Qualifications and Legal Enforcement of Money Cheating and Money Game Actions in Banking Transactions from the Perspective of Banking Laws

DOI:

https://doi.org/10.38035/jlph.v4i6.641Keywords:

Money Cheating,, Money Game,, Banking,, Law EnforcementAbstract

Violations of banking regulations and principles in banking practices carried out by certain parties for personal gain, such as commissioners, directors, shareholders, and bank employees. These actions, such as channeling profits to subsidiaries, maintenance billing, credit pipelines, and credit recycling, are categorized as Money Cheating. Meanwhile, Money Game is a form of illegal investment involving unauthorized fund collection, in accordance with the Banking Law. Although both practices appear to be fraudulent crimes, it is necessary to examine whether they constitute banking crimes or financial crimes. In Indonesia, there are no regulations or studies that specifically distinguish between Money Cheating and Money Game, despite the increasing prevalence of both practices in the banking sector. This study uses a normative juridical method to qualify Money Cheating and Money Game actions based on the Banking Law. The results of the study indicate that Money Cheating can be qualified as a banking crime according to Article 49 paragraph (1) of the Banking Law, while Money Game involves the application of several legal rules such as Article 46 paragraph (1) of the Banking Law, Article 378 of the Criminal Code, and Articles 3, 4, and 5 of the Anti-Money Laundering Law. In conclusion, both practices are serious criminal offenses that require strict legal sanctions to maintain the integrity of the banking system.

References

Abubakar, L., Sukmadilaga, C., & Handayani, T. (2013). Impact of Shadow Banking Activities As Non Bank Intermediation Toward Regulatory Developments In Function Control Of Financial Services Sector In Indonesia. Economic Policy Review, 1.

Adiliani, A., Abikusna, R. A., Fatakh, A., & Abdurokhim, A. (2023). THE IMPACT COVID-19 ON POVERTY LEVEL OF COMMUNITY FROM AN ISLAMIC ECONOMIC PERSPECTIVE. Journal of Economic Development and Village Building, 1(1), 1–15.

Amanda, S., Noval, S. M. R., & Herlina, E. (2022). Penegakan Hukum Terhadap Praktik Money Game Dengan Skema Ponzi Dalam Investasi Ilegal Pada Aplikasi Tiktok E-Cash Di Indonesia. Res Nullius Law Journal, 4(1), 57–76.

Aprita, S. (2021). Kewenangan Otoritas Jasa Keuangan (OJK) Melakukan Penyidikan: Analisis Pasal 9 Huruf C Undang-Undang Nomor 21 Tahun 2011 Tentang Otoritas Jasa Keuangan. Jurnal Ilmiah Universitas Batanghari Jambi, 21(2), 550–563.

Ardabili, D. (2023). Praktik pemasaran berjenjang Halal Network Internasional Herbal Penawar Alwahida Indonesia (HNI HPAI) Jakarta ditinjau dari aspek hukum ekonomi syariah. Co-Creation: Jurnal Ilmiah Ekonomi Manajemen Akuntansi Dan Bisnis, 2(2), 100–106.

Arum, I. M. (2012). Multi Level Marketing (MLM) Syariah: Solusi Praktis Menekan Praktik Bisnis Riba, Money Game. Muqtasid: Jurnal Ekonomi Dan Perbankan Syariah, 3(1), 25–45.

Fure, J. A. (2016). Fungsi Bank Sebagai Lembaga Keuangan Di Indonesia Menurut Undang-Undang Nomor 10 Tahun 1998 Tentang Perbankan. Lex Crimen, 5(4).

Harizan, H. (2017). Upaya Preventif Berkembangnya Money Game Di Indonesia. ASY SYAR’IYYAH: JURNAL ILMU SYARI’AH DAN PERBANKAN ISLAM, 2(1), 80–101.

Haykal, H., Tiopan, D., & Kurniawan, S. (2024). Legal Development Concerning the Creation of Digital Currency in the Financial System. Journal of Law and Sustainable Development, 12(1), e964–e964.

Ibrahim, J., & Haykal, H. (2016). Pertanggungjawaban Pidana Bank dalam Pelanggaran Kegiatan Operasional Didasarkan pada Undang-Undang Nomor 10 Tahun 1998. Dialogia Iuridica, 7(2), 43–53.

Lindawati, M. (2020). REVIEW OF GOOD CORPORATE GOVERNANCE (GCG) APPLICATION IN OPERATIONAL ACTIVITIES IN PT BANK CENTRAL ASIA, Tbk. Dinasti International Journal of Education Management And Social Science, 1(6), 867–877.

Matthews, K., Thompson, J., & Zhang, T. (2023). Economics Of Banking, The. World Scientific.

Rahardjo, S. (2000). Ilmu hukum, Cetakan ke-V. Bandung: Citra Aditya Bakti.

Setiady, T. (2007). Pokok-pokok Filsafat Hukum. Dewa Ruchi, Bandung.

Susanto, H., & S Sos, M. (2013). Bijak Meminjam dan Menggunakan Uang Bank. Elex Media Komputindo.

Wiwoho, J. (2014). Peran lembaga keuangan bank dan lembaga keuangan bukan bank dalam memberikan Distribusi keadilan bagi masyarakat. Masalah-Masalah Hukum, 43(1), 87–97.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Hassanain Haykal, Yosep Seftiadi, Gneissa Beltsazar, Safna Khaerani, Jillan Syifa

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

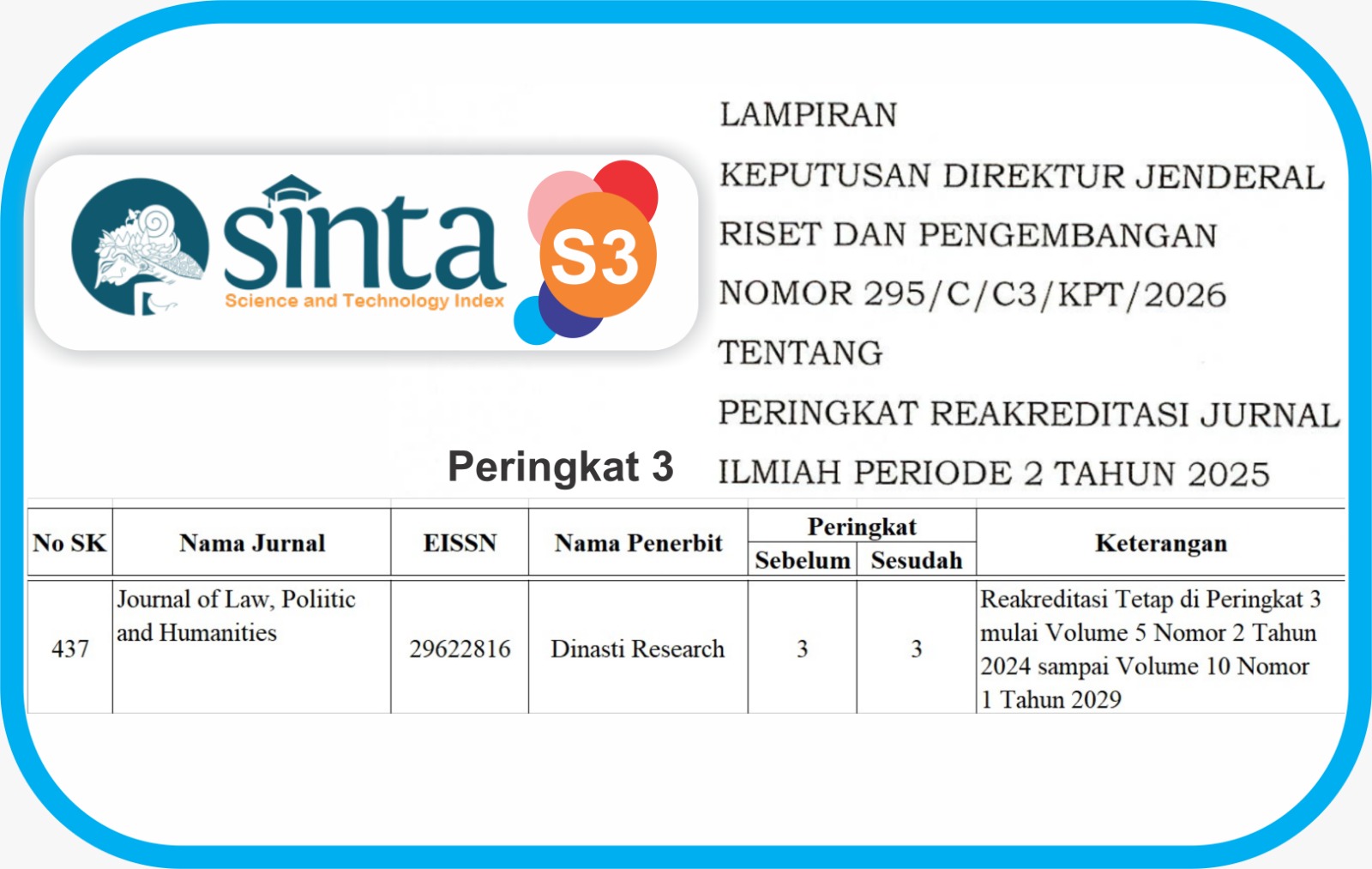

- The author acknowledges that the Journal of Law, Poliitic and Humanities (JLPH) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Law, Poliitic and Humanities (JLPH).