Implementation of Sustainable Finance Taxonomy Policy through Sustainable Credit: Regulations, Opportunities, and Challenges for Banks in Indonesia

DOI:

https://doi.org/10.38035/jlph.v5i5.1833Keywords:

Sustainable Finance Taxonomy, Sustainable Credit, Sustainable Development GoalsAbstract

Indonesia's commitment to the Sustainable Development Goals (SDGs) and the Paris Agreement has implications for banks in carrying out their business practices to lead to sustainable practices. The phenomenon occurs when banks indirectly contribute to causing environmental damage such as providing credit that is only oriented towards profit. The Financial Services Authority (OJK) as a regulator issues the Sustainable Finance Taxonomy Policy as a guideline for banks to maximize the implementation of sustainable finance, especially in providing credit. This study aims to analyze how the Sustainable Finance Taxonomy policy influences and plays a strategic role in increasing sustainable banking credit in Indonesia. This study uses a normative legal approach with analytical descriptive specifications and the object of research is PT Bank Mandiri (Persero) Tbk, this study found that the Sustainable Finance Taxonomy policy plays a strategic role in increasing sustainable credit. The results of this study are expected to provide knowledge for policy makers in creating a sustainable financial system with legal certainty.

References

Abubakar, L., & Handayani, T. (2019). Implementation of the Principles for Responsible Banking in Indonesian Banking Practices to Realize Sustainable Development Goals. Advances in Social Science, Education and Humanities Research, 358(1), 103–106. https://doi.org/10.2991/icglow-19.2019.26

Abubakar, L., Handayani, T., & Sukmadilaga, C. (2021). Regulation and Implementation of Sustainable Finance: a Challenge To Indonesian Banks. Journal of Management Information and Decision Sciences, 24(1), 1–12.

Ahdiat, A. (2024). Penyaluran Kredit Berkelanjutan di RI Terus Meningkat. https://databoks.katadata.co.id/keuangan/statistik/523c2d8671b42d4/penyaluran-kredit-berkelanjutan-di-ri-terus-meningkat

Amiruddin, & Asikin, Z. (2003). Pengantar Metode Penelitian Hukum. Raja Grafindo Persada.

Ariesta, A. (2024). OJK: Realisasi Penyaluran Kredit Berkelanjutan Capai Rp1.959 Triliun per 2023. https://www.idxchannel.com/banking/ojk-realisasi-penyaluran-kredit-berkelanjutan-capai-rp1959-triliun-per-2023

Bank Mandiri. (2025). Guest. https://www.bankmandiri.co.id/web/guest/esg

Budiantoro, S. (2014). Mengawal Green Banking Di Indonesia Dalam Konteks Pembangunan Berkelanjutan. Prakarsa.

Diah Anggraini, Aryani, D. N., & Prasetyo, I. B. (2019). Analisis Implementasi Green Banking Dan Kinerja Keuangan Terhadap Profitabilitas Bank Di Indonesia (2016-2019). Jurnal Bisnis, Manajemen an Infromatika, 1(2), 141–161.

Djumhana, M. (1993). Manajemen Dana Bank. Bina Usaha.

Driving Tropical Deforestation. (2023). Forest & Finance, Banking On Biodiversity Collapse: Tracking The Banks And Investors. https://forestsandfinance.org/publications/new-report-banking-on-biodiversity-collapse-tracking-the-banks-and-investors-driving-tropical-deforestation/

Furqan, A. M., & Sutrisno. (2024). Determinan Green Credit dan Pengaruhnya Terhadap Profitabilitas Perbankan di Indonesia. Proceeding Of National Conference On Accounting & Finance, 6(1), 391–405.

Handayani, T., Sulistyani, W., & Putri, N. S. (2023). Peran Perbankan Dalam Pengawasan Pembiayaan Korporasi (Sektor Hijau). Warta Pengabdian, 17(1), 47–64.

Handayani, T., & Abubakar, L. (2020). Banks Contribution to Promote Indonesian Financial Inclusion. In 1st Borobudur International Symposium on Humanities. Borobudur International Symposium on Humanities, Economics and Social Sciences, 976–979.

Imaniyati, N. S., & Putra, P. A. A. (2016). Pengantar Hukum Perbankan Indonesia. PT Refika Editama.

Kusumaatmadja, M. (2003). Fungsi dan Perkembangan Hukum Dalam Pembangunan Nasional. Bina Cipta.

Mumtaz, D. M., & Smith, D. Z. (2019). Green Finance for Sustainable Development in Pakistan.Islamabad Policy Research Institute Journal, 1-34.

Nugrahaeni, R., & Muharam, H. (2023). The Effect Of Green Credit And Other Determinants Of Credit Risk Commercial Bank In Indonesia. BUSTECHNO: Journal of Business, Social and Technology, 4(2), 135–147. https://bustechno.polteksci.ac.id/

Octavio, K. K., Abubakar, L., & Handayani, T. (2022). Pemberian Insentif Atmr Oleh Otoritas Jasa Keuangan Kepada Bank Sebagai Upaya Penerapan Prinsip Keuangan Berkelanjutan. Jurnal Yuridis, 9(1), 1–12.

Otoritas Jasa Keuangan. (2021). Roadmap Keuangan Berkelanjutan Tahap II (2021 – 2025). https://ojk.go.id/id/berita-dan-kegiatan/publikasi/Pages/Roadmap-Keuangan-Berkelanjutan-Tahap-II-(2021-2025).aspx

Otoritas Jasa Keuangan. (2024a). Frequently Asked Question (FAQ) Taksonomi untuk Keuangan Berkelanjutan Indonesia (TKBI). https://keuanganberkelanjutan.ojk.go.id/keuanganberkelanjutan/BE/uploads/siaranpers/files/file_e3876913-a6a6-4457-9c1e-d3985f72dbd7-19022024225645.pdf

Otoritas Jasa Keuangan. (2024b). Taksonomi Untuk Keuangan Berkelanjutan Indonesia. https://ojk.go.id/id/berita-dan-kegiatan/info-terkini/Documents/Pages/Taksonomi-untuk-Keuangan-Berkelanjutan-Indonesia/Buku Taksonomi untuk Keuangan Berkelanjutan Indonesia %28TKBI%29.pdf

Pratama, B. A., & Firmansyah, A. (2024). Pembiayaan Hijau: Akselerasi Pembangunan Berkelanjutan Demi Mencapai Net Zero Emission. Journal of Law, Administration, and Social Science, 4(1), 150–160. https://doi.org/10.54957/jolas.v4i1.743

PT Bank Mandiri (Persero) Tbk. (2021a). Laporan Keberlanjutan 2021 (Transformasi yang Berkelanjutan Menuju Bank Digital Terbaik/Sustainable Transformation Towards the Best Digital Bank). https://www.bankmandiri.co.id/documents/38265486/0/Sustainability+Report+Bank+Mandiri+2021+-+June+2022+-+lowres+%281%29.pdf/0d5fdc19-0160-2bc6-31b5-0014522c701b?t=1664252120461

PT Bank Mandiri (Persero) Tbk. (2021b). Laporan Tahunan 2021 (Melanjutkan Transformasi Digital & Inovasi Perbankan). https://www.bankmandiri.co.id/documents/38265486/0/Laporan+Tahunan+Mandiri+25+Juli+2022_compressed.pdf/73835289-33ab-5837-9031-fb3e4f28b991?t=1664251860488

PT Bank Mandiri (Persero) Tbk. (2022a). Laporan Keberlanjutan 2022 (TRANSFORMASI DIGITAL BERDAMPAK SIGNIFIKAN untuk ESG). https://www.bankmandiri.co.id/documents/38265486/0/SR+Mandiri+Mar20b.pdf/ea54dbdd-9fd9-dc40-8747-4364c4f02cf8?t=1680580068232

PT Bank Mandiri (Persero) Tbk. (2022b). Laporan Tahunan 2022 (TRANSFORMASI DIGITAL dengan EXCELLENT RESULT). https://www.bankmandiri.co.id/documents/38265486/38265681/Laporan+Tahunan+Mandiri+21+Oktober.pdf/34feb35b-7726-def6-867e-355d52af36aa?t=1698026843973

PT Bank Mandiri (Persero) Tbk. (2023a). Laporan Keberlanjutan 2023 (Mendukung Masa Depan Berkelanjutan Melalui Investasi Hijau). https://www.bankmandiri.co.id/documents/38265486/38265681/SR+Bank+Mandiri+2023+%28indo%29+-low-+20mar%280519%29.pdf/2836d521-9523-cbbd-61c5-e8bc9ebb0cb5?t=1711005221824

PT Bank Mandiri (Persero) Tbk. (2023b). Laporan Tahunan 2023 (Industry Leader Yang Tangguh: Selalu Menghadirkan Selalu Terdepan). https://www.bankmandiri.co.id/documents/38265486/38265681/LAPORAN+TAHUNAN+BMRI+2023+%28FINAL%29+-+22+Mei+2024.pdf/60971633-3f12-bc88-e82c-8c8f6a73b1a7?t=1716371205973

PT Bank Mandiri (Persero) Tbk. (2024a). Kerangka Keuangan Berkelanjutan. https://www.bankmandiri.co.id/esg

PT Bank Mandiri (Persero) Tbk. (2024b). Laporan Keuangan Konsolidasian. https://www.bankmandiri.co.id/documents/38265486/0/Mandiri_LapKeu_Q3-2024_Indonesian+Version+(1).pdf/44ea5cc8-ada0-4bb1-bd65-428bca9a272b?t=1730353047491

PT Bank Mandiri (Persero) Tbk. (2024c). Pendekatan Pembiayaan yang Bertanggung Jawab. https://www.idx.co.id/StaticData/NewsAndAnnouncement/ANNOUNCEMENTSTOCK/From_EREP/202402/09d9980c28_de02b92509.pdf

PT Bank Mandiri (Persero) Tbk. (2024d). Sustainable Finance Framework. PT Bank Mandiri Tbk.https://www.bankmandiri.co.id/documents/20143/249042147/NEW+BMRI_Sustainable+Finance+Framework+Okt+2024.pdf/b26dbd56-029f-2b64-3b04-636be89b9f03?t=1732801623617

PT Bank Mandiri (Persero) Tbk. (2025). Profile. https://www.bankmandiri.co.id/esg

Salim, M. A. (2018). Kesiapan Pemerintah Menerapkan Green Banking Melalui Pojk Dalam Mewujudkan Pembangunan Berkelanjutan Berdasarkan Hukum Positif Di Indonesia. Yustitia, 4(2), 119–141. https://doi.org/10.31943/yustitia.v4i2.40

Saragih, B., Abubakar, L., & Handayani, T. (2021). Implementing Sustainable Finance Principles: Legal Implications of Ease of Doing Business Towards Banking Credit Approval. Jurnal Komunikasi Hukum (JKH), 7(1), 38–50. https://doi.org/10.23887/jkh.v7i1.31456

Sati, D. (2022). Refleksi Keuangan Hijau di Indonesia dan Proyeksi Taksonomi Hijau sebagai Kebijakan Pintar. Jurnal Hukum Lingkungan Indonesia, 8(2), 339–371. https://doi.org/10.38011/jhli.v8i2.442

Soekanto, S., & Mamudji, S. (2001). Penelitian Hukum Normatif?: Suatu Tinjauan Singkat. Rajawali Pres.

Sukmadilaga, C., Bakar, L. A., Handayani, T., Sagara, Y., Sejiati, I. H., & Lestari, T. U. (2021). Sosialisasi Implementasi Pedoman Akuntansi Pesantren Berbasis Digital Pada Pesantren Di Indonesia. Dharmakarya: Jurnal Aplikasi Ipteks Untuk Masyarakat, 10(2), 115–121.

Wibisana, A. G. (2018). Instrumen Ekonomi Command and Control, Instrumen Ekonomi, dan Instrumen Lainnya: Kawan atau Lawan? Suatu Tinjauan Berdasarkan Smart Regulation, Jurnal Bina Hukum Lingkungan, 4(1), 173-197.

Yasmin, & Akhter. (2021). Determinants of Green Credit and Its Influence on Bank Performance Min Bangladesh. International Journal of Business, Economics and Law, 25(2), 31–41.

Downloads

Published

How to Cite

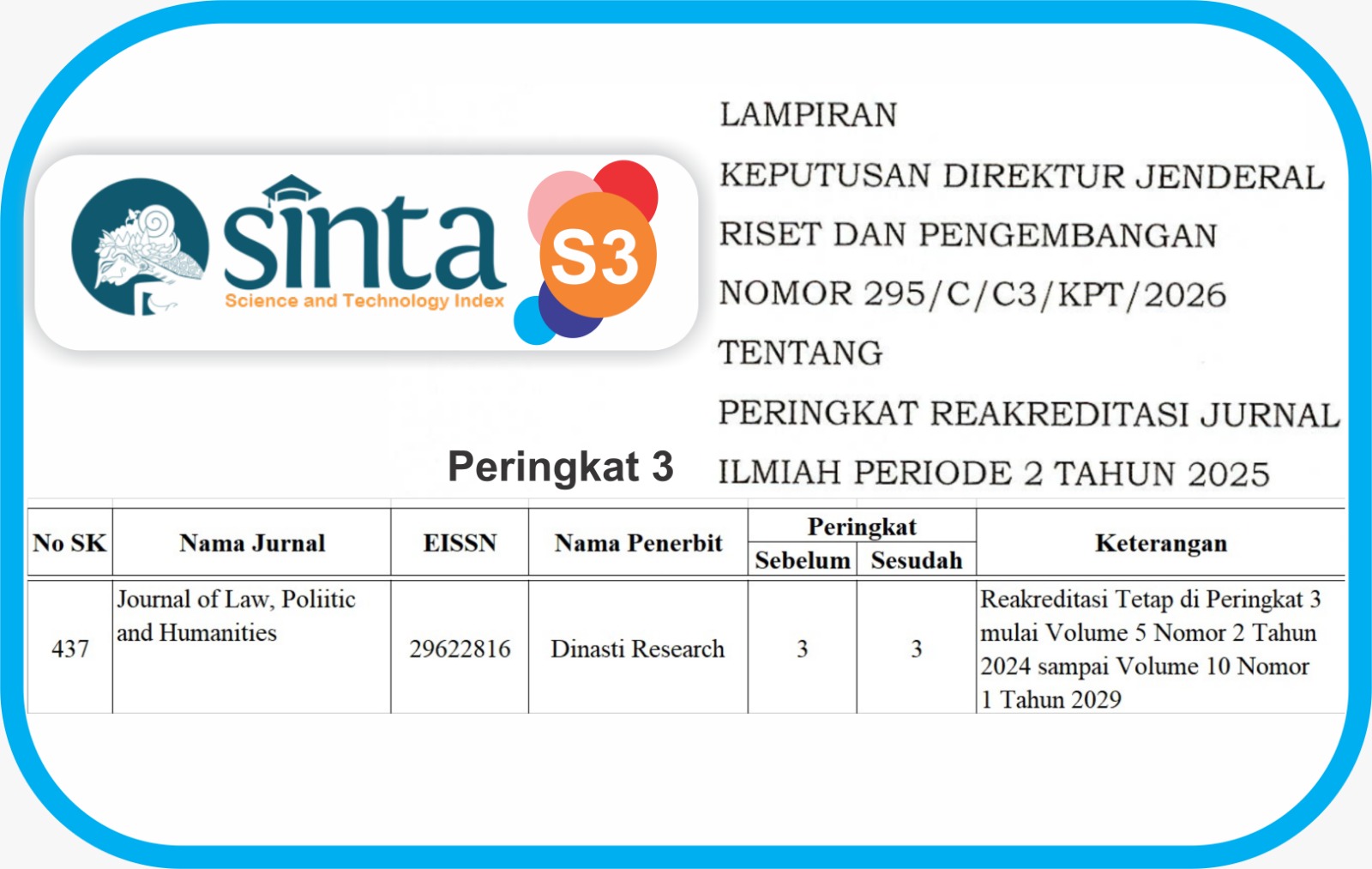

Issue

Section

License

Copyright (c) 2025 Muhammad Rifqi Novianto, Lastuti Abubakar, Tri Handayani

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Law, Poliitic and Humanities (JLPH) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Law, Poliitic and Humanities (JLPH).