Legal Optimization of Digital Tax Administration in Indonesia: Case of Coretax

DOI:

https://doi.org/10.38035/jlph.v6i2.2720Keywords:

Tax administration law, core tax system, Absolute Obligation Theory.Abstract

The core issue in Indonesia’s tax system lies in the underperformance of the core tax administration functions managed by the Directorate General of Taxes, particularly registration, reporting, payment, and enforcement. These weaknesses have contributed to low voluntary compliance and inefficient revenue collection in tax authorities. The purpose of this research is to evaluate whether Indonesia’s core tax system aligns with the Absolute Obligation Theory and the fundamental framework of tax administration law, which view taxation as a non-negotiable obligation of citizens in support of public services and national stability. Using a normative juridical method and a comparative approach with other tax administration models, the study identifies persistent shortcomings in Indonesia’s policy design, administrative capacity, and enforcement strategies. The findings reveal that Indonesia has yet to fully implement tax administration principles in a coherent and effective manner. In conclusion, the study suggests that Indonesia should adopt key lessons in legal clarity, digital integration, and institutional governance to build a more efficient tax administration system.

References

Ali, Zainuddin. Metode penelitian hukum. Sinar Grafika, 2021.

Alink, Matthijs, and Victor Van Kommer. Handbook on tax administration. IBFD, 2011.

Alm, James. Can Indonesia reform its tax system?: problems and options. No. 1906. Tulane University, Department of Economics, 2019.

Arianty, Fitria. "IMPLEMENTATION CHALLENGES AND OPPORTUNITIES CORETAX ADMINISTRATION SYSTEM ON THE EFFICIENCY OF TAX ADMINISTRATION." Jurnal Vokasi Indonesia 12, no. 2 (2024): 2.

Arifin, Dharmawan, Aris Prio Agus Santoso, and Poniman Poniman. "Discourse on the Coretax System in Indonesia: A Study of Legal Certainty and Guarantees for Taxpayers." The Easta Journal Law and Human Rights 3, no. 02 (2025): 118-127.

Cotton, Ms Margaret, and Gregory Dark. Use of technology in tax administrations 2: Core information technology systems in tax administrations. International Monetary Fund, 2017.

da Cunha Tavares, Henrique, and Adriano Sant’Ana Pedra. "Accessory tax obligations from the perspective of the fundamental duties theory." Human Rights, Rule of Law and the Contemporary Social Challenges in Complex Societies (2015): 2281.

Fetzer, Thomas. "E-government in Germany." DeSIGNING e. GOVeRNMeNT (2007): 85.

Fetzer, Thomas. "E-government in Germany." DeSIGNING e. GOVeRNMeNT (2007): 85.

Grewal, Amandeep S. "Taking Administrative Law to Tax: Foreword." Duke Law Journal 63, no. 8 (2014): 1625-1633.

Huseynov, Akbar. "Evaluation of tax system in Germany." Міжнародний науковий журнал Інтернаука 13 (2017): 40.

Jacobs, Bas. "Digitalization and taxation." Digital revolutions in public finance (2017): 25-55.

Joselin, Vincent Alexis, Temy Setiawan, Ernie Riswandari, and J. J. S. B. Kav. "Indonesia Core Tax System: Road Map to Implementation 2024." International Journal of Economics, Business and Management Research 8, no. 06 (2024): 46-56.

Law Number 7 of 2021 concerning Harmonization of Tax Regulations

Matabean, Redhy, and Vishnu Juwono. "Implementation of Data Collection Policy and Tax Information on Directorate General of Taxes." Jurnal Borneo Administrator 17, no. 3 (2021): 365-378.

Mikesell, John L. "Tax administration: The link between tax law and tax collections." PUBLIC ADMINISTRATION AND PUBLIC POLICY 67 (1998): 173-198.

Purnomolastu, Norbertus. "The analysis of tax ratio in Indonesia and the steps taken to increase it." Eurasia: Economics & Business, 6, no. 48 (2021): 117-127.

Rahayu, Derita Prapti, M. SH, and Sesi Ke. "Metode Penelitian Hukum." Yogyakarta: Thafa Media (2020).

Regulation of the Minister of Finance Number 81 of 2024 concerning Tax Provisions in the Framework of Implementing the Core Tax Administration System

Shome, Parthasarathi. Taxation history, theory, law and administration. Cham: Springer, 2021.

Sihombing, Jonker. Pokok-Pokok Hukum Pajak. Bandung: PT Alumni, 2013.

Sutedi, Adrian. Hukum pajak. Sinar Grafika, 2022.

Thuronyi, Victor, and Kim Brooks. Comparative tax law. Kluwer Law International BV, 2016.

Végh, Gyöngyi. "Tax administration good governance." EC Tax Review 27, no. 1 (2018).

Zimmermann, Horst. "History of local taxation in Germany." Journal of tax reform 5, no. 1 (2019): 57-69.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Jonker Sihombing

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

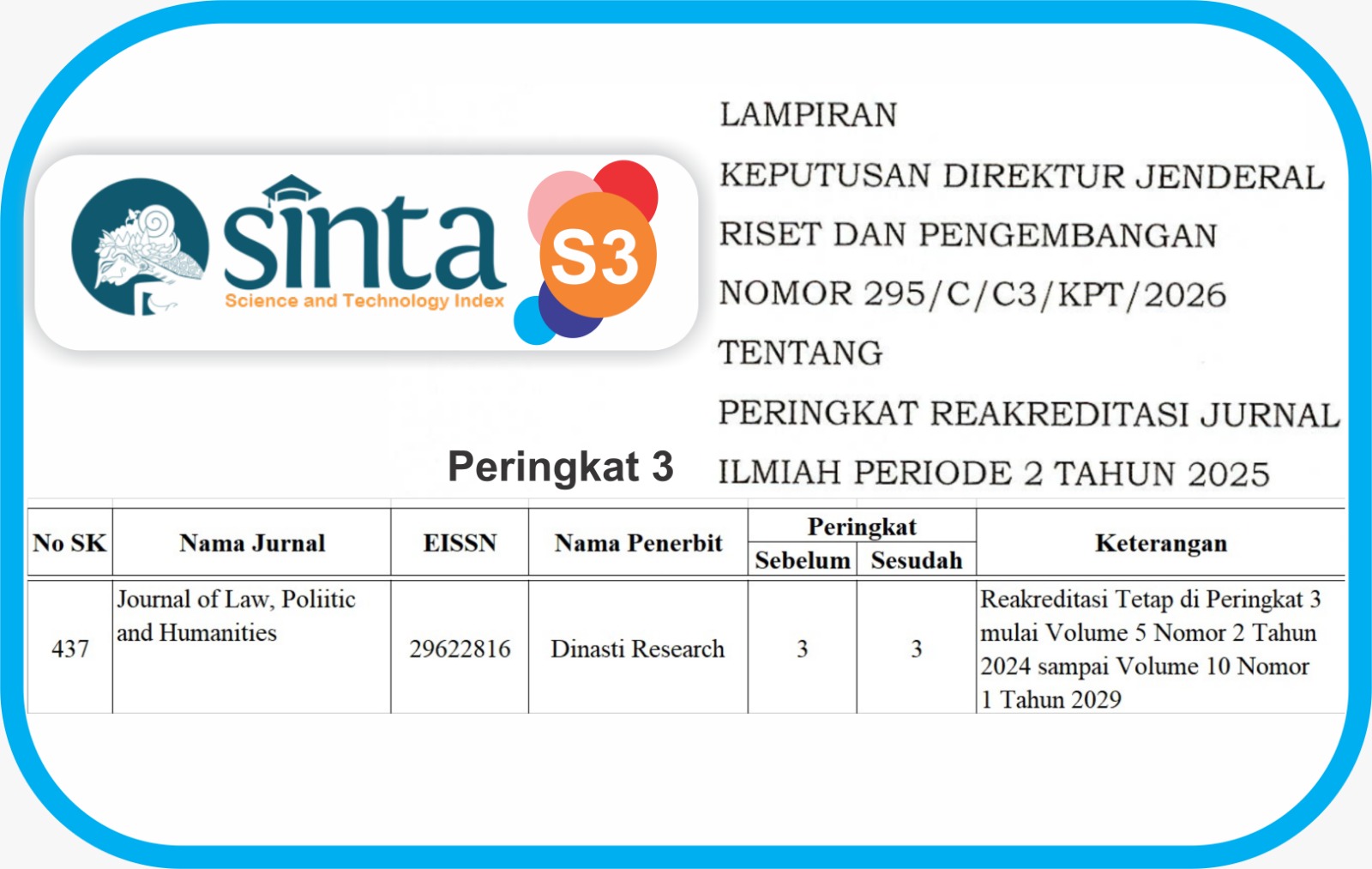

- The author acknowledges that the Journal of Law, Poliitic and Humanities (JLPH) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Law, Poliitic and Humanities (JLPH).