–106. https://doi.org/10.32722/eb.v19i2.3601

Saripudin, Yuniarti, R., & Ernawati, D. (2023). Exploring the Factors Influencing the Adoption of QRIS as a Digital Payment in Indonesia. The Journal of Management Theory and Practice, 4(1), 2716–7089. https://www.researchgate.net/publication/372165100_Exploring_the_Factors_Influencing_the_Adoption_of_QRIS_as_a_Digital_Payment_in_Indonesia

Setiawan, B., Khairani, M., Fadil, T., & Mohd Khairal ABD, T. (2022). Investigasi Behavioral Intention Pada Sistem Pembayaran QRIS Di Merchant UMKM. Jurnal Teknik Informatika dan Sistem Informasi, 9(4), 3467–3480. https://doi.org/10.35957/jatisi.v9i4.3364

Shetu, S. N., Islam, M. M., & Promi, S. I. (2022). An Empirical Investigation of the Continued Usage Intention of Digital Wallets: The Moderating Role of Perceived Technological Innovativeness. Future Business Journal, 8(1), 1–17. https://doi.org/10.1186/s43093-022-00158-0

Simarmata, M. T. A., & Hia, I. J. (2020). the Role of Personal Innovativeness on Behavioral Intention of Information Technology. Journal of Economics and Business, 1(2), 18–29. https://doi.org/10.36655/jeb.v1i2.169

Slade, E. L., Dwivedi, Y. K., Piercy, N. C., & Williams, M. D. (2015). Modeling Consumers’ Adoption Intentions of Remote Mobile Payments in the United Kingdom?: Extending UTAUT with Innovativeness , Risk , and Trust. Psychology and Marketing, 32(8), 860–873. https://doi.org/10.1002/mar.20823/abstract.

Suebtimrat, P., & Vonguai, R. (2021). An Investigation of Behavioral Intention Towards QR Code Payment in Bangkok, Thailand. Journal of Asian Finance, Economics and Business, 8(1), 939–950. https://doi.org/10.13106/jafeb.2021.vol8.no1.939

Syarwani, A., & Ermansyah, E. (2020). Analisis Penerimaan Teknologi Sistem Keuangan Desa Di Kabupaten Tabalong Menggunakan Technology Acceptance Model. Cyberspace: Jurnal Pendidikan Teknologi Informasi, 4(1), 1–13. https://doi.org/10.22373/cj.v4i1.6464

Tan, G. W.-H., Ooi, K.-B., Chong, S.-C., & Hew, T.-S. (2014). NFC mobile credit card: The next frontier of mobile payment? Telematics and Informatics, 31(2), 292–307. https://doi.org/https://doi.org/10.1016/j.tele.2013.06.002

Teo, A.-C., Tan, G. W.-H., Ooi, K.-B., Hew, T.-S., & Yew, K.-T. (2015). The effects of convenience and speed in m-payment. Industrial management & data systems, 115(2), 311–331. https://doi.org/10.1108/IMDS-08-2014-0231

Wingdes, I. (2020). Ekstensi TAM untuk Memprediksi Niat Menggunakan E-Money di Pontianak. Creative Information Technology Journal, 5(4), 264. https://doi.org/10.24076/citec.2018v5i4.221

Yan, L.-Y., Tan, G. W.-H., Loh, X.-M., Hew, J.-J., & Ooi, K.-B. (2021). QR code and mobile payment: The disruptive forces in retail. Journal of Retailing and Consumer Services, 58(May 2020), 102300. https://doi.org/10.1016/j.jretconser.2020.102300

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Angelina Pernanda Pramestiani, Azmi Fitriati, Suryo Budi Santoso, Siti Nur Azizah

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

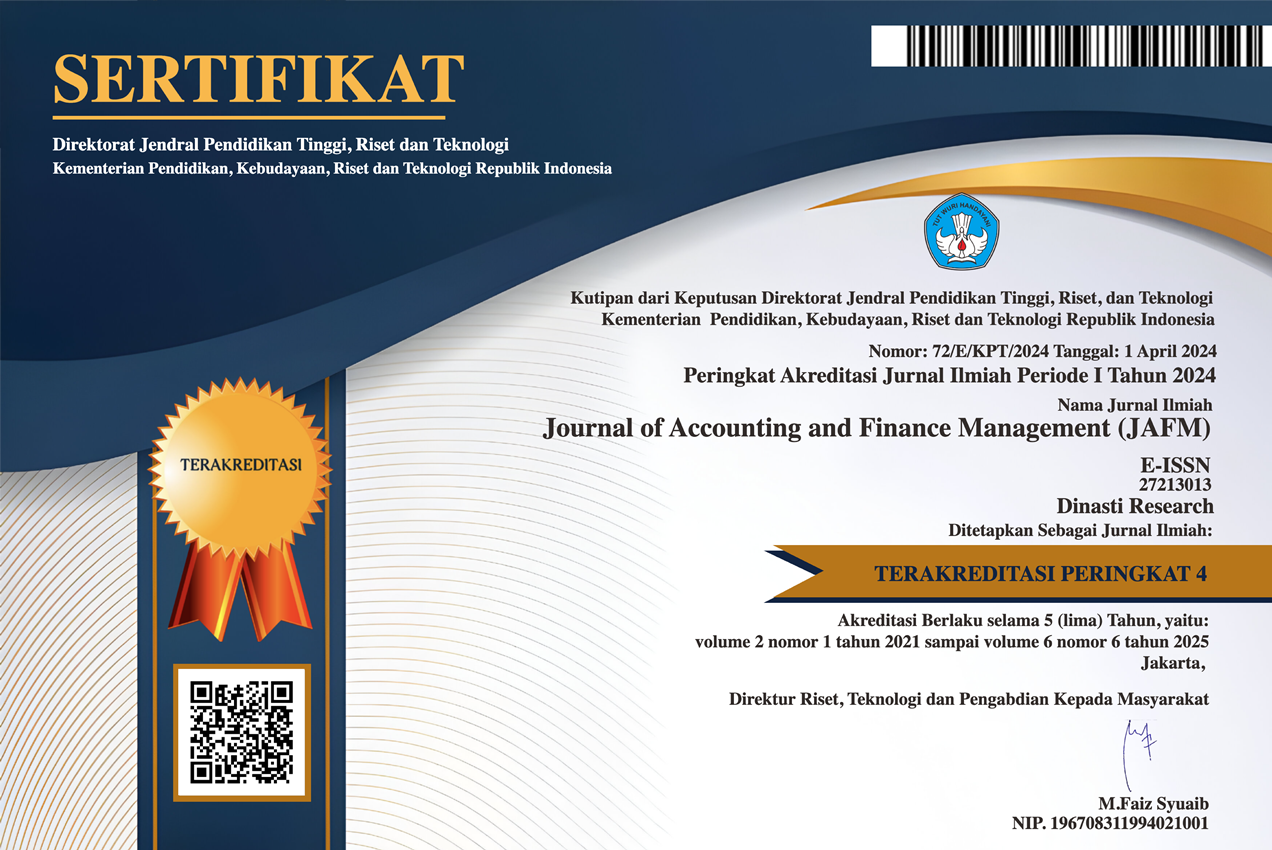

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).