On-Chain Off-Chain Regulation on Crypto Asset in Indonesia Market

DOI:

https://doi.org/10.38035/jlph.v6i1.2505Keywords:

blockchain regulation, crypto asset, cyber lawAbstract

The advancement of blockchain technology has created challenges for traditional regulatory frameworks, regarding consumer protection in crypto asset ecosystems. This paper examines dichotomy between on-chain governance mechanisms embedded within blockchain protocols and off-chain regulatory approaches imposed by state authorities. Through normative legal research and comparative analysis of international regulatory practices, this study identifies critical gaps in Indonesia's current crypto asset regulatory framework. The research reveals that existing regulations, through government’s commodity-based approach, inadequately address the technological governance inherent in blockchain systems like smart contracts, decentralized protocols, and automated consensus mechanisms. The study proposes a hybrid regulatory construction that synchronizes technological governance with traditional state regulation to create comprehensive consumer protection. The findings demonstrate that integrating on-chain compliance mechanisms with off-chain oversight can enhance consumer safety while maintaining innovation momentum. This research contributes to digital law study by providing regulatory models suitable for Indonesia's legal system and broader emerging market contexts.

References

Barbereau, T., & Bodó, B. (2023). Beyond financial regulation of crypto-asset wallet software: In search of secondary liability. Computer Law & Security Review, 49, 105829. https://doi.org/10.1016/J.CLSR.2023.105829

Briola, A., Vidal-Tomás, D., Wang, Y., & Aste, T. (2023). Anatomy of a Stablecoin’s failure: The Terra-Luna case. Finance Research Letters, 51, 103358. https://doi.org/10.1016/J.FRL.2022.103358

Burgess, T., & Liu, J. (2025). A tale of two jurisdictions: Contrasting cryptocurrency regulations in Hong Kong and the United Kingdom. Journal of Economic Criminology, 8, 100150. https://doi.org/10.1016/J.JECONC.2025.100150

Chainalysis. (2024). 2024 Global Crypto Adoption Index. https://www.chainalysis.com/blog/2024-global-crypto-adoption-index/

Chan, G. (2023). Anti Money Laundering Laws - a Thorn in the Side of the Four Asian Tigers. Journal of Law, Market and Innovation, 2(1). https://doi.org/10.13135/2785-7867/7443

Chason, E. D. (2023). Regulating Crypto, On and Off the Chain (Vol. 64). https://scholarship.law.wm.edu/wmlr

Conlon, T., Corbet, S., & Oxley, L. (2024). The influence of European MiCa regulation on cryptocurrencies. Global Finance Journal, 63, 101040. https://doi.org/10.1016/J.GFJ.2024.101040

De Filippi, P., & Wright, A. (2018). Blockchain and the Law. Harvard University Press. https://doi.org/10.2307/j.ctv2867sp

Ferreira, A., & Sandner, P. (2021). Eu search for regulatory answers to crypto assets and their place in the financial markets infrastructure. Computer Law & Security Review, 43, 105632. https://doi.org/10.1016/j.clsr.2021.105632

Hudima, T., Kamyshanskyi, V., Kulyk, O., & Dovhan, V. (2025). Stability without Consensus : Legal Approaches to Stablecoins in the EU, UK, Singapore and Japan. Financial and Credit Activity: Problems of Theory and Practice, 3(62), 577–588. https://doi.org/10.55643/fcaptp.3.62.2025.4745

Lessig, L. (2006). Code 2.0. https://archive.org/details/Code2.0

Makarov, I., & Schoar, A. (2020). Trading and arbitrage in cryptocurrency markets. Journal of Financial Economics, 135(2), 293–319. https://doi.org/10.1016/J.JFINECO.2019.07.001

Perdana, A., & Jhee Jiow, H. (2024). Crypto-Cognitive Exploitation: Integrating Cognitive, Social, and Technological perspectives on cryptocurrency fraud. Telematics and Informatics, 95, 102191. https://doi.org/10.1016/J.TELE.2024.102191

Saggu, A., Ante, L., & Kopiec, K. (2025). Uncertain Regulations, Definite Impacts: The Impact of the U.S. Securities and Exchange Commission’s Regulatory Interventions on Crypto Assets. Finance Research Letters, 72, 106413. https://doi.org/10.1016/J.FRL.2024.106413

Silva, J. F., & Ferreira, F. de S. (2020). Navigating the Transformative Potential and Legal Challenges of Cryptocurrencies and Blockchain Technology. Revista Ft, 50–51. https://doi.org/10.69849/revistaft/ar10202012011050

Ungureanu, P., Bellesia, F., & Cochis, C. (2025). Dealing with blame in digital ecosystems: The DAO failure in the Ethereum blockchain. Technological Forecasting and Social Change, 215, 124096. https://doi.org/10.1016/J.TECHFORE.2025.124096

Weber, R. H. (2025). From traditional to decentralized governance in the crypto environment: legal framework for decentralized autonomous organizations and decentralized finance (J. Lee & A. Darbellay, Eds.; p. 267). Edward Elgar Publishing. https://doi.org/10.4337/9781803929996

Wendl, M., Doan, M. H., & Sassen, R. (2023). The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: A systematic review. Journal of Environmental Management, 326, 116530. https://doi.org/10.1016/J.JENVMAN.2022.116530

Downloads

Published

How to Cite

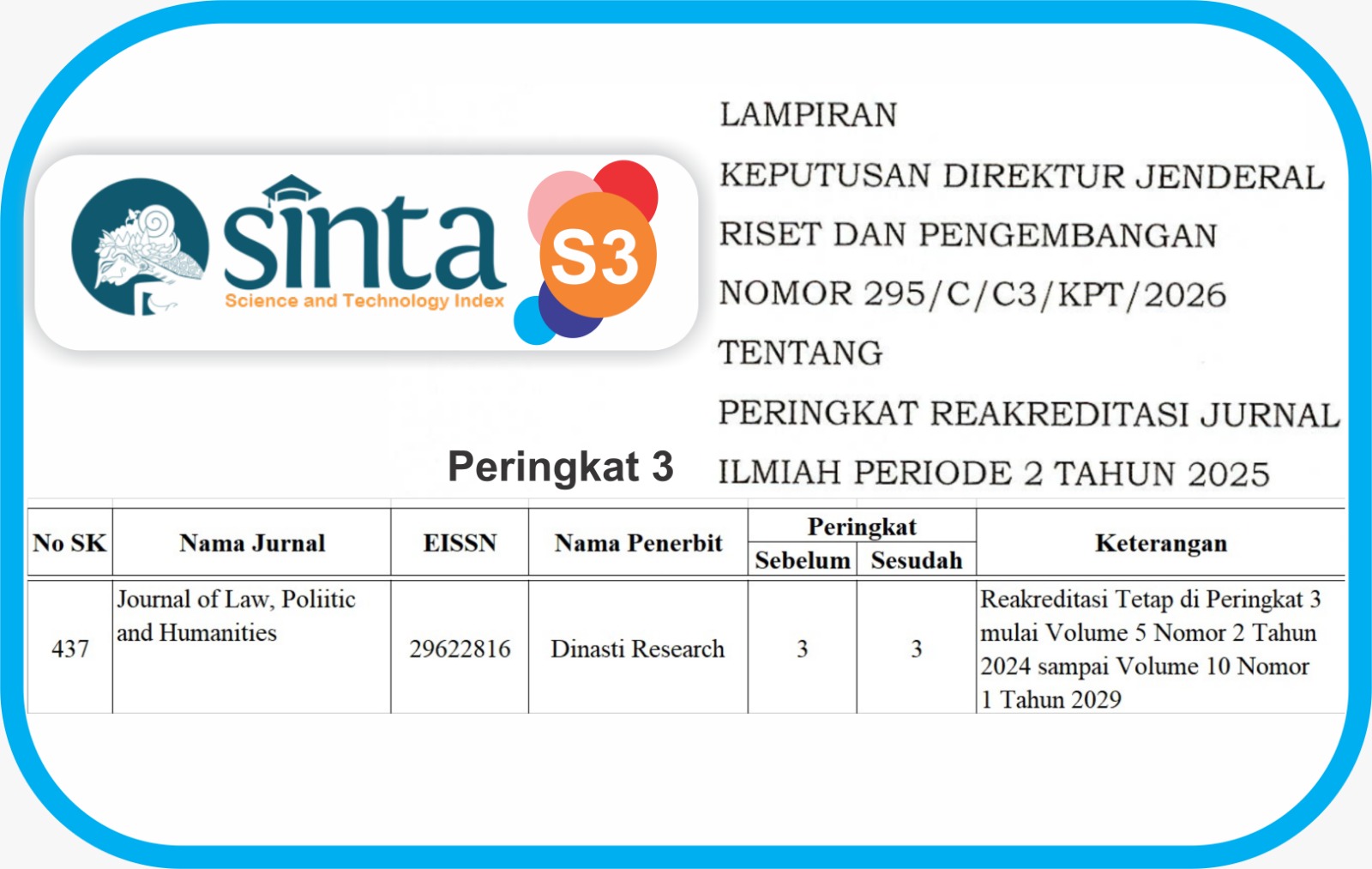

Issue

Section

License

Copyright (c) 2025 Aloysius Bernanda Gunawan, M.S. Tumanggor, Adi Nur Rohman, Amalia Syauket

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Law, Poliitic and Humanities (JLPH) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Law, Poliitic and Humanities (JLPH).