The The Legal Liability of Insurance Companies on Unit-Linked Insurance Plan's Mis-Selling Practices Done by Insurance Agents: an Approach to Law Number 4 of 2023 Concerning the Development and Strengthening of the Financial Sector (PPSK Law)

DOI:

https://doi.org/10.38035/jlph.v5i1.873Keywords:

Insurance, Unit Link, Unit-Linked Insurance Plan, Insurance Law, Mis-sellingAbstract

The purpose of this study aims to analyze the legal liability of an insurance company when an Unit-linked Insurance Plan (ULIP) products is mis-sold by an insurance agent. Using the normative judicial method, this study also examines the main factors of mis-selling practices and the legal responsibilities that both insurance companies and their agents have to carry based on Law Number 4 of 2023 concerning the Development and Strengthening of the Financial Sector (PPSK Law). The results revealed that many insurance agents have a poor knowledge of how ULIP and its investment works. High-pressure sales techniques is also often used by insurance agents to manipulatively persuade policyholders into buying ULIP, which then consequently leads into mis-selling. In accordance to the current PPSK Law, insurance company as the principal of the legally binding agency agreement is liable for the negligent actions commited by their agents, including when they mis-sell an ULIP product, however insurance agents can also be held liable for the negligent actions that are commited outside the scope of their authorities.

References

Andri, Gusti Yosi. et. al. (2023). Akibat Hukum Perjanjian Keagenan pada PT. Asuransi Allianz Life Indonesia. Hukum Responsif 14 (2): 79-91.

Astanti, Dhian Indah. (2015). Good Corporate Governance Pada Perusahaan Asuransi. Semarang University Press, Semarang.

Fauzan, Dirga Adil. et. al. (2021). Perlindungan Hukum Pemegang Polis Asuransi Jiwa terhadap Mis-selling oleh Agen Asuransi di PT. BNI Life Insurance. Jurnal Hukum De’rechtsstaat 7 (1): 1-20.

Ginting, Lidya Cristy Ndiloisa. et. al. (2023). Penerapan Prinsip Itikad Baik terhadap Kewajiban Pemberitahuan Riwayat Kesehatan sebagai Penyebab Ditolaknya Pembayaran Klaim Asuransi Jiwa. Locus Journal of Academic Literature Review 2 (6): 522-531.

Gupta, Anant. (2012). Unit Linked Insurance Products (ULIPs) – Insurance or Investment? Procedia – Social and Behavioral Sciences (37): 67-85.

Hanafi, M. (2006). Manajemen Risiko. Unit Penerbit dan Percetakan Tinggi Ilmu Manajemen YKPN, Yogyakarta.

Hopkin, Paul. (2017). Fundamentals of Risk Management. Kogan Page Limited, London.

Kurniasari, Tri Widya. et. al. (2023). Perlindungan Hukum Nasabah Unit Link dalam Risiko Penurunan Nilai Investasi. Jurnal Ilmu Hukum Reusam 11 (1): 13-22.

Otoritas Jasa Keuangan. (2023). Roadmap Perasuransian Indonesia 2023-2027. Retrieved from Otoritas Jasa Keuangan’s website: https://ojk.go.id/id/regulasi/otoritas-jasa-keuangan/rancangan-regulasi/Documents/Draft%20Roadmap%20Pengembangan%20Perasuransian%20Indonesia.pdf

Otoritas Jasa Keuangan. (2024). Siaran Pers Bersama: OJK dan BPS Umumkan Hasil Survei Nasional Literasi dan Inklusi Keuangan Tahun 2024. Retrieved from Otoritas Jasa Keuangan’s website: https://ojk.go.id/id/berita-dan-kegiatan/siaran-pers/Documents/Pages/OJK-dan-BPS-Umumkan-Hasil-Survei-Nasional-Literasi-dan-Inklusi-Keuangan-Tahun-2024/SP%20OJK%20dan%20BPS%20Umumkan%20Hasil%20Survei%20Nasional%20Literasi%20dan%20Inklusi%20Keuangan%20Tahun%202024.pdf

Pfau, Wade D. (2019). Investigating the Role of Whole Life Insurance in a Lifetime Financial Plan. Journal of Financial Planning 32 (2): 44–53.

Rosana, Alya Rosana. et. al. (2024). Konstruksi Hubungan Hukum dalam Skema Perjanjian Produk Asuransi yang Dikaitkan dengan Investasi (PAYDI). Jembatan Hukum: Kajian Ilmu Hukum, Sosial, dan Administrasi Negara 1 (2): 166-176.

Roy, Sunando. (2022). Preventing Mis-Selling and Protecting Customers in Financial Institutions. Retrieved from SSRN Electronic Journal’s website: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4142325

Salviana, Fries Melia. et. al. (2023). Perlindungan Hukum terhadap Tertanggung dalam Asuransi Jiwa Unit-link. Perspektif 28 (1): 19-24.

Saravanakumar, S. et. al. (2009). Multi-dimensions of Unit Linked Insurance Plan Among Various Investment Avenues. International Journal of Enterprise and Innovation Management Studies (IJEIMS) 1 (3): 53-60.

Setiawan, Eki Dyata Fredi. et. al. (2013). Pertanggungjawaban Agen Asuransi terhadap Perusahaan Asuransi Jika Tertanggung Melakukan Wanprestasi. Diponegoro Law Review 1 (2): 1-9.

Siregar, Reza Yamora. et. al. (2022). Unit Link 101. Indonesia Financial Group (IFG) Progress Financial Research Economic Bulletin (3): 1-15.

Siswanto, Ade Hari. et. al. (2022). Asuransi Jiwa Unit Link Ditinjau dari Hukum Asuransi dan Hukum Investasi. Lex Jurnalica 19 (3): 400-409.

Sudjana. (2022). Tanggung Jawab Prinsipal terhadap Konsumen dalam Perjanjian Keagenan dan Distributor. Ajudikasi: Jurnal Ilmu Hukum 6 (1): 1-18.

Downloads

Published

How to Cite

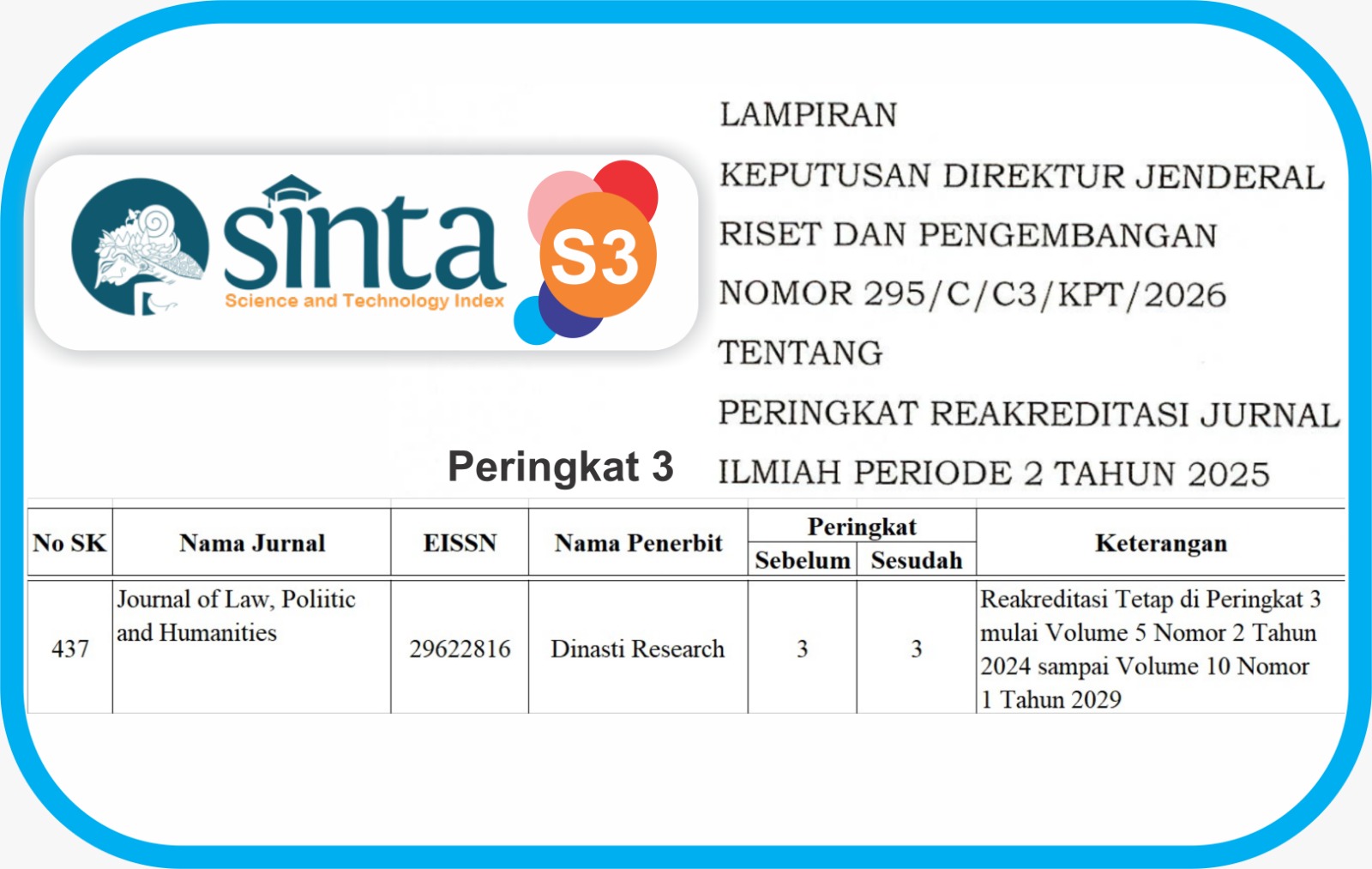

Issue

Section

License

Copyright (c) 2024 Levina Kezia, Christine Kansil

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Law, Poliitic and Humanities (JLPH) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Law, Poliitic and Humanities (JLPH).