Legal Implications of The Danantara Superholding Model on Public Accountability in State-Owned Bank Asset Management in Indonesia

DOI:

https://doi.org/10.38035/jlph.v5i5.1916Keywords:

Danantara, State-owned Banks, State Own Enterprises (SOEs), Superholding.Abstract

State-Owned Enterprises (SOEs) play a crucial role in Indonesia’s economy, yet governance challenges persist, particularly regarding asset management and public accountability. This article critically examines the legal implications of establishing Badan Pengelola Investasi Daya Anagata Nusantara (Danatara), a superholding formed under Law Number 1 of 2025 concerning the Third Amendment to Law Number 19 of 2003, focusing on state-owned banking governance. Using a normative juridical (doctrinal) method supported by comparative studies with Singapore’s Temasek Holdings, this research analyzes the risks of diminished public accountability due to legal separations between Danatara’s investments and state assets. Findings reveal that while the superholding model aims to enhance efficiency, it may weaken constitutional principles concerning state asset control, impair public financial oversight, and obscure transparency and anti-corruption efforts. Moreover, an overemphasis on profitability risks undermining SOEs’ social functions, particularly in financial inclusion and development support. To ensure Danatara fulfills its constitutional mandate, this study recommends strengthening regulatory frameworks, legislative oversight, external audits, and institutional transparency mechanisms.

References

Ackers, B. (2022). Corporate Governance by South African State-Owned Entities (SOEs)– Contributing to Achieving Agenda 2063. PanAfrican Journal of Governance and Development (PJGD), 3(2), 137-165. https://doi.org/10.46404/panjogov.v3i2.3943

Chamba, L., & Chazireni, B. (2023). Investing in intrapreneurial capabilities for improved performance in state-owned enterprises. Africa’s Public Service Delivery & Performance Review, 11(1), a663. https://doi.org/10.4102/apsdpr.v11i1.663

Da Silva, P. R., Kasper, L., Baccin Brizolla, M. M., Brum, A. L., Baggio, D. K., & Sausen, J. O. (2023). The Relationship Between Governance Mechanisms and Social Responsibility Practices In Gaúcha Cooperatives. Revista de Gestao Social e Ambiental, 17(8), e03963, 1-15. https://doi.org/10.24857/rgsa.v17n8-027

Economic Intelligence Unit (EIU) of the Ceylon Chamber of Commerce (CCC). (2022). Holding Company for SOEs: Learning for Sri Lanka. Strategic Insight Series, 12, 1-15.

Fuady, M. (2016). Pengantar Hukum Bisnis: Menata bisnis modern di era global. PT Citra Aditya Bakti.

Gao, Y., Pan, X., & Ye, Q. (2023). Corporate governance effects of state asset protection: A perspective on real earnings management. Finance Research Letters, 58(PD), 104637. https://doi.org/10.1016/j.frl.2023.104637.

Geng, Y., Li, Z., Tan, X., & Zhou, Z. (2023). Study on the Impact of Private Enterprises' Participation in the Mixed Reform of State-owned Enterprises on the Value Preservation and Appreciation of State-owned Assets. Interscience Management Review, 6(2), 1-22. https://doi.org/10.47893/IMR.2023.1132

Harun, R. (2019). BUMN Dalam Sudut Pandang Tata Negara. Balai Pustaka.

Hartini, R. (2017). BUMN Persero Konsep Keuangan Negara dan Hukum Kepailitan di Indonesia. Setara Press.

Hasan, Z., Din, K., & Susanto, E. (2023). Comparison of Good Corporate Governance (GCG) Performance of Companies in Asean Countries. Corporate Sustainable Management Journal, 1(1), 43-50. http://doi.org/10.26480/csmj.01.2023.43.50

Hernandar, M., Fontana, A., & Wijanto, S. (2024). The role of innovation ecosystem in an open innovation model of state-owned enterprises to build collaborative advantage. Journal of Infrastructure, Policy and Development, 8(13), 1-42. https://doi.org/10.24294/jipd6983

International Monetary Fund (IMF). (2020). Fiscal Monitor: Policies to support people during the COVID-19 pandemic. Fiscal Monitor.

Kaunda, E., & Pelser, T. (2022). A strategic corporate governance framework for state-owned enterprises in the developing economy. Journal of Governance and Regulation, 11(2), 257–276. https://doi.org/10.22495/jgrv11i2siart5

Kaunda, E., & Pelser, T. (2023). Corporate governance and performance of state-owned enterprises in a least developed economy. South African Journal of Business Management, 55(1), 1-13. https://doi.org/10.4102/sajbm.v55i1.4415

Khumalo, M., & Mazenda, A. (2021). An assessment of corporate governance implementation in state-owned enterprises of the emerging economy. Journal of Governance and Regulation, 10(4), 59–69. https://doi.org/10.22495/jgrv10i4art5

Kim, K. (2018). Matchmaking: Establishment of state-owned holding companies in Indonesia. Asia & the Pacific Policy Studies, 5, 313–330. https://doi.org/10.1002/app5.238

Koeswahyono, I. (2024). A Model of State-Owned Asset Management Based on Pancasila Values: Achieving the Highest and Best Use. Arena Hukum, 17(3), 1-25. https://doi.org/10.21776/ub.arenahukum2024.01703.1

La Bara, L., & Fiorani, G. (2023). Sustainable development, stakekolders’ partnership, state-owned assets in a system thinking model. Strategica Internasional Conference, 11, 356-366. . https://doi.org/10.25019/str/2023.026.

Leutert, W. (2024). Singapore’s Temasek Model and State Asset Management in China. Asian Survey, 64(4), 700-726. https://doi.org/10.1525/as.2024.2122271

Meissner, D., Sarpong, D., & Vonortas, N. (2018). Introduction to the Special Issue on “Innovation in State Owned Enterprises: Implications for Technology Management and Industrial Development”. Industry and Innovation, 26, 121- 126. https://doi.org/10.1080/13662716.2019.1551838

Ng, W. J. N. (2018). Comparative Corporate Governance: Why Singapore’s Temasek Model Is Not Replicable in China. New York University Journal of International Law and Politics, 51: 211–249.

Quartey, J. (2019). Towards Survival of State Owned Enterprises in Sub-Saharan Africa: Do Fiscal Benefits Matter?. International Journal of Economics, Commerce and Management United Kingdom, VII(5), 207-234.

Rajagukguk, E. (2003). Hukum Ekonomi Indonesia Memperkuat Persatuan Nasional, Mendorong Pertumbuhan Ekonomi Dan Memperluas Kesejahteraan Sosial. In VIII National Law Development Seminar and Workshop, organized by the National Legal Development Agency, Ministry of Justice and Human Rights, Denpasar (pp. 14-18).

Rezzy, Ikhwansyah, I., Suryanti, N., & Darmawan, A. (2024). Super Holding of State-Owned Enterprize (Soes) to Realize A Healthy Company Based on The Principles of Good Corporate Governance to Create the Prosperity of All Indonesian People. Journal of Law and Sustainable Development, 12(1), e02203, 1-20. https://doi.org/10.55908/sdgs.v12i1.2203

Romadhan, R. C. (2021). Kedudukan Hukum Badan Usaha Milik Negara Sebagai Anak Perusahaan Dalam Perusahaan Holding Induk. Media Iuris, 4(1), 73–90. https://doi.org/10.20473/mi.v4i1.23669

Tjandra, W. R. (2013). Hukum keuangan negara. Grasindo.

Widjayanti, K. (2011). Manajemen BUMN dan Strategi Privatisasi. Semarang University Press.

Downloads

Published

How to Cite

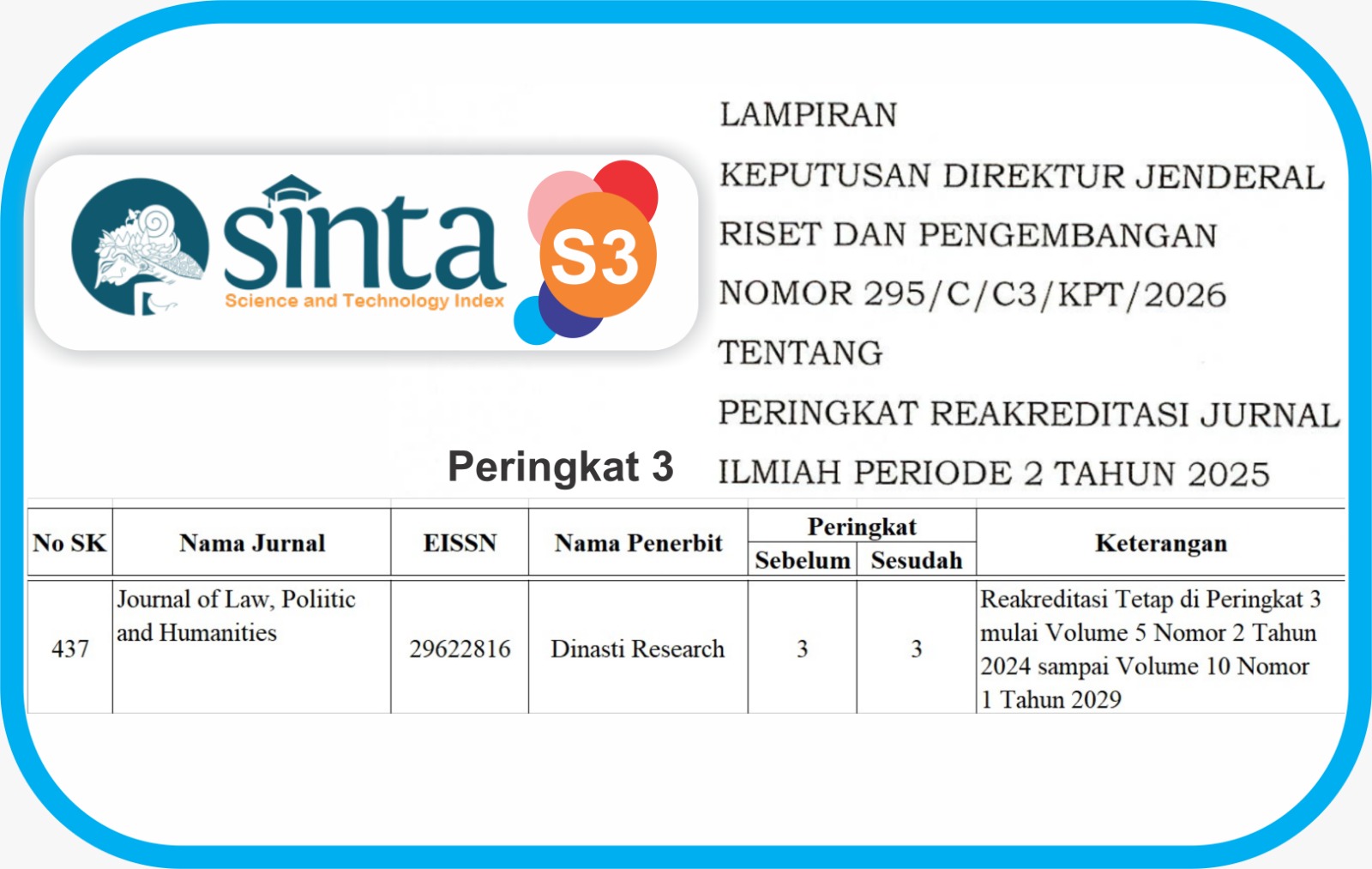

Issue

Section

License

Copyright (c) 2025 Catherine Ayunia Zoerien Pellokila, Dewi Kania Sugiharti, Nurafni Kusumawardhani Affandi

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Law, Poliitic and Humanities (JLPH) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Law, Poliitic and Humanities (JLPH).