Pengaruh Persepsi Manfaat dan Persepsi Risiko terhadap Niat Penggunaan Berkelanjutan QRIS yang Dimediasi oleh Kepercayaan pada Generasi Z

DOI:

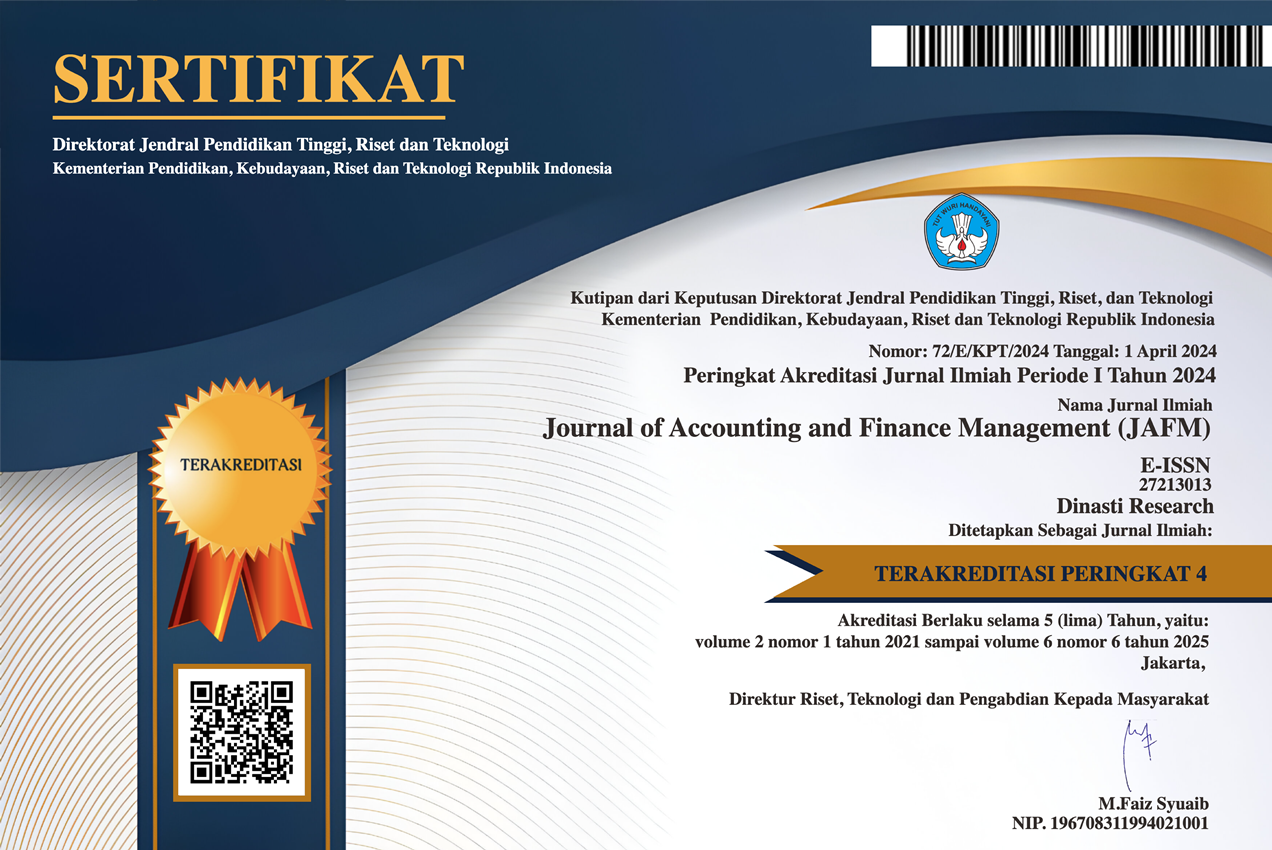

https://doi.org/10.38035/jafm.v6i2.1984Keywords:

QRIS, Persepsi Manfaat, Persepsi Risiko, Kepercayaan, Niat Penggunaan BerkelanjutanAbstract

Perkembangan teknologi mendorong transformasi pembayaran digital, ditandai dengan meningkatnya penggunaan QRIS di Indonesia. Keberhasilan QRIS dipengaruhi oleh manfaat, risiko, dan kepercayaan. Penelitian ini bertujuan menganalisis pengaruh persepsi manfaat dan risiko terhadap niat penggunaan berkelanjutan QRIS, serta menguji peran kepercayaan sebagai variabel mediasi. Populasi penelitian ini mencakup mahasiswa pengguna QRIS, dengan jumlah sampel yang digunakan 157 responden. Teknik penentuan sampel menggunakan convenience sampling dan dianalisis menggunakan metode SEM-PLS. Hasil penelitian menunjukkan bahwa persepsi manfaat dan kepercayaan berpengaruh positif terhadap niat penggunaan berkelanjutan. Persepsi manfaat juga berpengaruh tidak langsung melalui kepercayaan. Sebaliknya, persepsi risiko tidak berpengaruh terhadap kepercayaan maupun niat penggunaan berkelanjutan, baik secara langsung maupun tidak langsung. Temuan ini menunjukkan bahwa niat penggunaan berkelanjutan lebih didorong oleh manfaat yang dirasakan yang dapat membentuk kepercayaan pengguna.

References

Ali, M., Raza, S. A., Khamis, B., Puah, C. H., & Amin, H. (2021). How perceived risk, benefit and trust determine user Fintech adoption: a new dimension for Islamic finance. In Foresight (Vol. 23, Nomor 4). https://doi.org/10.1108/FS-09-2020-0095

Azizah, S. N. (2018). Analysis of Factors Affecting Application of Computer-Based Accounting Information System on Banking Sector. 231(Amca), 382–385. https://doi.org/10.2991/amca-18.2018.105

Azizah, S. N., Endratno, H., & Harjono, H. (2022). Analysis of Digital Legal Acceptance based on the Technology Acceptance Model 3 (TAM3). Kosmik Hukum, 22(3), 212. https://doi.org/10.30595/kosmikhukum.v22i3.15647

Bagus Prasasta Sudiatmika, N., & Ayu Oka Martini, I. (2022). Faktor-Faktor mempengaruhi Niat Pelaku UMKM Kota Denpasar menggunakan QRIS. JMM Unram - Master of management journal, 11(3), 239–254. https://doi.org/10.29303/jmm.v11i3.735

Benlian, A., & Hess, T. (2011). Opportunities and risks of software-as-a-service: Findings from a survey of IT executives. Decision Support Systems, 52(1), 232–246. https://doi.org/10.1016/j.dss.2011.07.007

Chandra, M. B., & Kohardinata, D. C. (2021). Dampak Persepsi Manfaat dan Persepsi Risiko terhadap Fintech Continuance Intention pada E-wallet. In PERFORMA: Jurnal Manajemen dan Start-Up Bisnis (Vol. 6, Nomor 5).

Devina, S., & Waluyo. (2016). Pengaruh persepsi kegunaan, persepsi kemudahan, kecepatan, keamanan dan kerahasiaan serta kesiapan teknologi informasi wajib pajak terhadap penggunaan e-Filing bagi wajib pajak orang pribadi di Kota Tangerang, Kecamatan Karawaci. Ultimaccounting: Jurnal Ilmu Akuntansi, 8(1), 75–91.

Diana, N., & Leon, F. M. (2020). Factors Affecting Continuance Intention of FinTech Payment among Millennials in Jakarta. European Journal of Business and Management Research, 5(4). https://doi.org/10.24018/ejbmr.2020.5.4.444

Dianawati, P. S., & Kusuma, P. S. A. J. (2025). Menguak minat Generasi “Z” di Denpasar mengadopsi QRIS. El-Mal: Jurnal Kajian Ekonomi & Bisnis Islam, 6(3), 1084–1094. https://doi.org/10.47467/elmal.v6i3.6638

Ema Fitriyani, A. airiza gunanto. (2024). Melonjak Volume Transaksi QRIS karena Fenomena Cashless Gen Z. Kumparan Bisnis. https://kumparan.com/kumparanbisnis/melonjak-volume-transaksi-qris-karena-fenomena-cashless-gen-z-23polVWZMsA/full

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: An introduction to theory and research. Reading, MA: Addison-Wesley

Fitriati, A., Tubastuvi, N., Mudjiyanti, R., & Wahyuni, S. (2024). Mobile banking acceptance model for Generation Z: The role of trust, self-efficacy, and enjoyment. Journal of Accounting and Investment, 25(3), 1–16. https://doi.org/10.18196/jai.v25i3.21639

Foster, B., Hurriyati, R., & Johansyah, M. D. (2022). The effect of product knowledge, perceived benefits, and perceptions of risk on Indonesian student decisions to use e-wallets for Warunk Upnormal. Sustainability, 14(11), 6475. https://doi.org/10.3390/su14116475

Gefen, D. (2000). E-commerce: The role of familiarity and trust. Omega, 28(6), 725–737. https://doi.org/10.1016/S0305-0483(00)00021-9

Ghassani, A., Raharso, S., & Tiorida, E. (2024). Pengaruh persepsi kemudahan, persepsi kegunaan, dan persepsi kepercayaan terhadap niat menggunakan mobile banking: Kasus penggunaan aplikasi BCA Mobile di Kota Bandung. VISA: Journal of Vision and Ideas, 4(2), 1059–1078. https://doi.org/10.47467/visa.v4i2.3185

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. https://doi.org/10.2753/MTP1069-6679190202

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2014). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). SAGE Publications

Hamid, R. S., Anwar, S. M., Salju, Rahmawati, Hastuti, & Lumoindong, Y. (2019). Using the triple helix model to determine the creativity a capabilities of innovative environment. IOP Conference Series: Earth and Environmental Science, 343(1). https://doi.org/10.1088/1755-1315/343/1/012144

Hanifah, T. R., & Mukhlis, I. (2022). Pengaruh Efektivitas, Hedonis, Kemanfaatan, Dan Kepercayaan Terhadap Minat Mahasiswa Universitas Negeri Malang Dalam Menggunakan Layanan Shopeepay: Pendekatan Technology Acceptance Model. Ecobisma (Jurnal Ekonomi, Bisnis Dan Manajemen), 9(2), 69–83. https://doi.org/10.36987/ecobi.v9i2.2711

Hu, Z., Ding, S., Li, S., Chen, L., & Yang, S. (2019). Adoption intention of fintech services for bank users: An empirical examination with an extended technology acceptance model. Symmetry, 11(3). https://doi.org/10.3390/sym11030340

Indiani, N. L. P., & Febriandari, S. N. S. (2021). Key antecedents of consumer purchasing behaviour in emerging online retail market. Cogent Business and Management, 8(1). https://doi.org/10.1080/23311975.2021.1978370

Kim, D. J., Ferrin, D. L., & Rao, H. R. (2008). A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision Support Systems, 44(2), 544–564. https://doi.org/10.1016/j.dss.2007.07.001

Laloan, W. T. J., Wenas, R. S., & Loindong, S. S. R. (2023). Pengaruh kemudahan penggunaan, persepsi manfaat, dan risiko terhadap minat pengguna e-payment QRIS pada mahasiswa Fakultas Ekonomi dan Bisnis Universitas Sam Ratulangi Manado. Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 11(2), 375–386. https://ejournal.unsrat.ac.id/index.php/emba/article/view/48312

Li, J., Chen, T., Li, S., & Hu, B. (2024). Honor the Contract? Effects of Algorithmic Recommendation System Features on Perceived Benefits, Privacy Risk, and Continuance Intention to Use TikTok. International Journal of Human-Computer Interaction. https://doi.org/10.1080/10447318.2024.2436736

Maharani, S. A., & Sundari, E. (2024). Pengaruh Perceived Usefulness, Perceived Ease of Use, Trust dan Security terhadap Behavioral Intention to Use BRI Mobile (Studi Kasus: pada Pengguna BRImo di Kota Pekanbaru). Al Qalam: Jurnal Ilmiah Keagamaan dan Kemasyarakatan, 18(1), 161. https://doi.org/10.35931/aq.v18i1.2975

Mandagi, C., Lapian, J., & Tumewu, F. J. (2021). Antecedent fintech continuance intention in Manado (Case study: GoPay). Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis, dan Akuntansi, 9(4), 415–427.

Mascarenhas, A. B., Perpétuo, C. K., Barrote, E. B., & Perides, M. P. (2021). The influence of perceptions of risks and benefits on the continuity of use of fintech services. Brazilian Business Review, 18(1), 1–21. https://doi.org/10.15728/BBR.2021.18.1.1

Nurikmah, T., Mudjiyanti, R., Santoso, S. B., & Amir. (2023). The Influence of Perceived Ease, Perceived Risk, System Security, and Service Quality on Trust in Transactions Using Shopee E-commerce. Innovation Business Management and Accounting Journal, 2(4), 264–274. https://doi.org/10.56070/ibmaj.v2i4.70

Nurlaily, F., Aini, E. K., & Asmoro, P. S. (2021). Understanding the fintech continuance intention of Idonesian users: The moderating effect of gender. Business: Theory and Practice, 22(2), 290–298. https://doi.org/10.3846/btp.2021.13880

Paleni, H., & Indah, T. P. (2024). Pengaruh perceived usefulness, perceived ease of use dan perceived risk terhadap minat penggunaan e-payment QRIS (Quick Response Code Indonesian Standard) pada mahasiswa Prodi Manajemen Universitas Bina Insan. Prosiding The 3rd Economic, Social, Culture, and Academic Forum (ESCAF), 390–398.

Park, J., Amendah, E., Lee, Y., & Hyun, H. (2018). M-payment service: Interplay of perceived risk, benefit, and trust in service adoption. Human Factors and Ergonomics In Manufacturing, 29(1), 31–43. https://doi.org/10.1002/hfm.20750

Prabowo, D. (2019). Pengaruh Perceived Risk dan Perceived Technology terhadap Online Purchase Intention Pada Shopee dengan Online Trust Sebagai Variabel Mediasi (Studi Empiris terhadap Masyarakat Magelang). Prosiding 2nd Business and Economics Conference In Utilizing of Modern Techonolgy, 1(1), 799–810.

Pramestiani, A. P., Fitriati, A., Santoso, S. B., & Azizah, S. N. (2025). Model penerimaan QRIS: Studi pada mahasiswa di Purwokerto. Journal of Accounting and Finance Management, 5(6), 1253–1270.

Purnama, E. S., Suryadi, N., & Andarwati, A. (2023). The Influence of Perceived Risk and Perceived Benefits on Continuance Intention to Adopt Fintech P2P Lending Mediated by Trust in Indonesia. Journal of Business and Management Review, 4(10), 754–770. https://doi.org/10.47153/jbmr410.8522023

Putri Darwiyani, A., Ahda Mahira, A., Maharani, M., Syariah, P., & Konseling, B. (2023). Fenomena Penggunaan QRIS dalam Pembangunan Ekonomi Kreatif Menuju Indonesia Emas 2045

Putri, P. A., Taufiqurrahman, & Noviasari, H. (2024). Pengaruh persepsi manfaat dan persepsi kemudahan penggunaan melalui kepercayaan terhadap keputusan penggunaan QRIS pada mahasiswa generasi Z di Kota Pekanbaru. Jurnal Ilmiah Mahasiswa Ekonomi Manajemen, 9(2), 296–316. https://jim.usk.ac.id/EKM/article/view/30017

Putritama, A. (2019). The mobile payment fintech continuance usage intention in Indonesia. Jurnal Economia, 15(2), 243–258. https://doi.org/10.21831/economia.v15i2.26403

Rahmayanti, P. L. D., & Rahyuda, I. K. (2020). The role of trust in mediating the effect of perceived risk and subjective norm on continuous usage intention on GoPay users in Denpasar. Russian Journal of Agricultural and Socio-Economic Sciences, 108(12), 69–80. https://doi.org/10.18551/rjoas.2020-12.09

Ryu, H. S. (2018). What makes users willing or hesitant to use Fintech?: the moderating effect of user type. Industrial Management and Data Systems, 118(3), 541–569. https://doi.org/10.1108/IMDS-07-2017-0325

Sari, H. C. (2022). The Impact of Perceived Risk, Perceived Benefit, and Trust on Customer Intention To Use Tokopedia A pps. Jurnal Bisnis Strategi, 31(2), 145–149.

Savitha, B., Hawaldar, I. T., & Kumar K, N. (2022). Continuance intentions to use FinTech peer-to-peer payments apps in India. Heliyon, 8(11), e11654. https://doi.org/10.1016/j.heliyon.2022.e11654

Sienatra, K. (2020). Dampak persepsi manfaat dan persepsi risiko terhadap fintech continuance intention pada generasi milenial di Surabaya. Jurnal Nusantara Aplikasi Manajemen Bisnis, 5(1), 1–12. https://doi.org/10.29407/nusamba.v5i1.14225

Venkatesh, V., Thong, J. Y. L., Chan, F. K. Y., Hu, P. J. H., & Brown, S. A. (2011). Extending the two-stage information systems continuance model: Incorporating UTAUT predictors and the role of context. Information Systems Journal, 21(6), 527–555. https://doi.org/10.1111/j.1365-2575.2011.00373.x

Venny Setyadi, E., Suarly, R., Handoko, R., & Ali, A. (2020). Faktor-Faktor yang Mempengaruhi Continuance Intention dari Pengguna Pada Layanan M-Payment (Studi Kasus Go-Pay). Kajian Branding Indonesia, 2(2), 162–200. https://doi.org/10.21632/kbi.2.2.162-200

Wachid, M. N. (2024). Transaksi QRIS Credinex Berhasil Namun Saldo Tidak Masuk ke Merchant. Media Konsumen. https://mediakonsumen.com/2024/10/10/surat-pembaca/transaksi-qris-credinex-berhasil-namun-saldo-tidak-masuk-ke-merchant

Wang, Z., & Li, H. (2016). Factors Influencing Usage of Third Party Mobile Payment Services in China: An Empirical Study. UPPSALA Universitet, 1–52.

Wijaya, I. D., Astuti, E. S., Yulianto, E., & Abdillah, Y. (2024). The Mediation Role of Perceived Risk, Trust, and Perceived Security Toward Intention to Use in the Model of Fintech Application Adoption: An Extension of TAM. KnE Social Sciences. https://doi.org/10.18502/kss.v9i11.15804

Winarto, Y. (2024). Kasus Penyalahgunaan QRIS, Pengamat Teknologi: Tanggungjawab Seluruh Pihak. Kontan. https://keuangan.kontan.co.id/news/kasus-penyalahgunaan-qris-pengamat-teknologi-tanggungjawab-seluruh-pihak

Yudiantara, P. O., & Widagda, I. G. N. J. A. (2022). role of trust in mediating the effect of perceived usefulness and perceived ease of use on decisions to use the LinkAja digital wallet. International journal of health sciences, 6310–6327. https://doi.org/10.53730/ijhs.v6ns4.11176

Zain, F., & Andhaniwati, E. (2023). Pengaruh Kemudahan Penggunaan, Kepercayaan, Dan Kebiasaan Terhadap Penggunaan Aplikasi Fintech Payment Go-Pay. Jurnal Akuntansi, 19(01), 104–117.

Zavolokina, L., Dolata, M., & Schwabe, G. (2016). The FinTech phenomenon: antecedents of financial innovation perceived by the popular press. In Financial Innovation (Vol. 2, Nomor 1). SpringerOpen. https://doi.org/10.1186/s40854-016-0036-7

Zhao, H., & Khaliq, N. (2024). In quest of perceived risk determinants affecting intention to use fintech: Moderating effects of situational factors. Technological Forecasting and Social Change, 207. https://doi.org/10.1016/j.techfore.2024.123599

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Tifani Azzahra Mutiara Perdani, Azmi Fitriati, Ani Kusbandiyah, Siti Nur Azizah

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Journal of Accounting and Finance Management (JAFM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Journal of Accounting and Finance Management (JAFM).