Debtor's Legal Consequences of Approval of Motor Over Credit Without the Leasing Party's Knowledge

DOI:

https://doi.org/10.38035/jlph.v4i4.449Keywords:

Leasing Company, Default, Fiduciary GuaranteeAbstract

The Over credit process is a method of purchasing an asset by transferring credit from the initial debtor to the new debtor. In the motorbike overcredit scheme, the first party who transfers their motorbike credit to the second party will receive compensation in the form of cash as a substitute for the down payment or what is usually called Down Payment. Meanwhile, the second party will continue the remaining installments from the previous installments. Transfer of fiduciary guarantees or over credit transfer is the process of transferring ownership of an object along with installment payments that are still on credit to an individual who is a third party. The fiduciary guarantee itself is a security right for an object in the credit process that remains in the control of the debtor. The development of leasing companies is quite rapid in Indonesia, the types of goods financed are increasingly varied, not only in the field of transportation but also expanding to the industrial, telecommunications, agricultural and other sectors. Financing carried out by the leasing party is stated in the credit agreement between the leasing party and the debtor.

References

Achmad Yusuf Sutarjo, Djuwityastuti, 2018, “Akibat Hukum Debitor Wanprestasi Pada Perjanjian Pembiayaan Konsumen Dengan Obyek Jaminan Fidusia Yang Disita Pihak Ketiga” (Studi Kasus: Putusan Mahkamah Agung Nomor 3089 K/Pdt/2015) , Privat Law Vol.6, No. 1

Hartanto, Cut Wilda Meutia Syafiina, 2021 “Efektivitas Perlindungan Konsumen Terhadap Produk Kosmetik Yang Tidak Memiliki Izin Edar Balai Besar Pengawas Obat Dan Makanan Diy (Dalam Perspektif Hukum Pidana)”, Jurnal Meta-Yuridis Vol 4, No 1 Kadek Cinthya Dwi Lestari*, I Nyoman Putu Budiartha dan Ni Made Puspasutari Ujianti, 2020, “Hilangnya Objek Jaminan Fidusia yang Tidak Didaftarkan”, Jurnal Analogi Hukum, 2 (3)

Munir Fuady “hukum jaminan hutang” Jakarta 2013 hlm 30

Hamzah Dan Sendung Manulang, Hukum jaminan , Rineka cipta Jakarta hlm 167

R. Wiryono Projodikoro, Asas Perjanjian Hukum , Bandung: Sumur 1933 hlm 9

Warman Johan, Kredit Bank, Jakarta 2018 hlm 152

Qirom Syamsudin, pokok hukum Perjanjian beserta pengembangannya, Yogyakarta 2006 hlm9

Sutarno, Aspek-Axpek Hukum Perkreditan Puda Bank, (Jakarta: Alfabeta, 2003), hlm. 118

Mahkamah Agung RI, Masalah Leasing. Bagian Penerbitan Mahkamah Agung, Jakarta, 1989 hlm.6

Pasal 1365 Kitab Undang-Undang Hukum Perdata (KUHPerdata)

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Hilman Alfiansah, Yuniar Rahmatiar , Suyono Sanjaya , Muhamad Abas

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

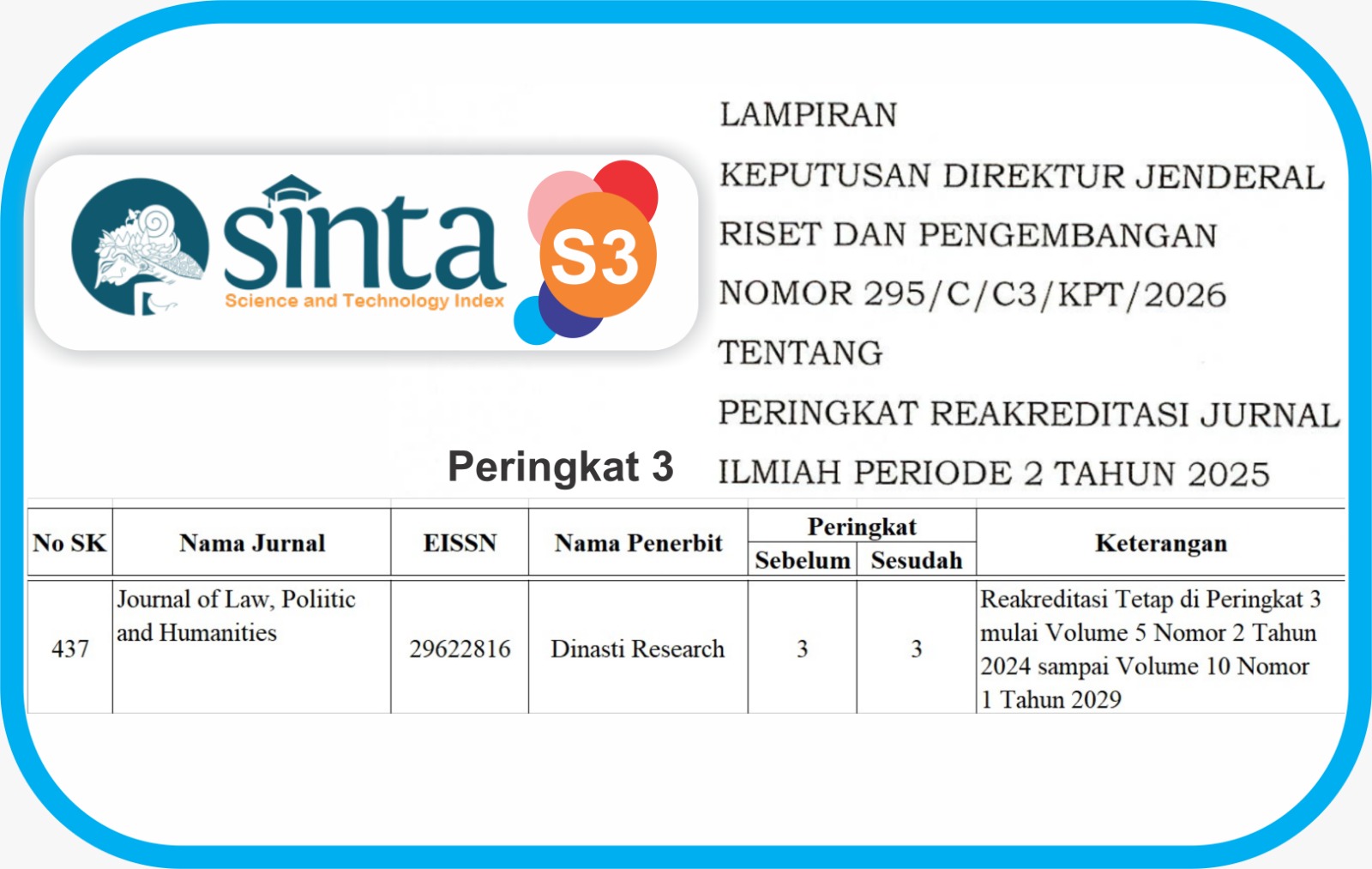

- The author acknowledges that the Journal of Law, Poliitic and Humanities (JLPH) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Law, Poliitic and Humanities (JLPH).